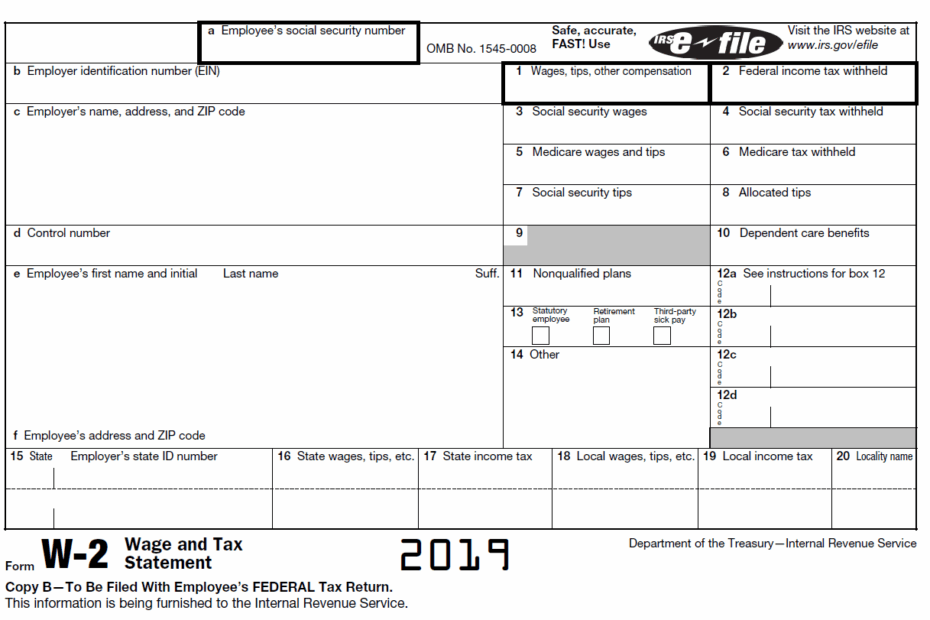

As tax season approaches, it’s important for employees to have their W-2 forms ready for filing their taxes. A W-2 form is a document provided by employers to their employees that outlines the amount of wages earned and taxes withheld throughout the year. This form is essential for accurately reporting income to the IRS and ensuring that taxes are paid correctly.

For those who prefer to fill out their W-2 forms manually, printable versions are available online. These forms can be easily downloaded, filled out, and submitted to the IRS along with other tax documents. Having a printable W-2 form can make the tax-filing process more convenient and efficient for individuals who prefer to handle their paperwork themselves.

Easily Download and Print W-2 Form Printable

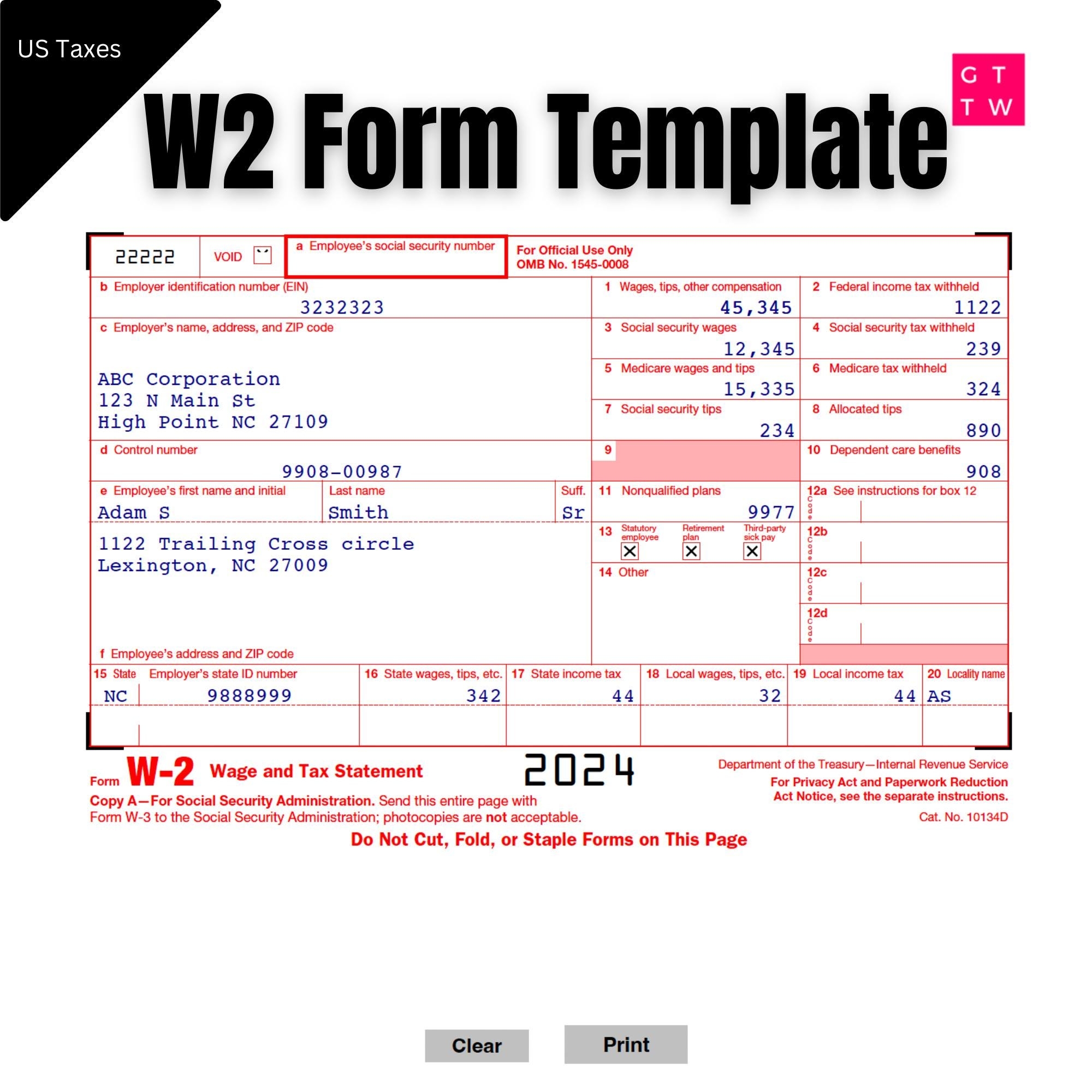

Free W2 Form Generator Create A W2 Form In One Click

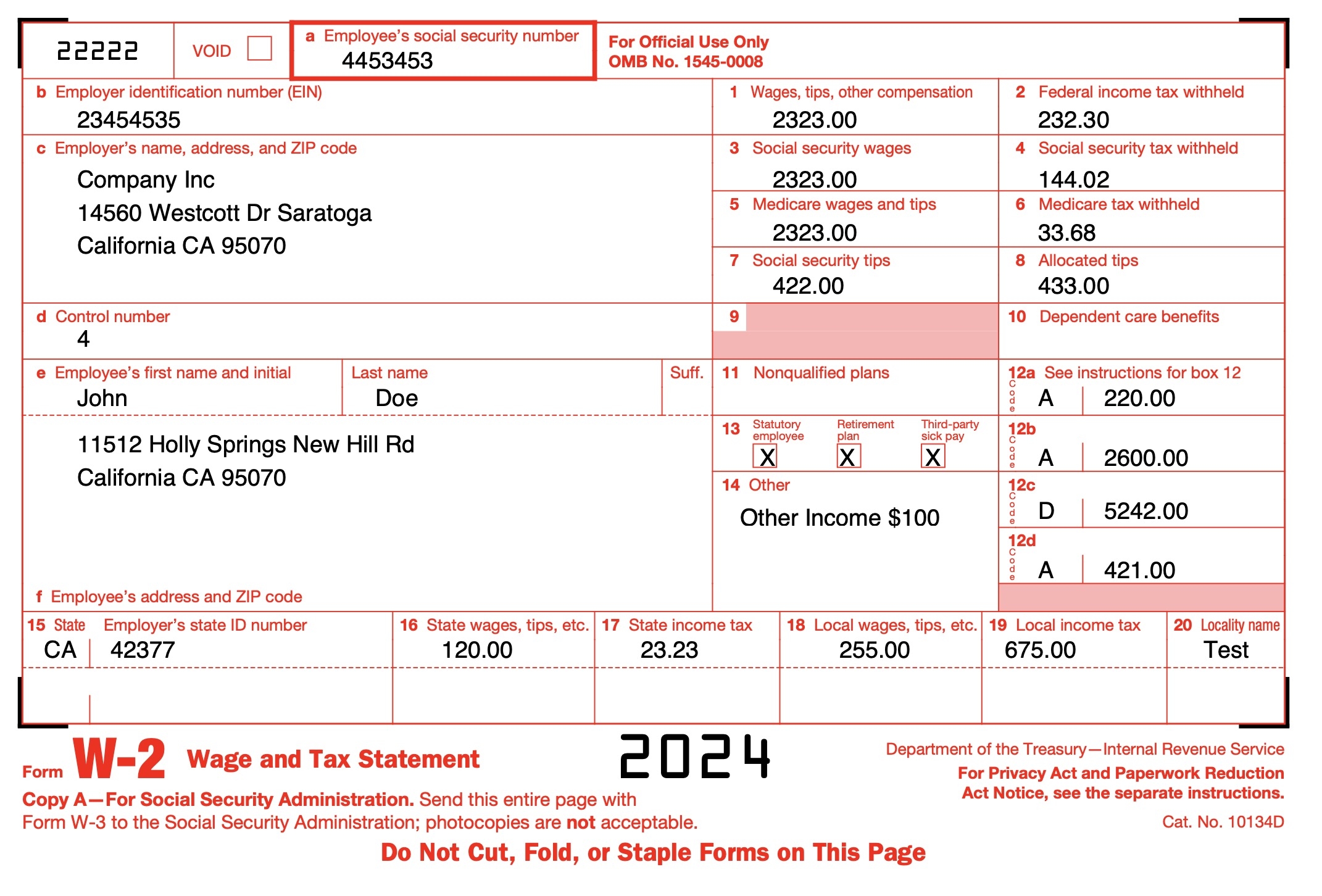

Free W2 Form Generator Create A W2 Form In One Click

When printing out a W-2 form, it’s important to ensure that all information is filled out accurately and completely. Any errors or missing information could result in delays in processing or potential penalties from the IRS. Double-checking the form for accuracy before submission is crucial to avoid any issues with tax filings.

Additionally, it’s recommended to keep a copy of the completed W-2 form for personal records. Having a record of income and taxes withheld can be helpful for future reference or in case of any discrepancies that may arise. Keeping organized records of tax documents can make the process of filing taxes each year much smoother and less stressful.

Overall, utilizing a printable W-2 form can be a convenient option for employees who prefer to handle their tax filings independently. By ensuring that the form is filled out accurately and completely, individuals can avoid potential issues with the IRS and make the tax-filing process more efficient. Having a record of tax documents can also be beneficial for future reference and organization.

As tax season approaches, it’s important to have all necessary documents ready for filing taxes. With a printable W-2 form, individuals can easily access and fill out this essential document to accurately report income and taxes withheld throughout the year. By staying organized and thorough in the tax-filing process, individuals can ensure that their taxes are filed correctly and avoid any potential penalties or issues with the IRS.