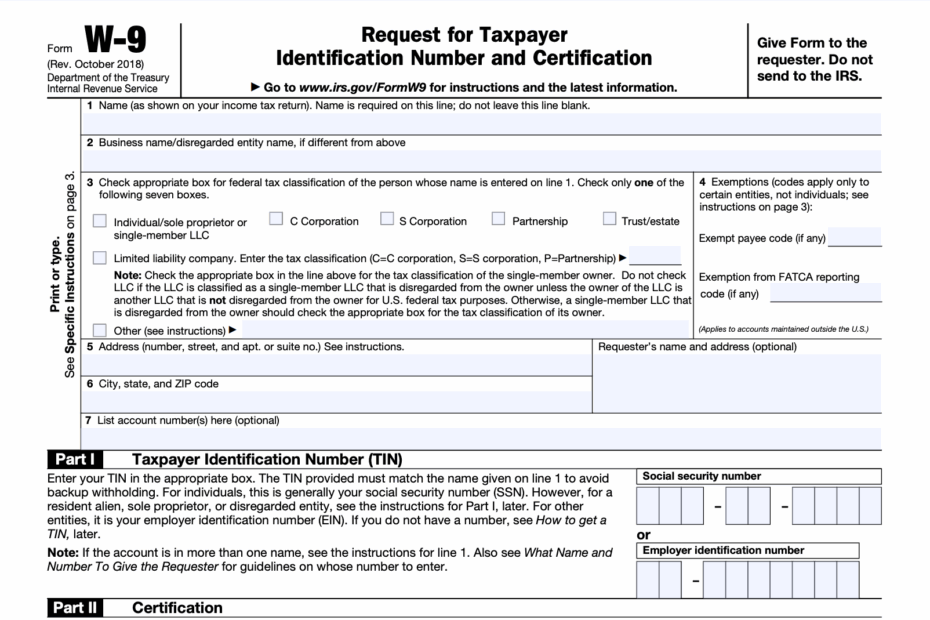

When it comes to tax requirements, the W9 IRS form is an essential document that helps businesses collect necessary information from independent contractors or freelancers. This form is used to gather the taxpayer identification number (TIN) of individuals or entities who provide services to a business. It is crucial for maintaining accurate records and ensuring compliance with IRS regulations.

By completing the W9 IRS form, businesses can accurately report payments made to contractors and avoid potential penalties for non-compliance. This form also helps the IRS track income earned by individuals and ensure that taxes are properly withheld and reported. It is a vital tool in the tax reporting process and should be taken seriously by all parties involved.

Get and Print W9 Irs Form Printable

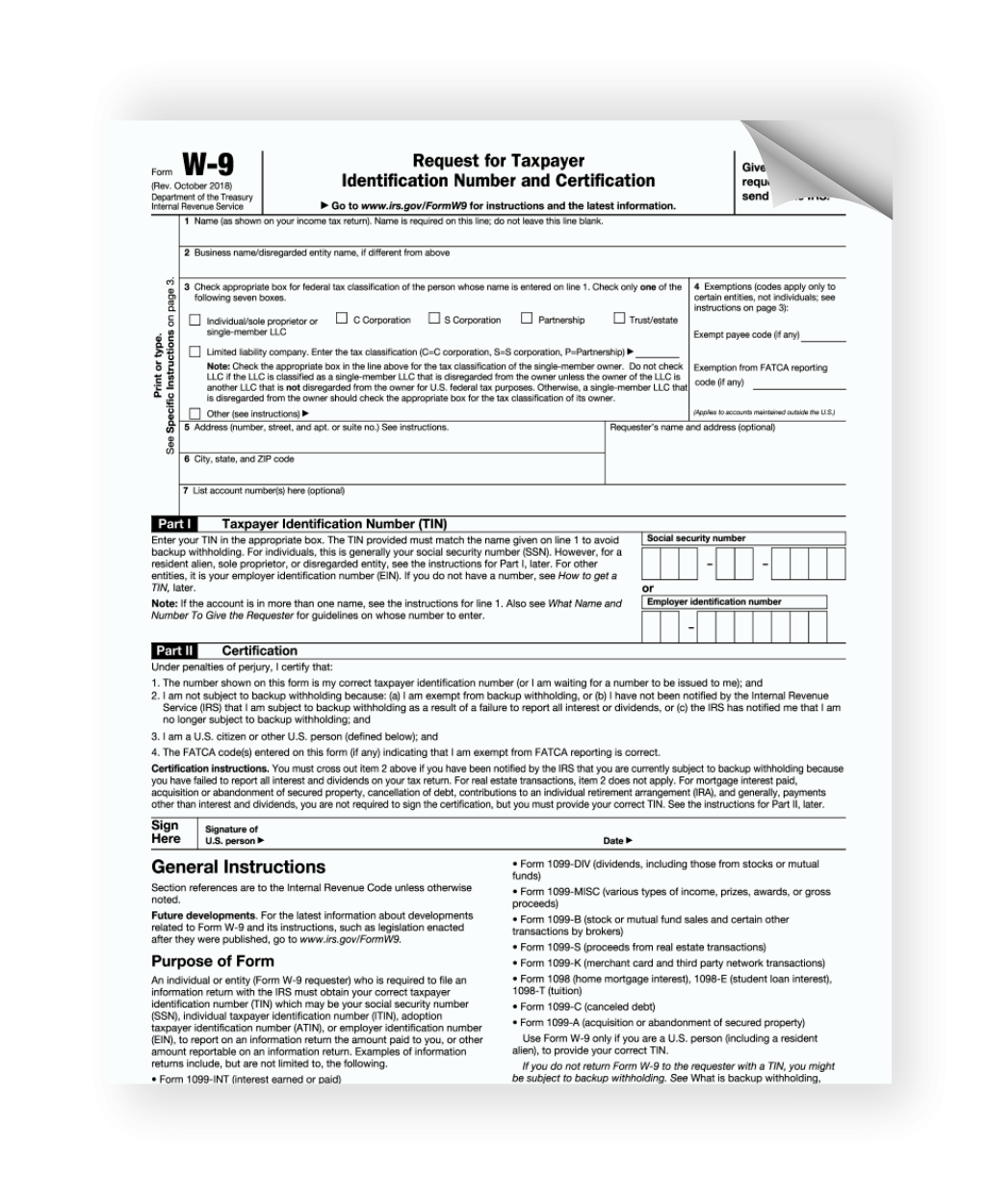

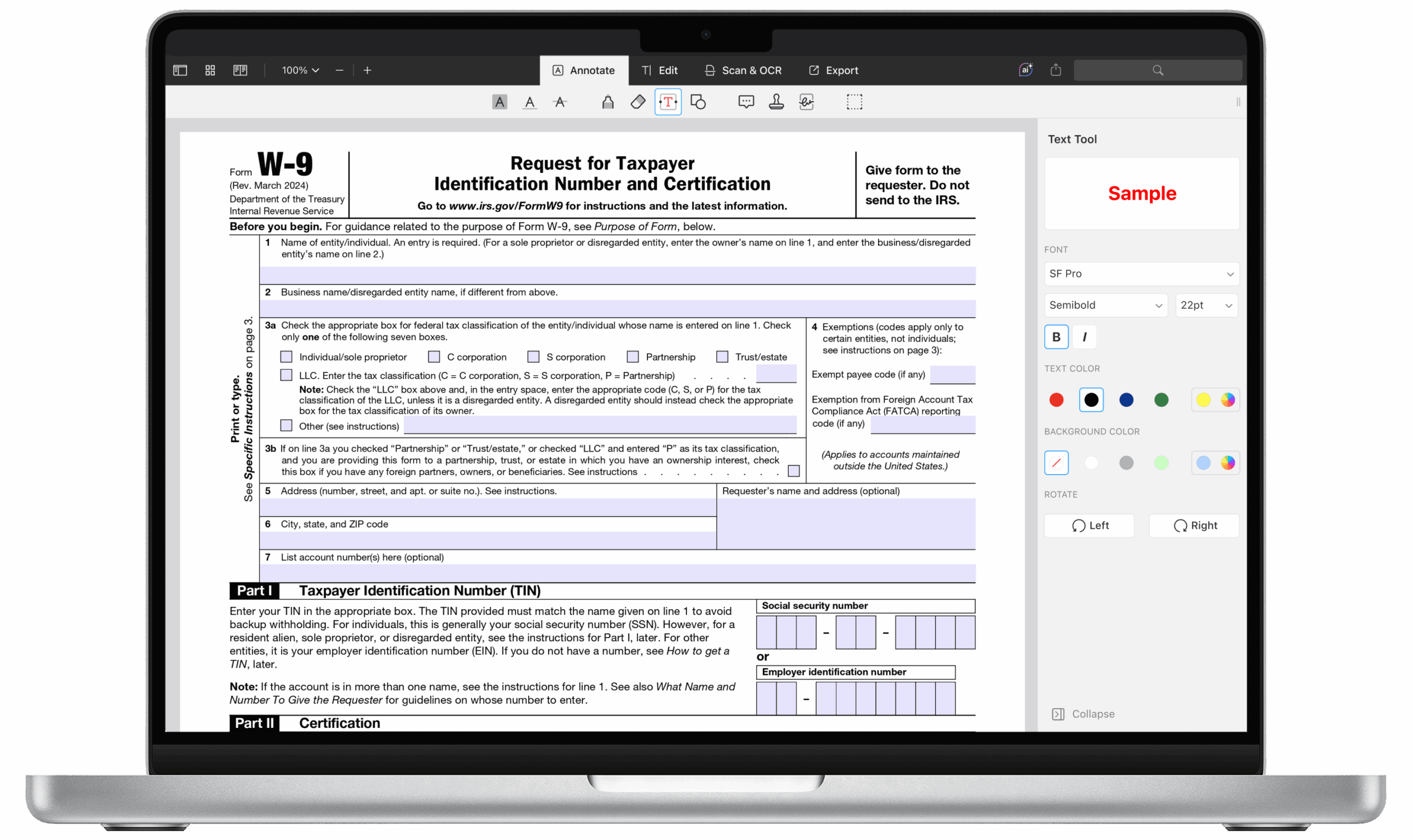

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

W9 IRS Form Printable

For those in need of a W9 IRS form, there are printable versions available online. These forms can be easily downloaded and filled out by contractors or freelancers before they begin working with a business. Having a printable W9 form on hand makes it convenient for both parties to complete the necessary paperwork and streamline the tax reporting process.

When filling out the W9 IRS form, individuals will need to provide basic information such as their name, business name (if applicable), address, and TIN. It is important to ensure that all information is accurate and up-to-date to avoid any discrepancies or issues with tax reporting. Once the form is completed, it should be submitted to the business for their records.

Businesses should keep all W9 IRS forms on file for at least four years in case of an IRS audit. Having these forms readily available can help businesses provide accurate information to the IRS and demonstrate compliance with tax regulations. By keeping thorough records and following proper procedures, businesses can avoid potential penalties and ensure smooth tax reporting processes.

In conclusion, the W9 IRS form is a crucial document for businesses and independent contractors alike. By ensuring that this form is completed accurately and kept on file, both parties can avoid potential issues with tax reporting and maintain compliance with IRS regulations. Utilizing printable versions of the W9 form can make the process easier and more efficient for everyone involved.