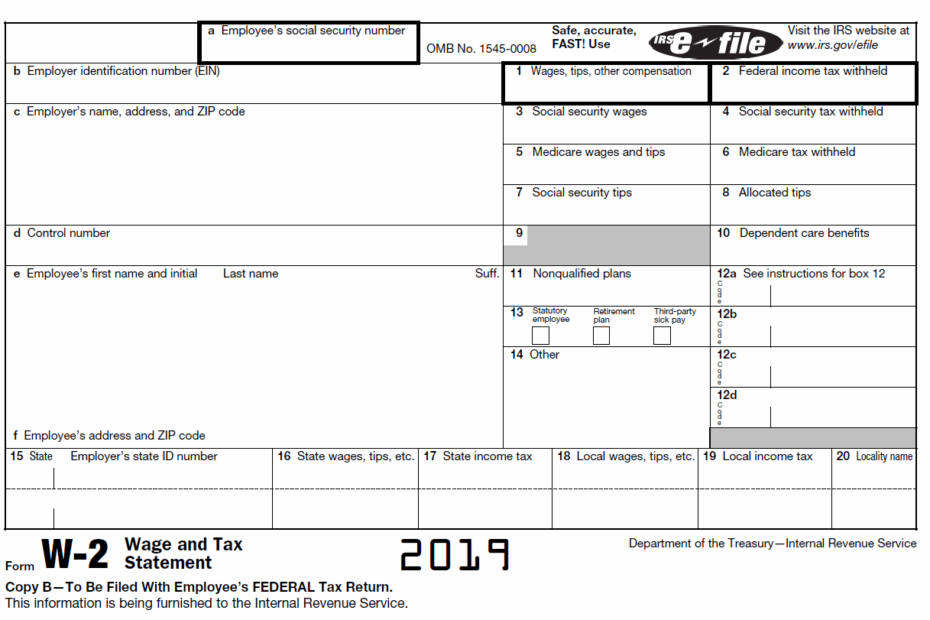

When tax season rolls around, one of the most important documents you’ll need is your W2 form. This form is provided by your employer and outlines the amount of money you earned throughout the year, as well as any taxes that were withheld from your paycheck. Having a printable version of your W2 form can make the tax-filing process much easier.

W2 forms are typically sent out by employers at the beginning of the year, but if you’ve misplaced yours or need an extra copy, being able to print it out yourself can be a lifesaver. Having a printable W2 form also allows you to keep a digital copy for your records, making it easier to reference in the future.

Download and Print W2 Forms Printable

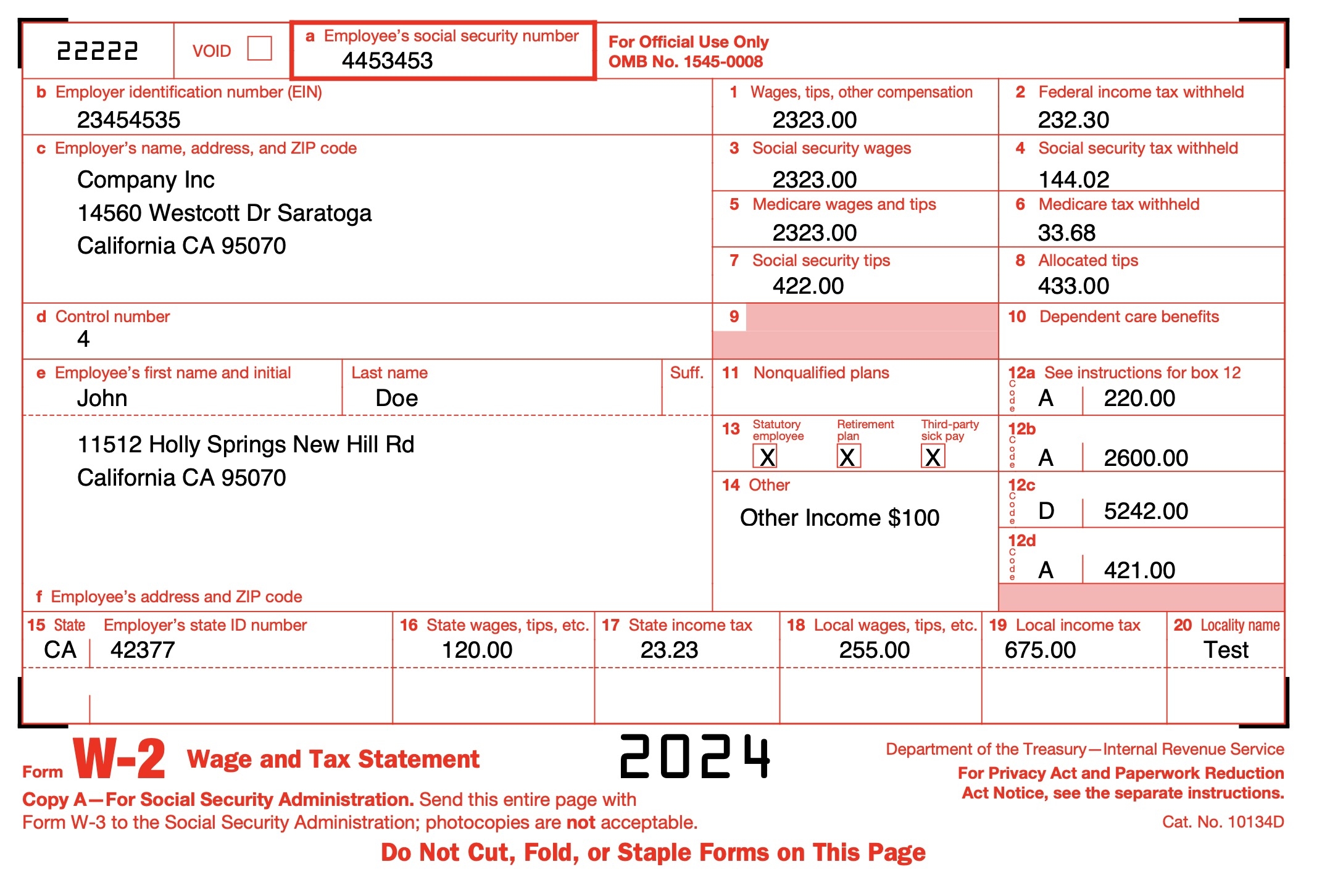

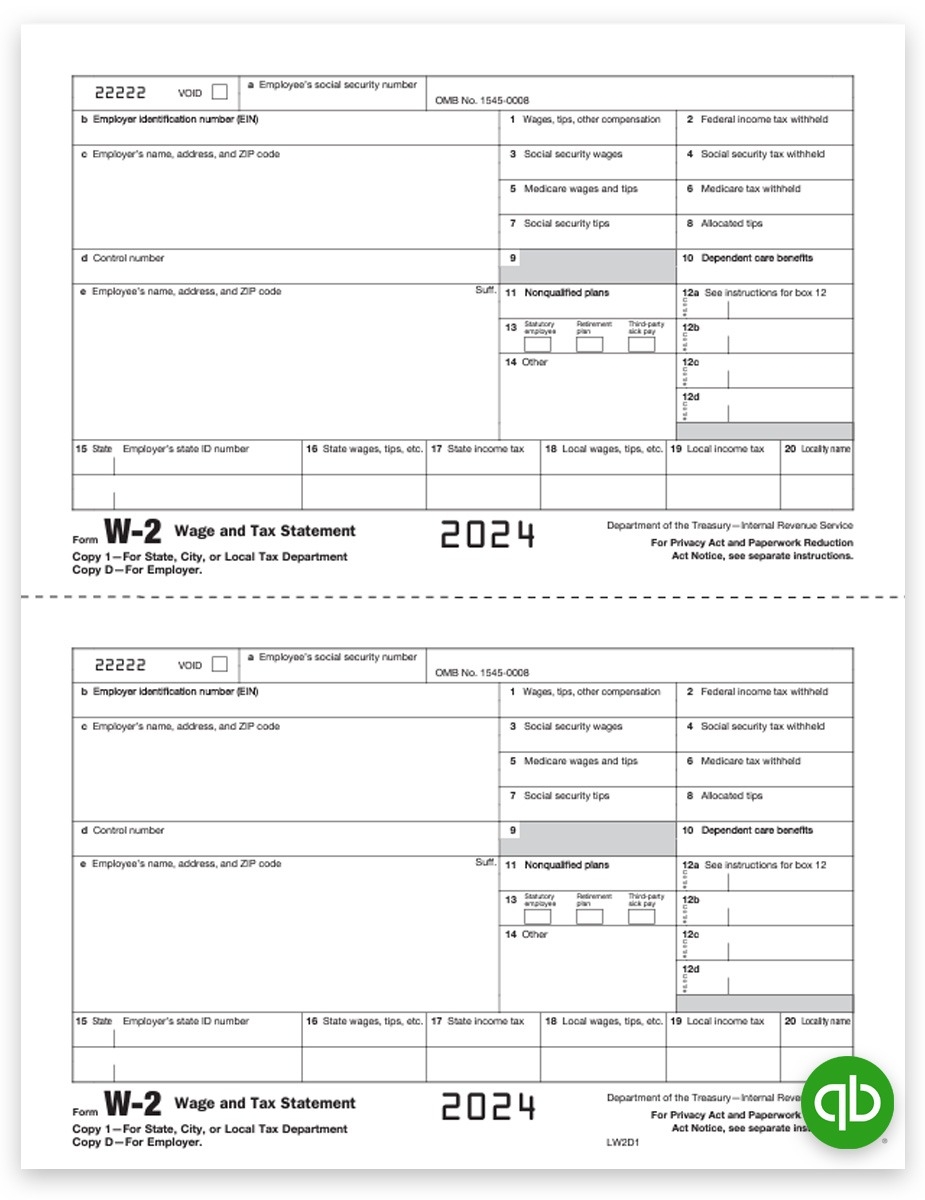

Quickbooks W2 Tax Form Copy 1 D For Employer

Quickbooks W2 Tax Form Copy 1 D For Employer

There are several websites and online services that offer printable W2 forms for free. These forms are usually in a PDF format, which can be easily downloaded and printed from your computer. Some sites even offer the option to fill out the form digitally before printing, saving you time and hassle.

Before printing your W2 form, be sure to double-check all the information on it for accuracy. Any mistakes or discrepancies could cause issues when filing your taxes, so it’s important to make sure everything is correct. If you notice any errors, reach out to your employer to get them corrected before proceeding.

Having a printable W2 form on hand can make the tax-filing process a lot smoother and more efficient. By being able to access and print your form whenever you need it, you can stay organized and on top of your finances. So, whether you need an extra copy of your W2 or just want to have a digital version for your records, having a printable W2 form is a valuable resource during tax season.

Make sure to take advantage of the convenience and ease of access that printable W2 forms offer. With just a few clicks, you can have your form in hand and be one step closer to completing your taxes. Stay organized, stay prepared, and make tax season a little less stressful with a printable W2 form.