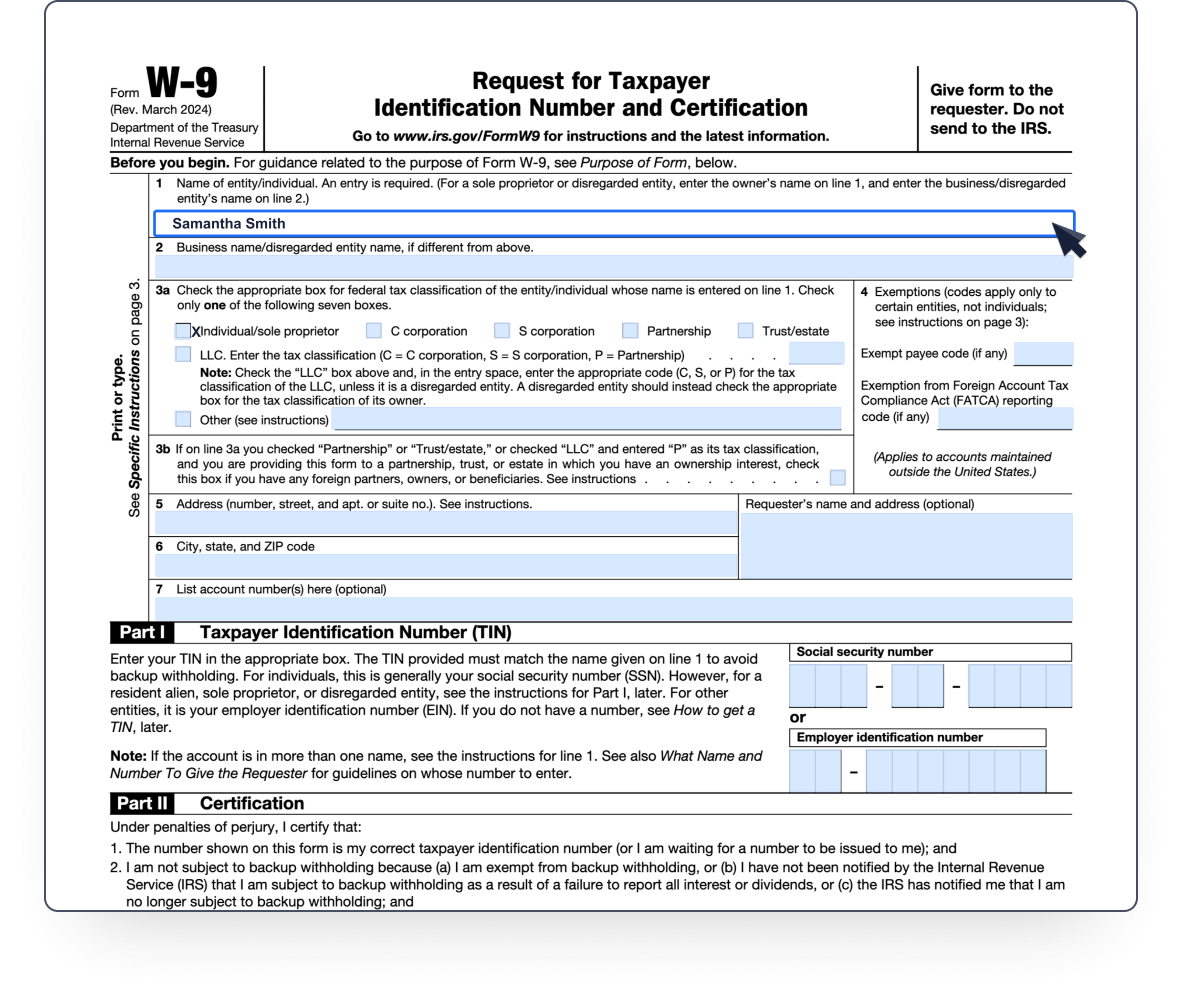

When it comes to tax season, it’s important to have all the necessary forms ready to go. One such form that you may need to fill out is the W-9 IRS Form 2025. This form is used to provide your taxpayer identification number to entities that will be paying you income, such as employers or clients.

It’s essential to understand the purpose of the W-9 form and how to properly fill it out. By providing accurate information on this form, you can ensure that you are properly reported to the IRS and that you receive any necessary tax forms, such as a 1099, at the end of the year.

Quickly Access and Print W 9 Irs Form 2025 Printable

W 9 Form 2024 Fillable PDF For Secure And Legal Tax ID Sharing Worksheets Library

W 9 Form 2024 Fillable PDF For Secure And Legal Tax ID Sharing Worksheets Library

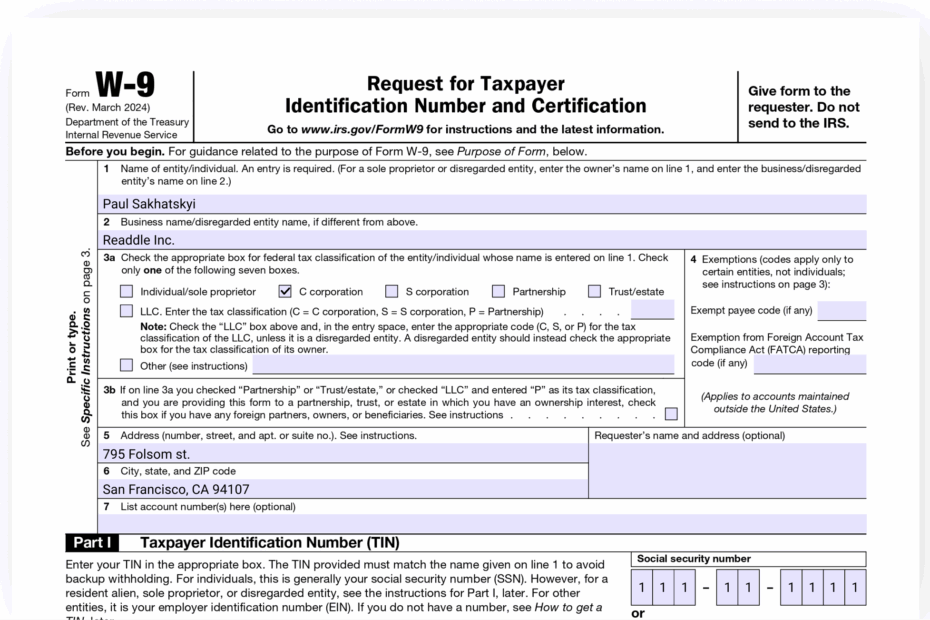

When filling out the W-9 IRS Form 2025, you will need to provide basic information such as your name, address, and taxpayer identification number (usually your Social Security number or Employer Identification Number). You will also need to indicate your tax classification, such as whether you are an individual, corporation, or partnership.

It’s important to note that the W-9 form is not submitted to the IRS but rather to the entity requesting it. They will use the information provided on the form to accurately report your income to the IRS. The form is typically kept on file by the requesting entity for at least four years.

As tax laws and forms can change over time, it’s always a good idea to ensure that you are using the most current version of the W-9 form. The IRS regularly updates its forms, so it’s important to check for any updates or revisions to the form before submitting it.

In conclusion, the W-9 IRS Form 2025 is an essential document for anyone who will be receiving income from a third party. By understanding the purpose of the form and how to properly fill it out, you can ensure that you are accurately reported to the IRS and receive any necessary tax forms at the end of the year.