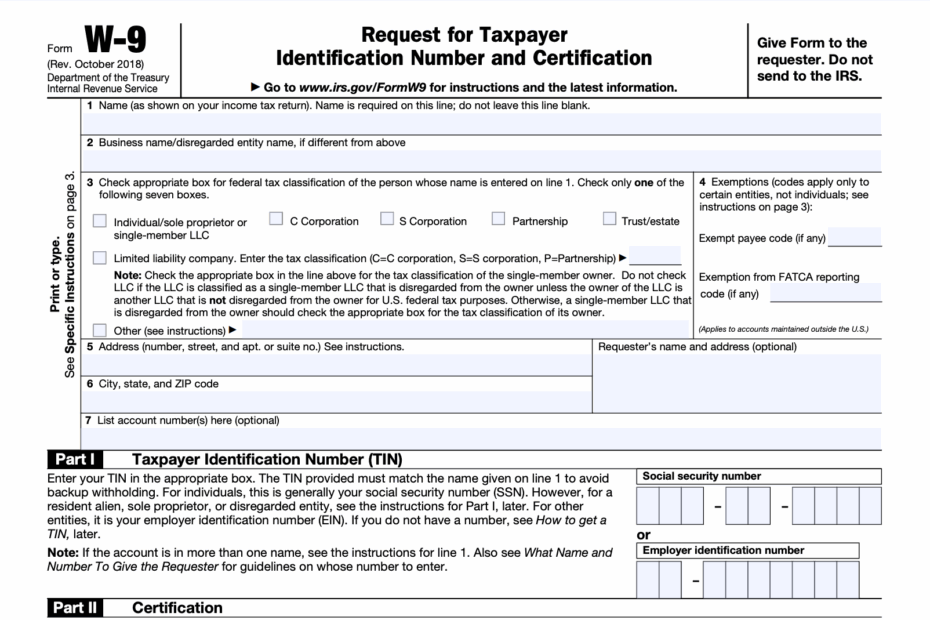

When it comes to tax forms, the W-9 is one that is commonly used in the United States. This form is used by businesses to request information from independent contractors or vendors they work with. It is important for both parties to understand the purpose and significance of the W-9 form to ensure compliance with tax laws.

The W-9 form is used to collect the taxpayer identification number (TIN) of the individual or entity providing services to a business. This information is crucial for the business to report payments made to the IRS and to the recipient for tax purposes. Failure to provide accurate information on the W-9 form can result in penalties and other consequences.

Get and Print W 9 Printable Form

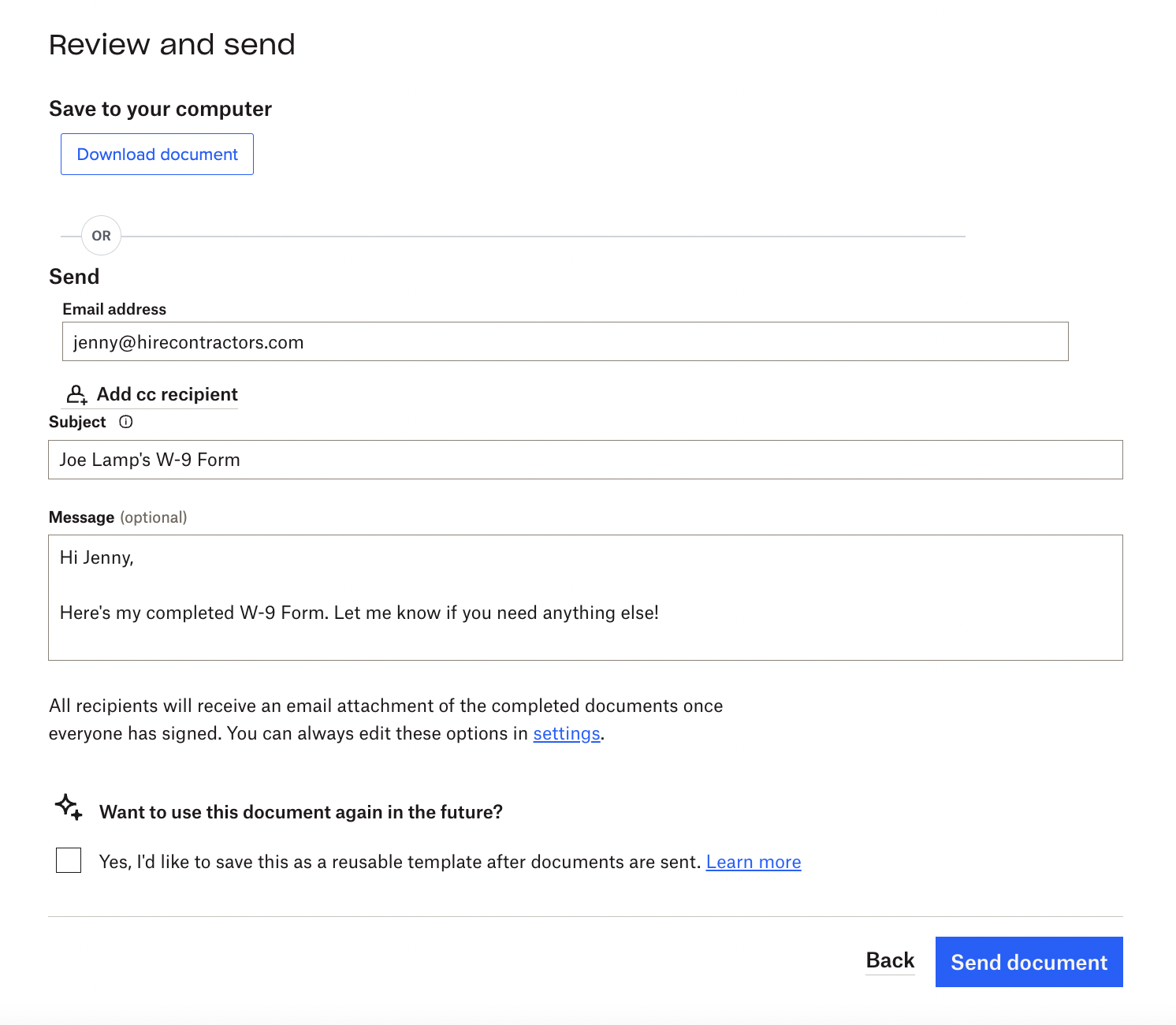

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

W-9 Printable Form

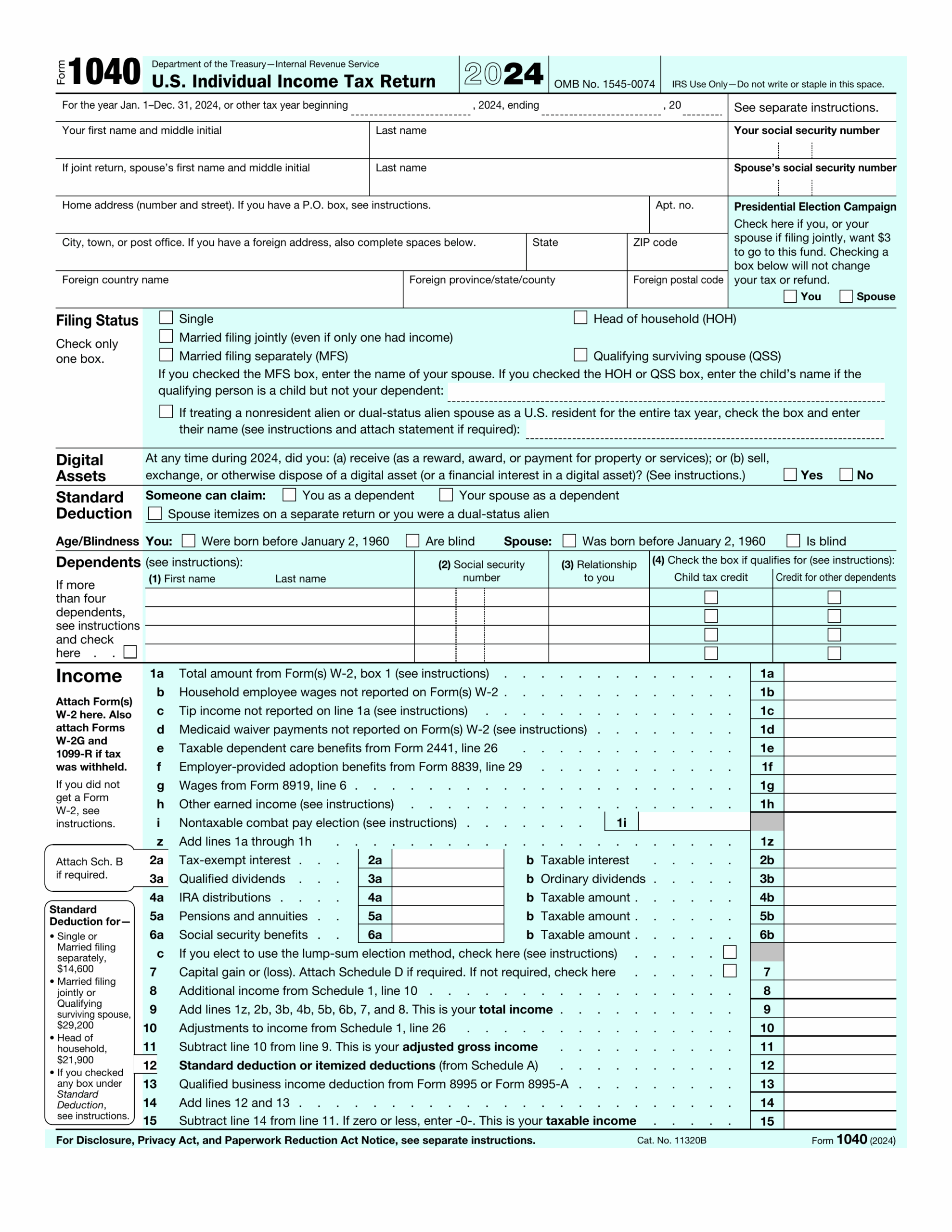

When it comes to filling out the W-9 form, it is important to ensure that all the required information is accurately provided. The form typically includes fields for the name, address, and TIN of the payee. It is important to use the most current version of the form, which can be easily found online and printed for use.

One of the key aspects of the W-9 form is that it is not submitted to the IRS. Instead, the information provided on the form is used by the business to prepare 1099 forms for reporting income paid to the recipient. It is important for businesses to keep accurate records of the W-9 forms they receive to ensure compliance with tax laws.

Overall, the W-9 form plays a crucial role in the tax reporting process for businesses and independent contractors. It is important for both parties to understand their responsibilities when it comes to providing and collecting accurate information on the form. By ensuring compliance with tax laws, businesses and individuals can avoid potential penalties and other consequences.

In conclusion, the W-9 printable form is a vital document for businesses and independent contractors in the United States. By understanding the purpose and significance of this form, both parties can ensure compliance with tax laws and avoid potential issues with the IRS. It is important to accurately fill out the form and keep accurate records for tax reporting purposes.