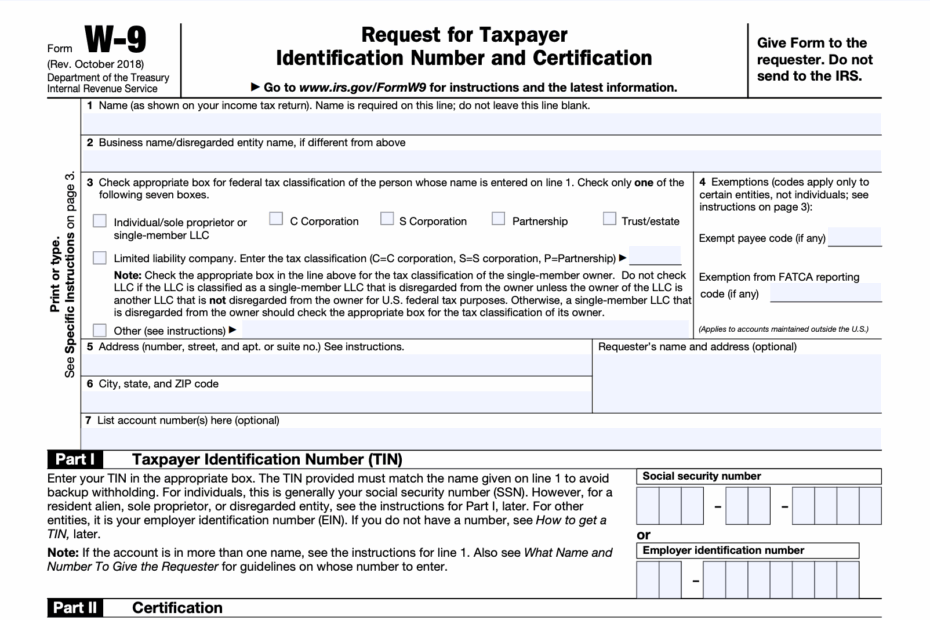

When it comes to tax forms, the W-9 Form is an important document that is commonly used in the United States. This form is used to collect information from individuals or businesses who are considered independent contractors, freelancers, or vendors. It is essential for businesses to have this form on file for tax reporting purposes.

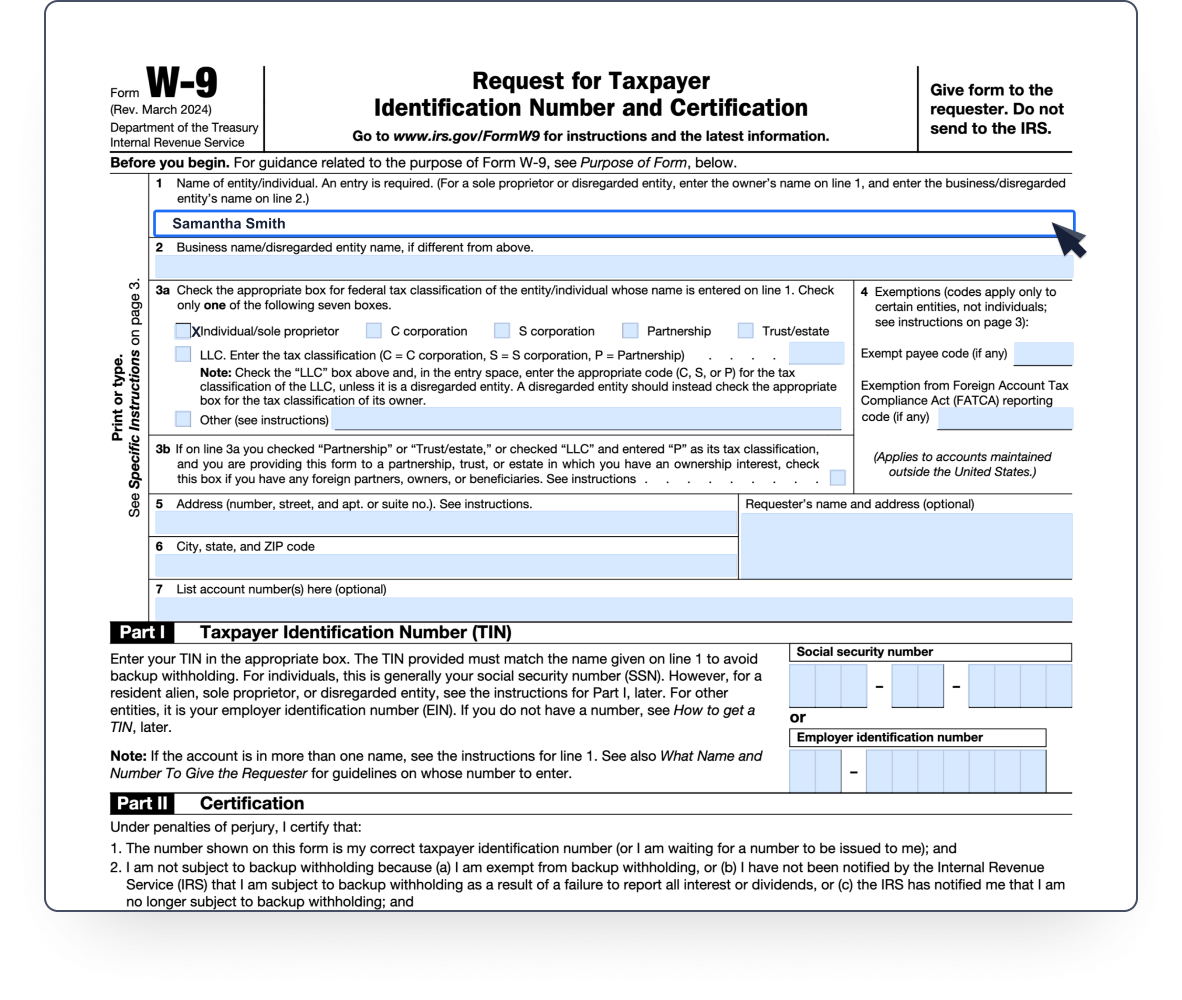

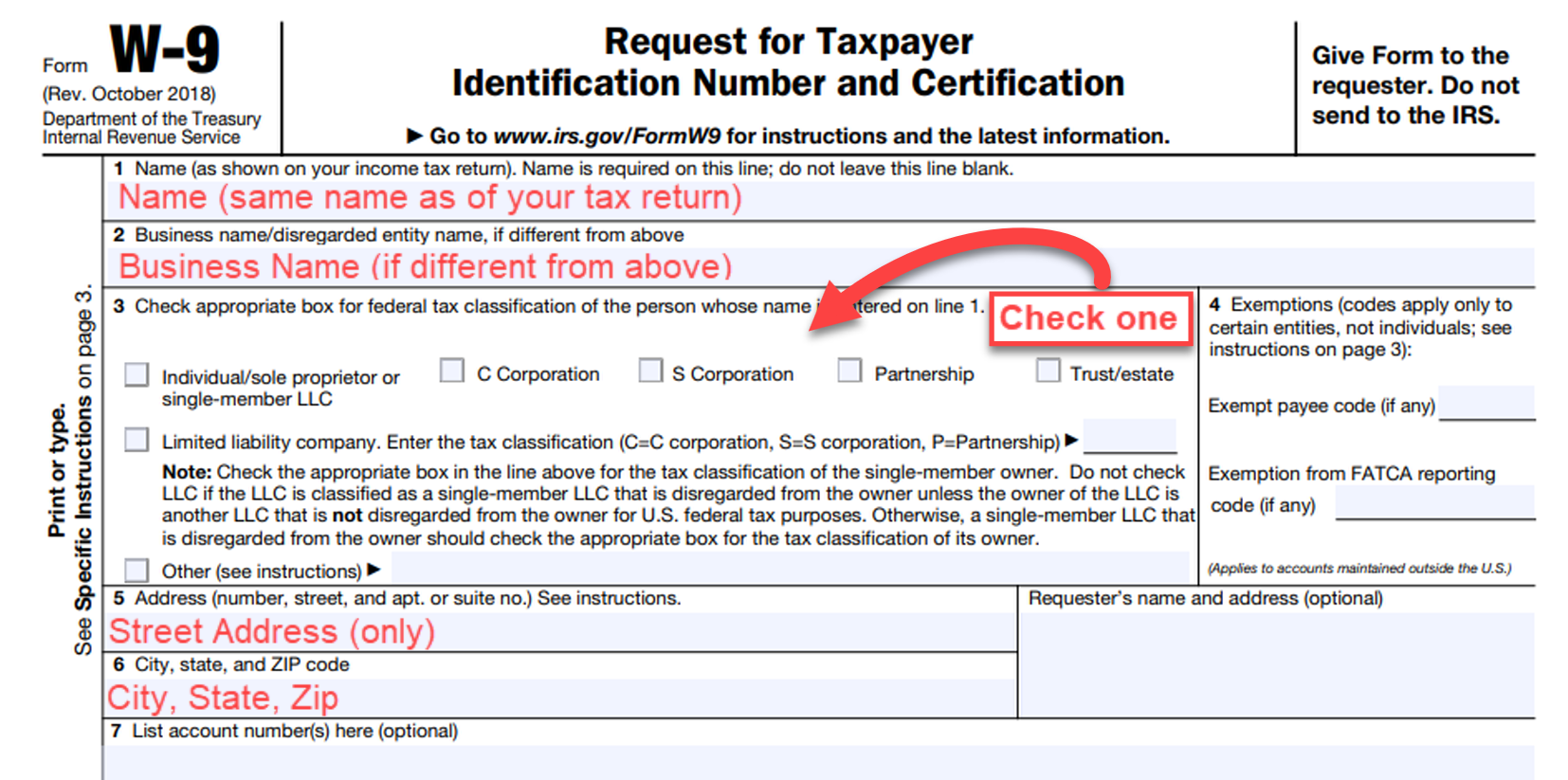

Understanding how to properly fill out a W-9 Form is crucial for both parties involved. The form requires basic information such as name, address, and tax identification number. It is important to fill out the form accurately to avoid any issues with tax reporting in the future.

Easily Download and Print W-9 Form Printable

Free IRS Form W9 2024 PDF EForms

Free IRS Form W9 2024 PDF EForms

W-9 Form Printable

For those who need to fill out a W-9 Form, there are many resources available online where you can find a printable version of the form. Having a printable version of the form makes it easy to access and fill out whenever needed. It is recommended to keep a copy of the completed form for your records.

When filling out the W-9 Form, be sure to double-check all information before submitting it to the requesting party. Any errors or missing information could lead to delays in payment or tax reporting issues. It is always best to review the form thoroughly to ensure accuracy.

It is also important to note that the information provided on the W-9 Form is confidential and should only be shared with authorized individuals or entities. Protecting your personal information is essential to prevent identity theft or fraud. Be cautious when submitting the form and only provide it to trusted sources.

In conclusion, the W-9 Form is a necessary document for tax reporting purposes for independent contractors, freelancers, and vendors. Having a printable version of the form makes it convenient to fill out and keep on file. Remember to fill out the form accurately, review it carefully, and protect your personal information when submitting it.

We hope this article has provided valuable information about the W-9 Form and its importance in tax reporting. If you have any questions or need assistance with filling out the form, feel free to reach out to us for guidance.