When it comes to tax season, it’s important to have all the necessary forms in order to accurately report your income and expenses. One such form that is commonly used is the W9 tax form. This form is used by businesses to request information from independent contractors or freelancers they have hired to complete work. It is essential for both parties to have a completed and accurate W9 form on file to ensure proper reporting to the IRS.

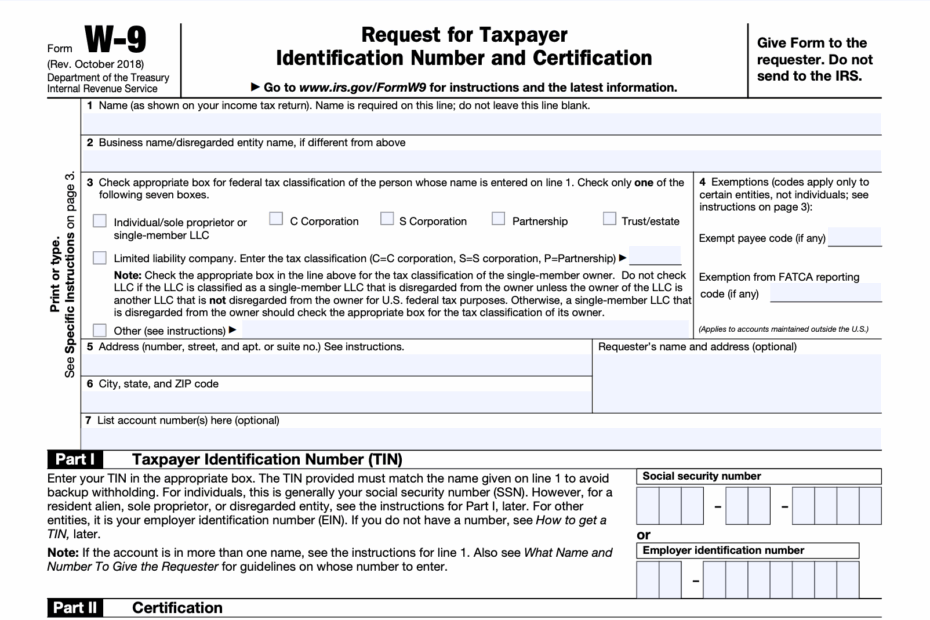

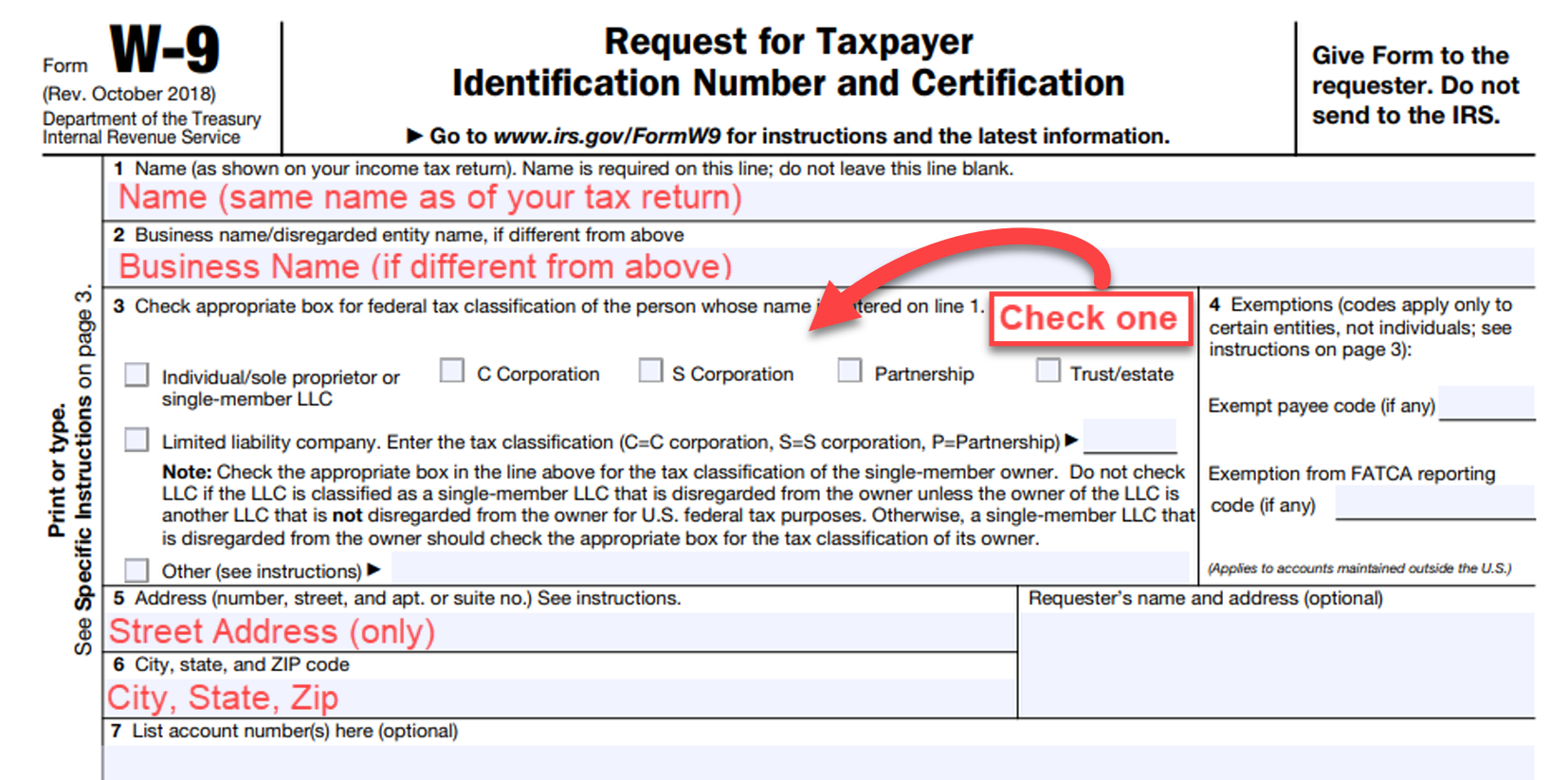

The W9 tax form is a document that collects important information such as the contractor’s name, address, and taxpayer identification number (TIN). This information is used by the business to report payments made to the contractor to the IRS. The form is typically required for any contractor who is paid $600 or more in a calendar year.

Download and Print W9 Tax Form Printable

Fillable W 9 Form Template Formstack Documents

Fillable W 9 Form Template Formstack Documents

Having a printable version of the W9 tax form is convenient for both parties involved. The contractor can easily fill out the form and provide it to the business in a timely manner. The business can then keep a copy on file for their records and use it to accurately report payments to the IRS.

It is important to note that the W9 tax form is not filed with the IRS but is kept on file by the business for reporting purposes. The information provided on the form is used to generate a 1099 form for the contractor at the end of the year, which shows the total amount of income earned.

Overall, having a printable W9 tax form is essential for businesses and contractors to ensure proper reporting of income to the IRS. It helps both parties stay compliant with tax laws and regulations, and provides a clear record of payments made throughout the year. Make sure to have a W9 form on hand for any independent contractor you hire to avoid any potential tax issues down the road.

In conclusion, the W9 tax form is a crucial document for businesses and independent contractors alike. Having a printable version of the form makes the process of collecting and submitting information much easier. Make sure to stay organized and keep accurate records to avoid any tax-related complications in the future.