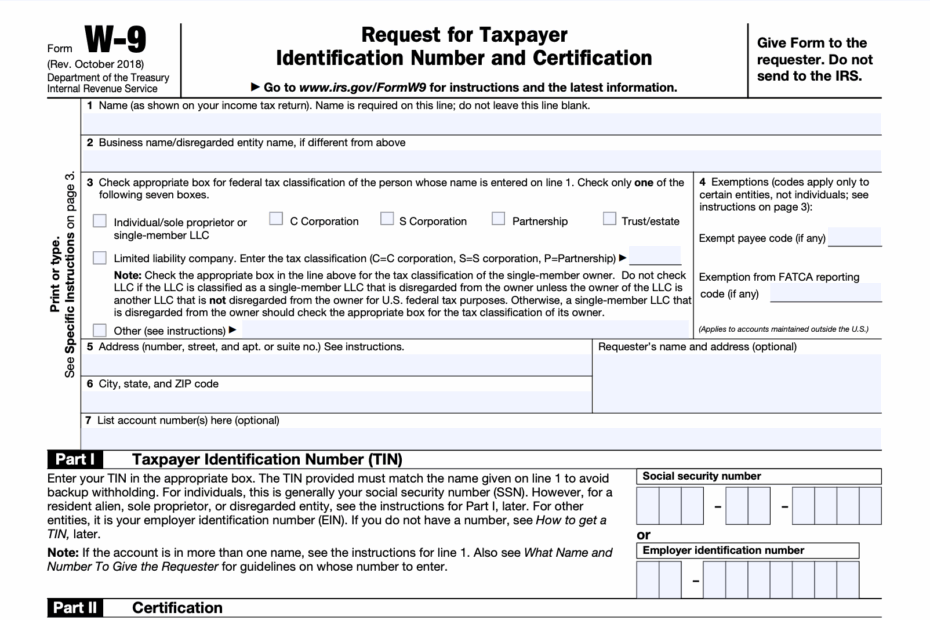

When it comes to tax forms, the W-9 form is a crucial document that is often required by employers or clients. This form is used to gather information from independent contractors or freelancers who provide services to a business. The information provided on the W-9 form is used to report payments made to these individuals to the IRS.

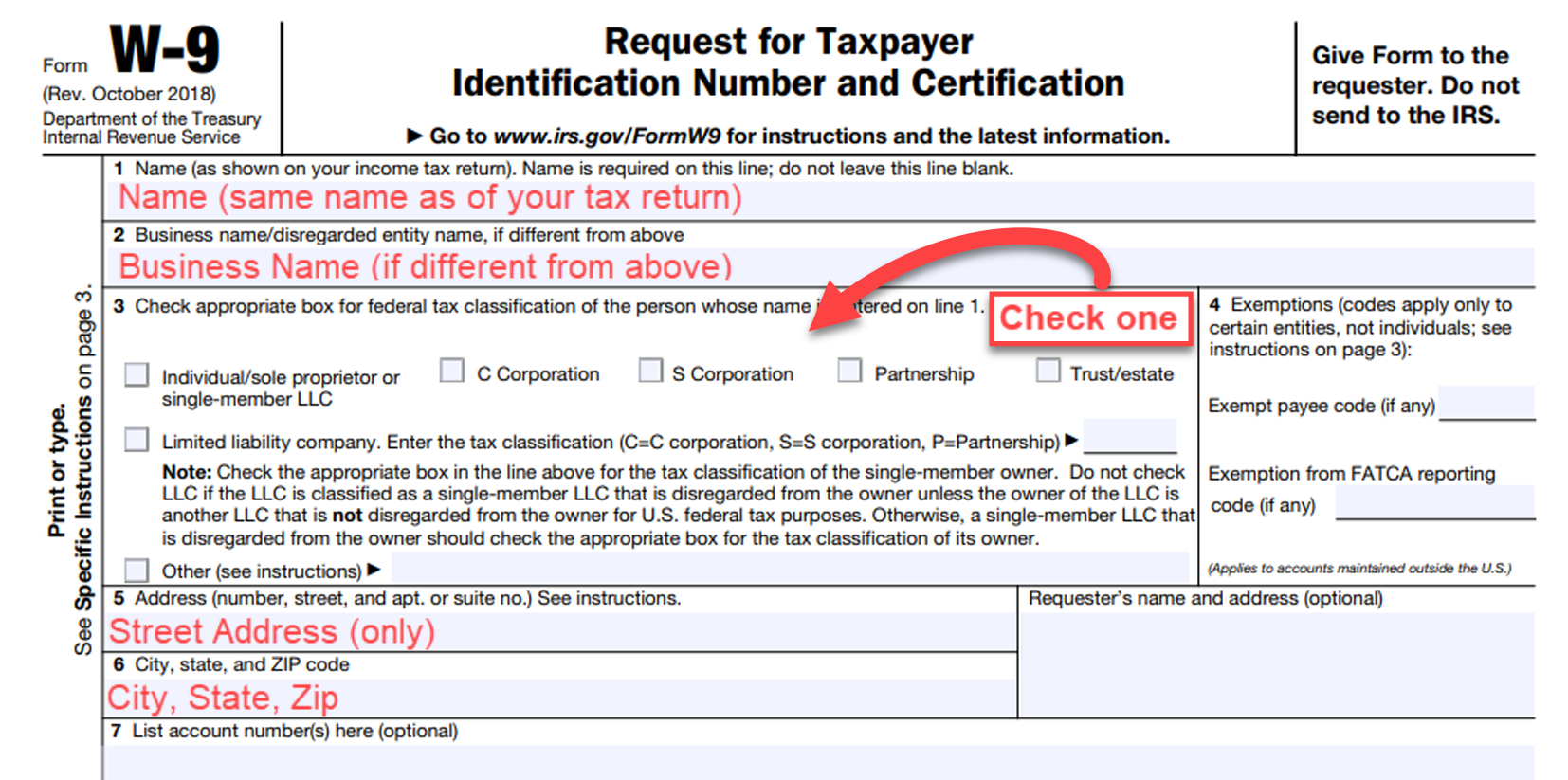

One of the key features of the W-9 form is its simplicity and ease of use. It is a one-page document that requires basic information such as the individual’s name, address, social security number or employer identification number, and signature. This form can be easily filled out and submitted either electronically or in paper form.

Save and Print W 9 Form Printable

Free IRS Form W9 2024 PDF EForms

Free IRS Form W9 2024 PDF EForms

W-9 Form Printable

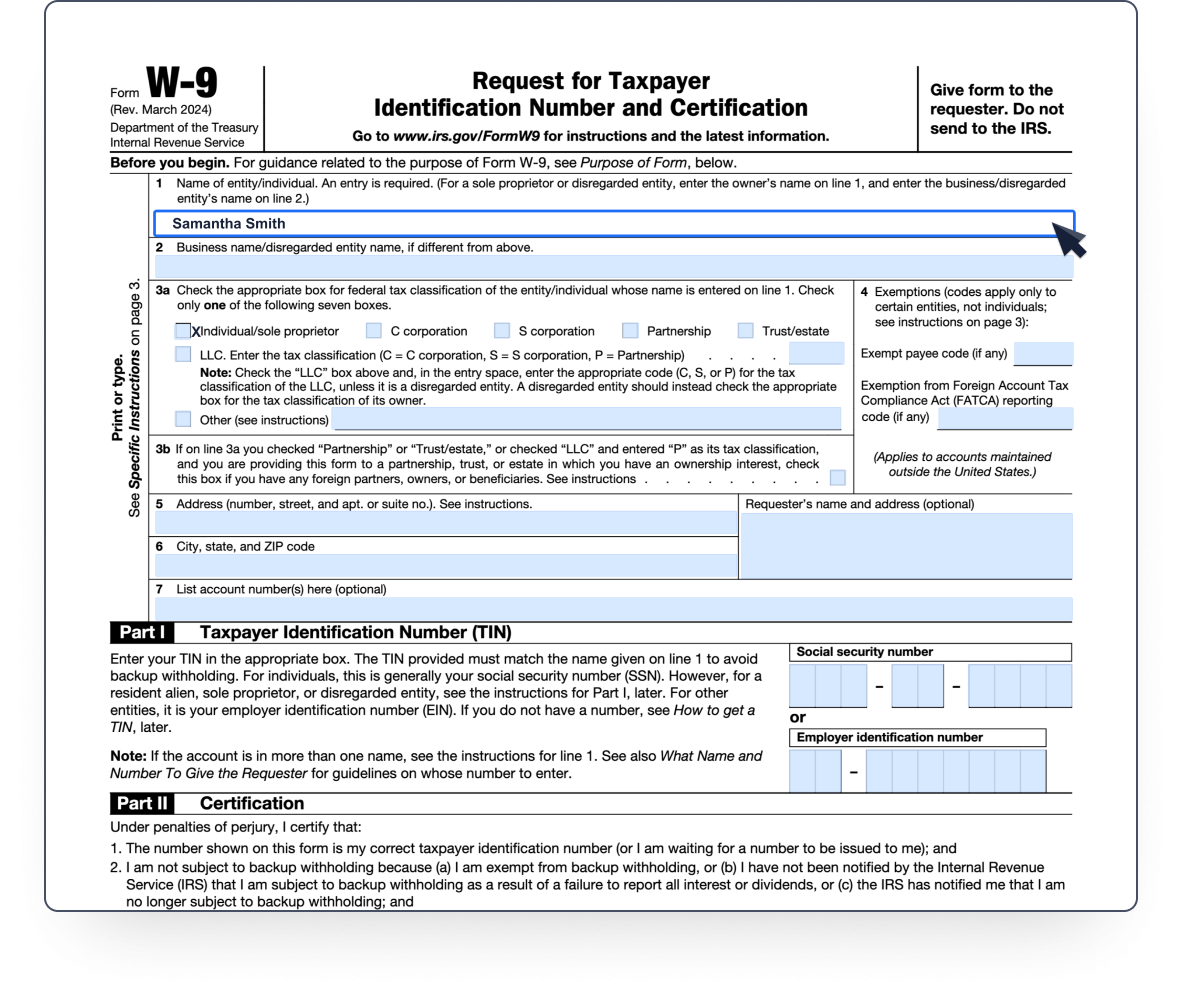

If you are in need of a W-9 form, you can easily find a printable version online. There are many websites that offer a downloadable PDF version of the form that you can fill out and submit. This makes the process of providing your information to a client or employer quick and convenient.

When filling out the W-9 form, it is important to ensure that all the information provided is accurate and up to date. Any discrepancies or errors in the form could lead to issues with reporting payments to the IRS. It is also important to keep a copy of the completed form for your records.

Overall, the W-9 form is a simple yet important document that is necessary for individuals who work as independent contractors or freelancers. By providing the required information on this form, you can ensure that your payments are reported accurately to the IRS and avoid any potential issues with tax compliance.

In conclusion, the W-9 form is a vital document for individuals who work as independent contractors or freelancers. By utilizing the printable version of this form, you can easily provide the necessary information to your clients or employers and ensure compliance with IRS regulations.