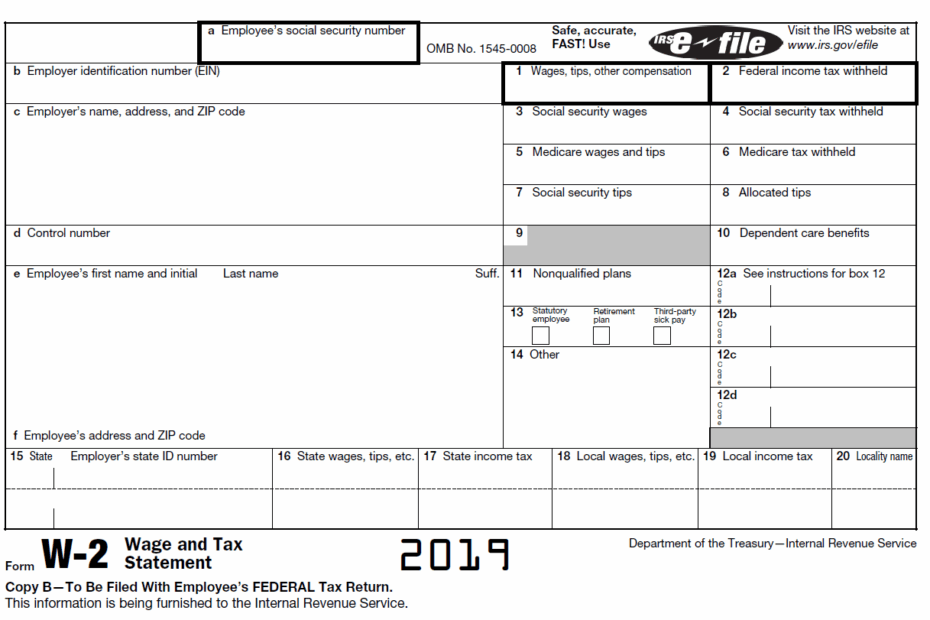

When tax season rolls around, one of the most important documents you’ll need is your W2 form. This form, also known as the Wage and Tax Statement, provides vital information about your earnings and taxes withheld by your employer. It is essential for filing your taxes accurately and ensuring you receive any refunds or credits you may be eligible for.

Obtaining your W2 form is crucial for completing your tax return, whether you file independently or seek professional assistance. While many employers provide digital copies of the form, having a printable version on hand can be useful for reference and record-keeping purposes. Understanding how to access and utilize the W2 form printable can streamline the tax-filing process and help you avoid any errors or delays.

Download and Print W2 Form Printable

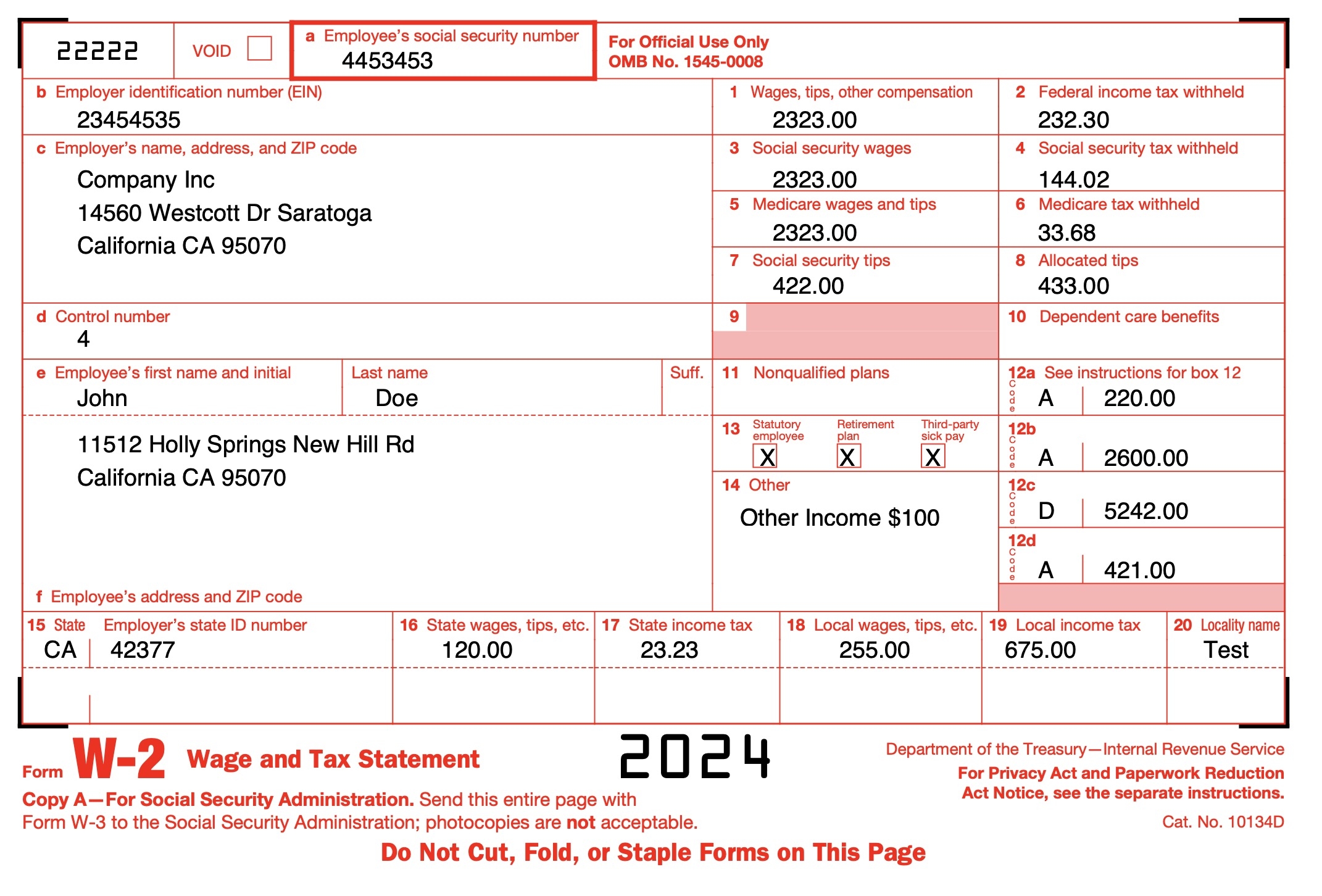

W2 Tax Forms Condensed 4up V1 For Employees DiscountTaxForms

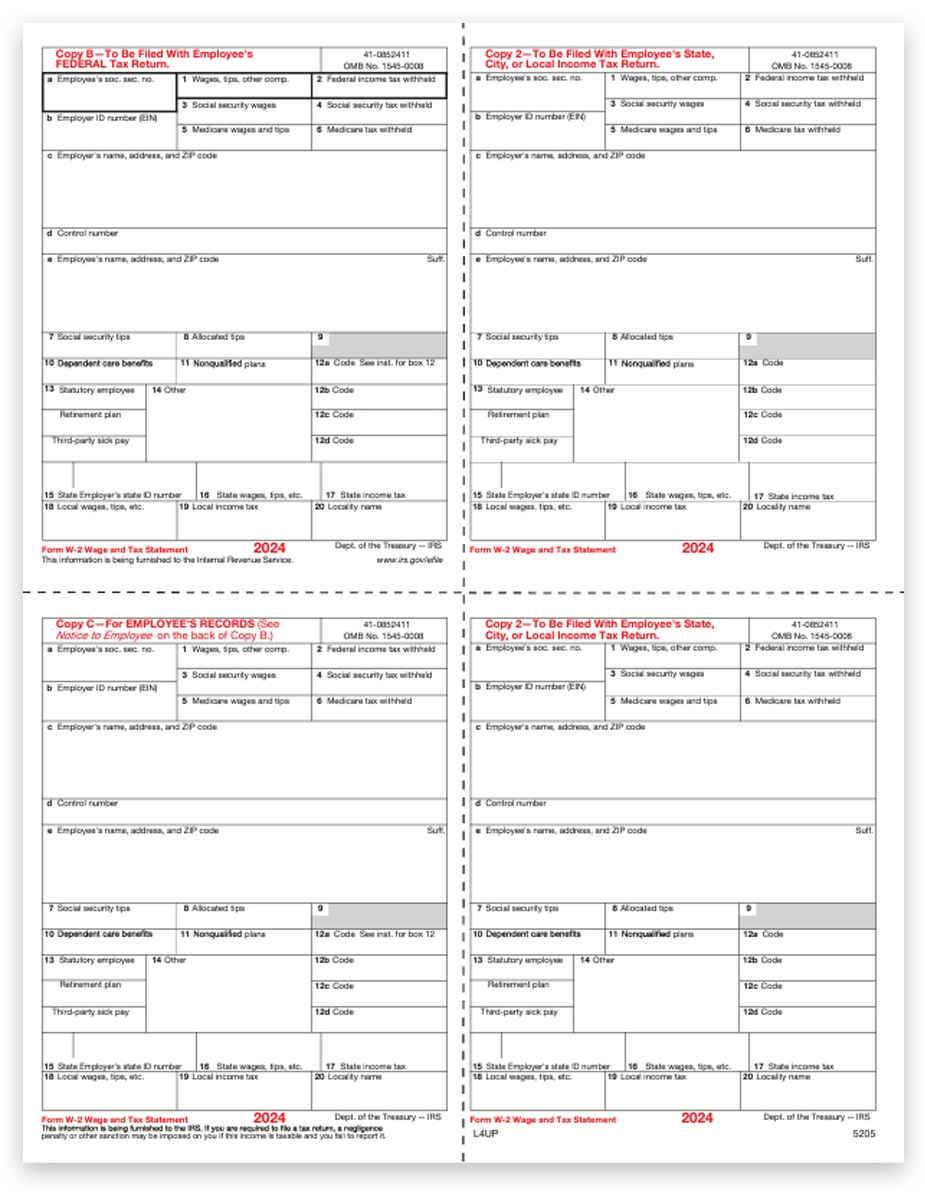

W2 Tax Forms Condensed 4up V1 For Employees DiscountTaxForms

W2 Form Printable

Having a printable W2 form allows you to easily review your income, deductions, and tax withholdings before filing your taxes. You can request a physical copy from your employer or access a digital version through your company’s payroll portal. Once you have the form in hand, you can print it out and use it to complete your tax return accurately.

It’s essential to verify that all the information on your W2 form is correct, including your name, Social Security number, and earnings. If you notice any discrepancies, notify your employer immediately to have them corrected. Filing your taxes with accurate information can help you avoid audits or penalties from the IRS.

When using the W2 form printable to file your taxes, make sure to follow the instructions provided by the IRS carefully. You will need to input the information from your form into the appropriate sections of your tax return, such as your income, deductions, and tax payments. Double-check your entries to ensure accuracy and completeness before submitting your return.

By utilizing the W2 form printable effectively, you can simplify the tax-filing process and ensure that you meet all legal requirements. Keep a copy of your completed return, along with your W2 form, for your records. If you have any questions or need assistance, consider consulting a tax professional to help you navigate the complexities of the tax code.

In conclusion, the W2 form printable is a vital tool for accurately reporting your income and taxes to the IRS. Make sure to obtain your form from your employer promptly and review it carefully for accuracy. By understanding how to use the W2 form printable correctly, you can file your taxes with confidence and avoid any potential issues with the IRS.