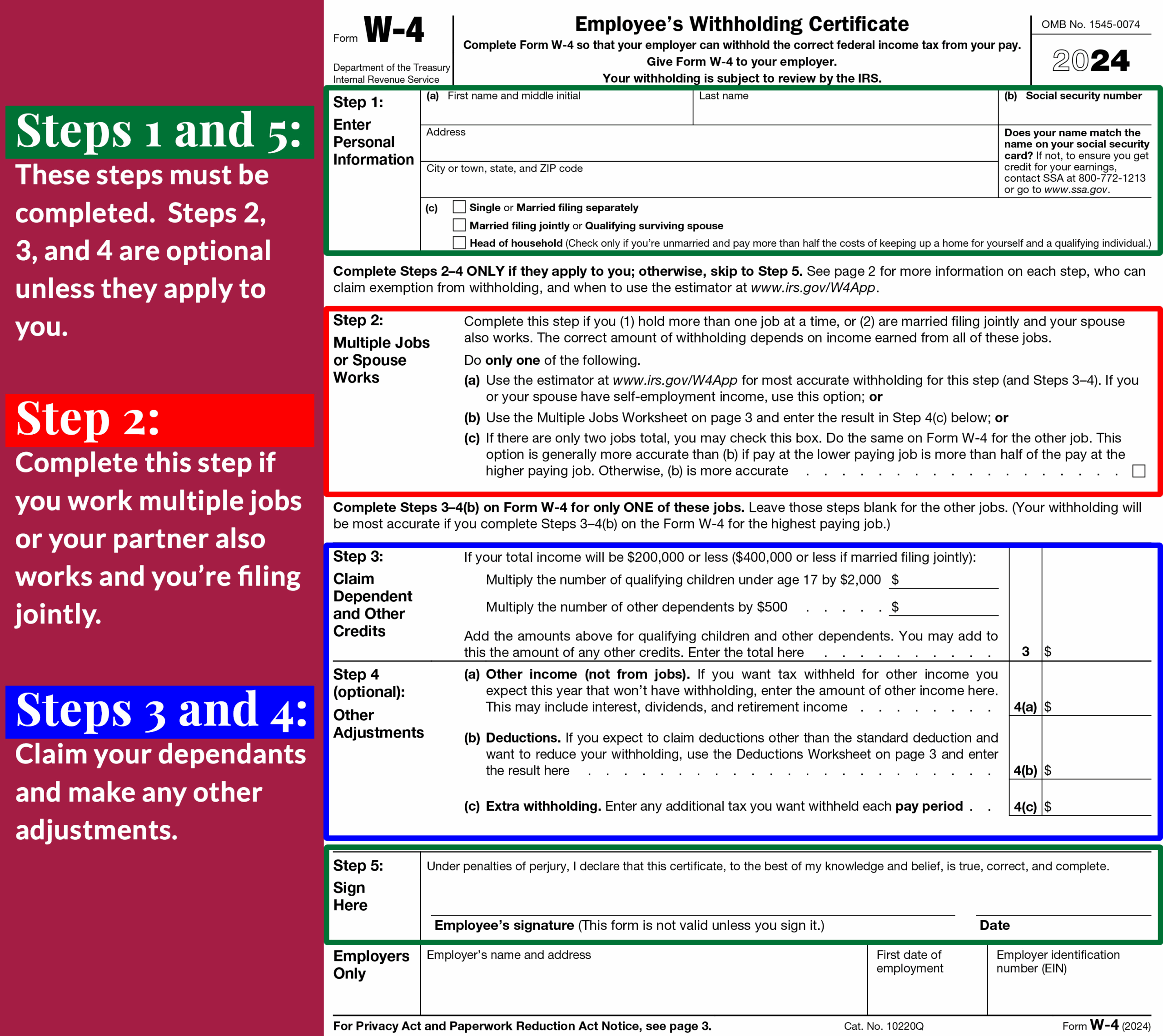

When starting a new job, one of the first forms you will be asked to fill out is the W-4 form. This form is crucial for determining how much federal income tax should be withheld from your paycheck. It is important to fill out this form accurately to avoid any surprises come tax time.

With the release of the W-4 Form 2024, there have been some updates and changes that individuals need to be aware of. This new form takes into account changes in tax laws and aims to make the process of withholding taxes more accurate and efficient for both employees and employers.

Get and Print W-4 Form 2024 Printable

Form W 4 Form Pros Worksheets Library

Form W 4 Form Pros Worksheets Library

W-4 Form 2024 Printable

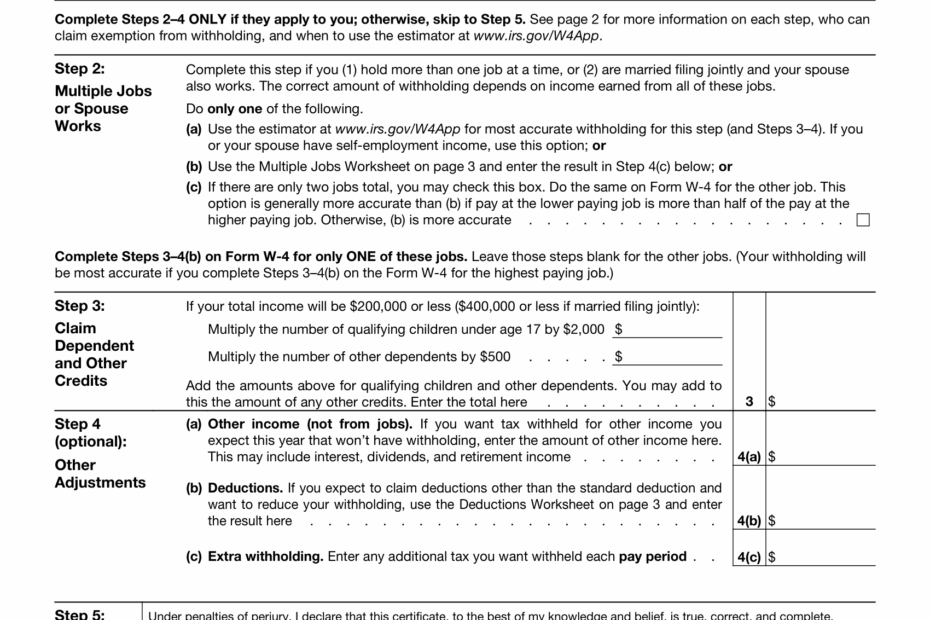

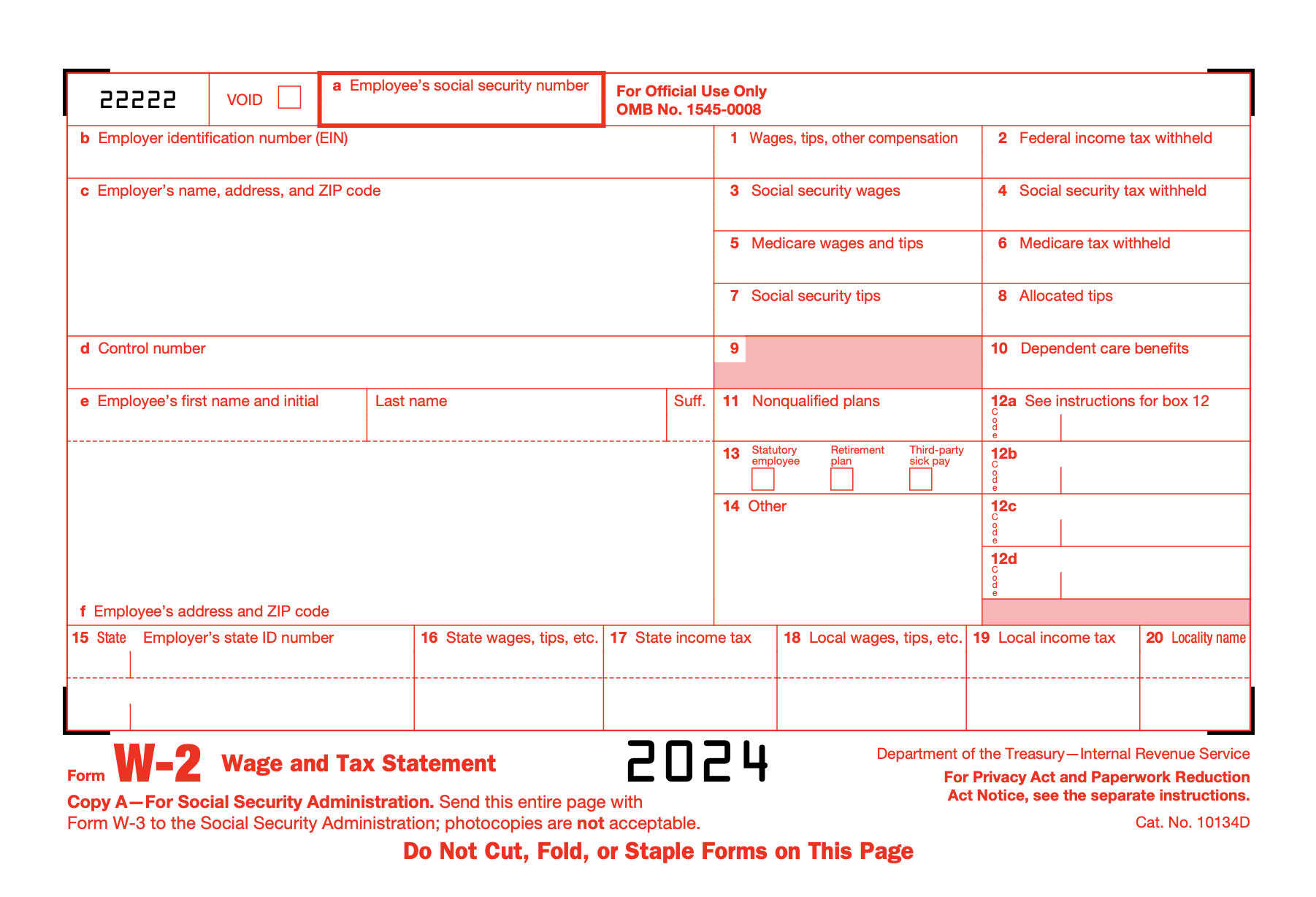

The W-4 Form 2024 Printable is readily available online for individuals to download and fill out. This form includes sections for personal information, such as your name, address, and Social Security number, as well as sections for indicating your filing status, any dependents you have, and any additional income you may have.

One of the key changes in the W-4 Form 2024 is the removal of allowances. Instead of claiming a certain number of allowances, individuals will now indicate any additional income they expect to earn and any deductions or credits they plan to claim. This new method aims to provide a more accurate withholding amount based on individual circumstances.

It is important to take the time to carefully fill out the W-4 Form 2024 to ensure that the correct amount of federal income tax is withheld from your paycheck. Failing to do so could result in owing taxes at the end of the year or receiving a smaller refund than expected.

Overall, the W-4 Form 2024 Printable is a valuable tool for both employees and employers in accurately determining federal income tax withholding. By understanding the changes in the new form and taking the time to fill it out correctly, individuals can avoid any potential tax surprises and ensure that their tax obligations are met.

Make sure to download and fill out the W-4 Form 2024 Printable when starting a new job or whenever your tax situation changes to stay on top of your tax obligations and avoid any unnecessary penalties or fees.