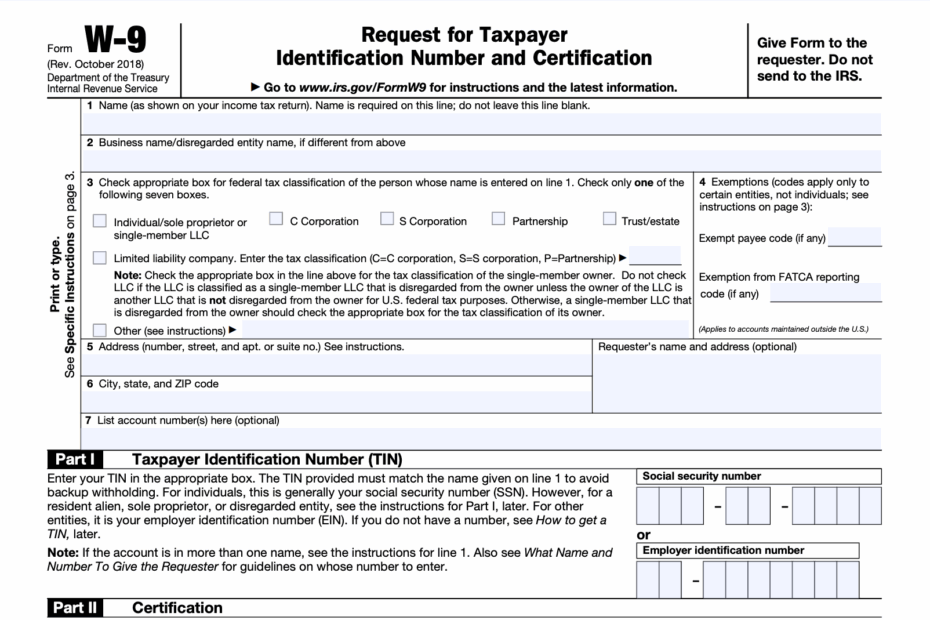

When it comes to tax season, filling out the necessary forms can be a daunting task. One of the most common forms that individuals and businesses are required to fill out is the W-9 form. This form is used to provide your taxpayer identification number to the entity that is requesting it, such as an employer or client. Understanding how to properly fill out and submit a W-9 form is essential to ensure that your tax information is accurate and up to date.

It’s important to note that the W-9 form is not actually filed with the IRS, but rather kept on file by the requesting entity for their records. This form is used to gather information about your tax status, such as whether you are a U.S. citizen or resident alien, and whether you are subject to backup withholding. It’s crucial to fill out the form accurately to avoid any potential issues with your tax filings in the future.

Get and Print W 9 Form Printable Form

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

W 9 Form Printable Form

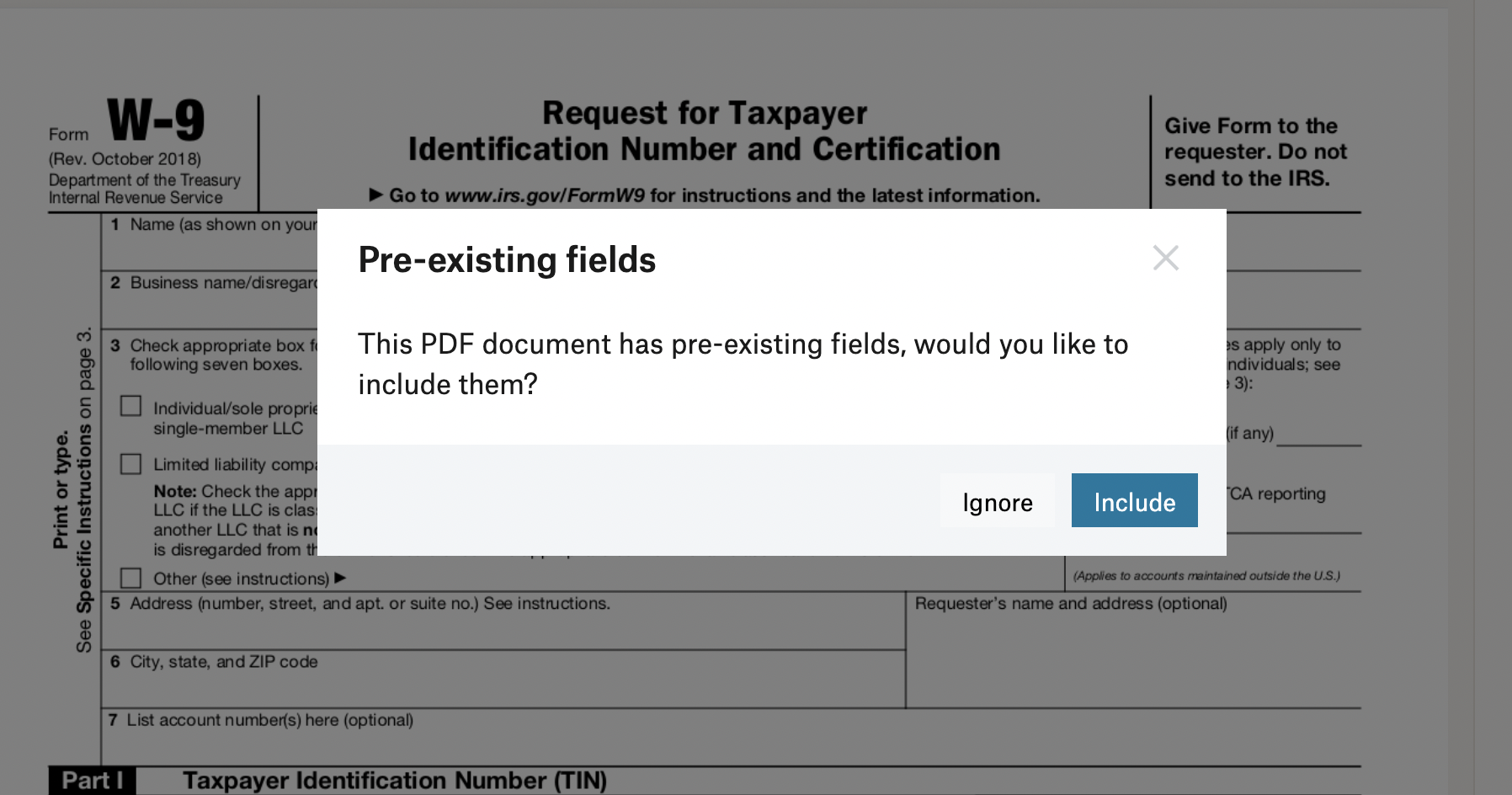

Fortunately, the W-9 form is readily available online and can be easily printed out for your convenience. Having a printable version of the form allows you to fill it out at your own pace and ensure that all the required information is included. You can find the W-9 form on the IRS website or through various tax preparation software platforms.

When filling out the W-9 form, be sure to provide your name, business name (if applicable), address, and taxpayer identification number. It’s important to double-check all the information you provide to ensure its accuracy. Once you have completed the form, you can then submit it to the requesting entity either electronically or by mail.

By submitting a completed W-9 form, you are not only providing the necessary information to the entity requesting it but also certifying that the information you have provided is correct. This helps to establish your tax status and ensures that you are properly identified for tax reporting purposes.

In conclusion, understanding how to properly fill out and submit a W-9 form is essential for individuals and businesses alike. By utilizing a printable form, you can easily gather and provide the necessary information to the requesting entity. Be sure to take the time to accurately complete the form to avoid any potential issues with your tax filings in the future.