When tax season rolls around, it’s important to have all your necessary forms in order. One such form that many individuals receive is the W-2 form. This form is crucial for accurately reporting your income and taxes to the IRS. Understanding how to properly fill out and utilize the W-2 form is essential for a smooth tax filing process.

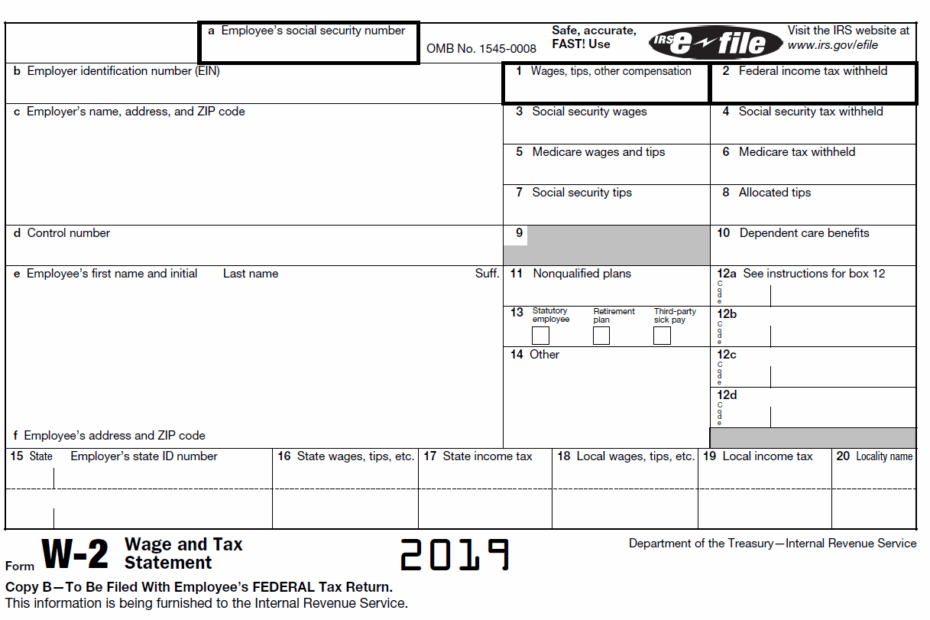

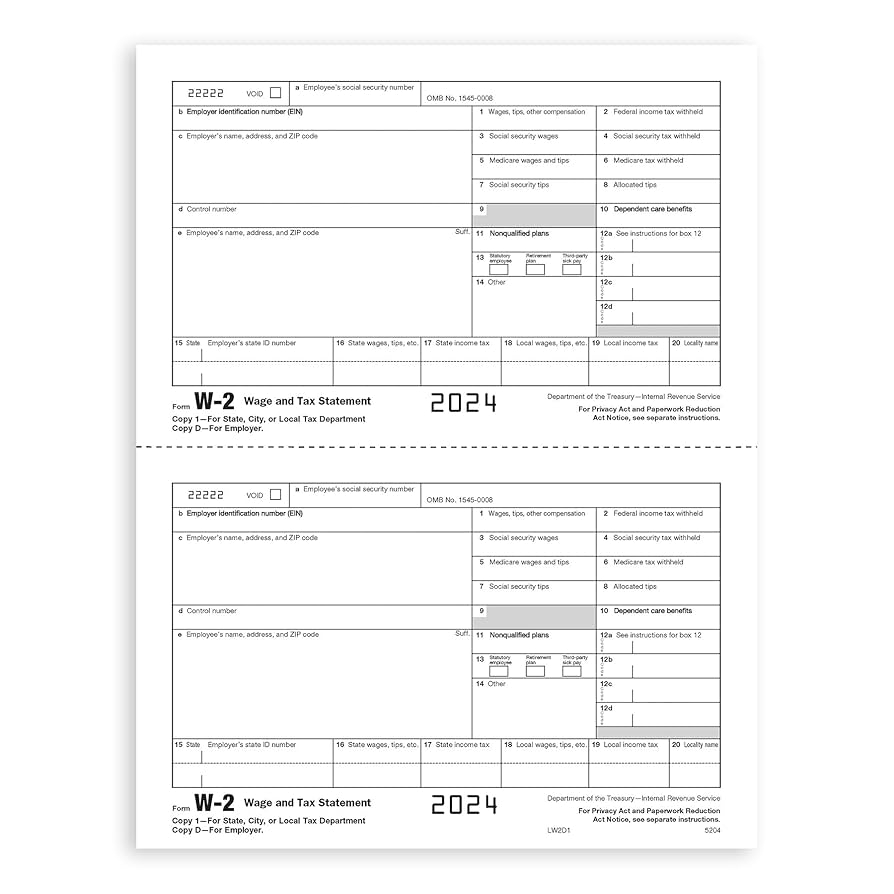

Employers are required to provide their employees with a W-2 form each year, detailing their earnings and taxes withheld. This form is necessary for individuals to file their taxes accurately and on time. The W-2 form includes information such as wages earned, federal and state taxes withheld, and any other deductions or contributions made throughout the year.

Get and Print W 2 Printable Form

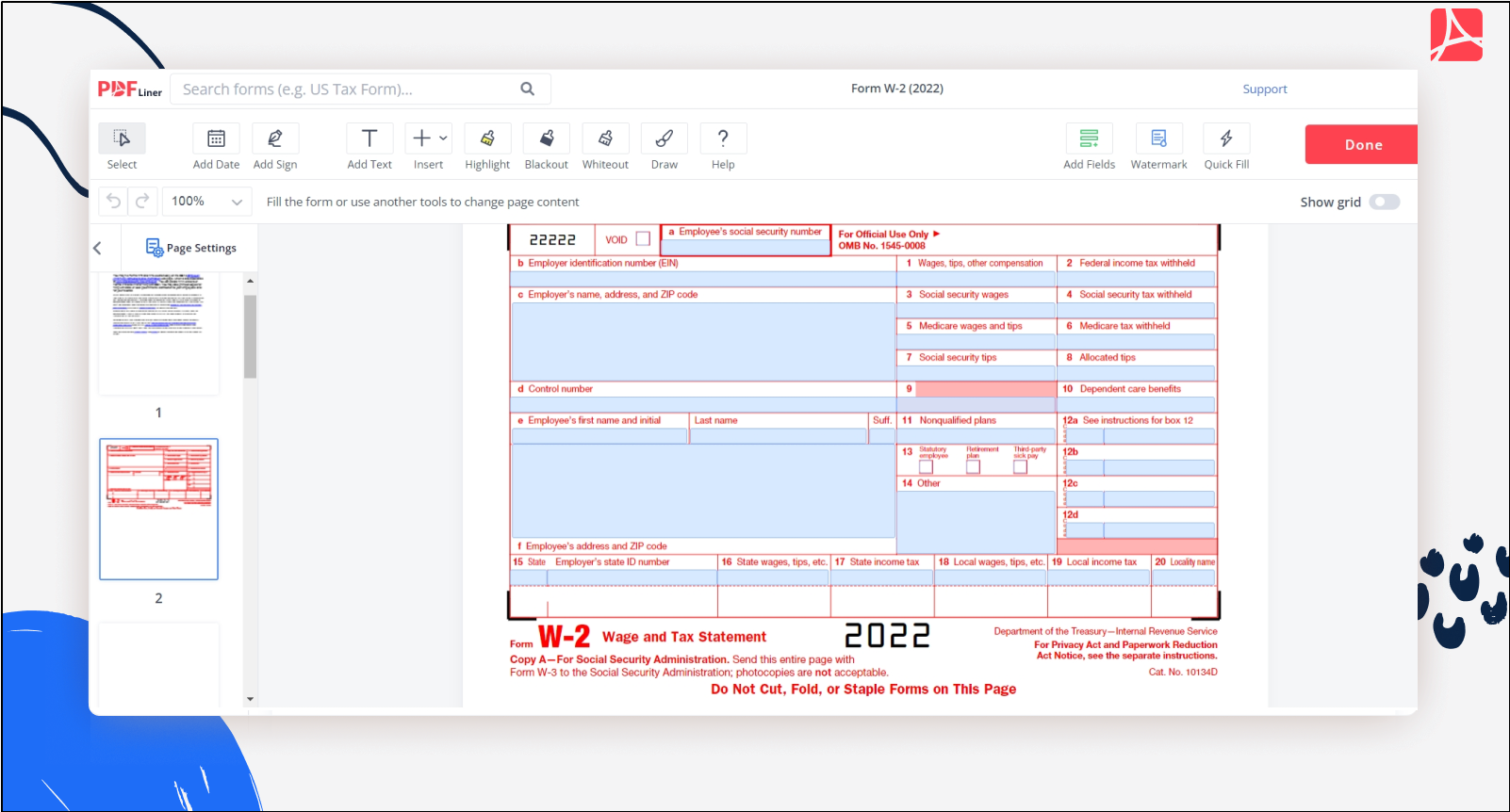

Form W 2 2022 Printable Form W 2 Sign Forms Online PDFliner

Form W 2 2022 Printable Form W 2 Sign Forms Online PDFliner

W-2 Printable Form

For individuals who prefer to file their taxes manually or simply want a hard copy of their W-2 form, there are printable versions available online. These forms can be easily accessed, downloaded, and printed for your convenience. It’s important to ensure that all information on the form is accurate and matches the information provided by your employer. Any discrepancies could lead to delays or issues with your tax filing.

When using a printable W-2 form, be sure to follow the instructions provided carefully. Fill in all necessary fields accurately and double-check the information before submitting it with your tax return. It’s also important to keep a copy of your W-2 form for your records, as well as any other supporting documents related to your income and taxes.

By utilizing a printable W-2 form, you can take control of your tax filing process and ensure that all necessary information is included. Whether you file your taxes independently or seek assistance from a tax professional, having a completed W-2 form is essential for an accurate and timely tax return.

In conclusion, the W-2 form is a crucial document for accurately reporting your income and taxes to the IRS. Utilizing a printable version of this form can make the tax filing process easier and more convenient. Be sure to fill out the form accurately, keep a copy for your records, and submit it with your tax return on time. With the right tools and information, you can navigate tax season with confidence.