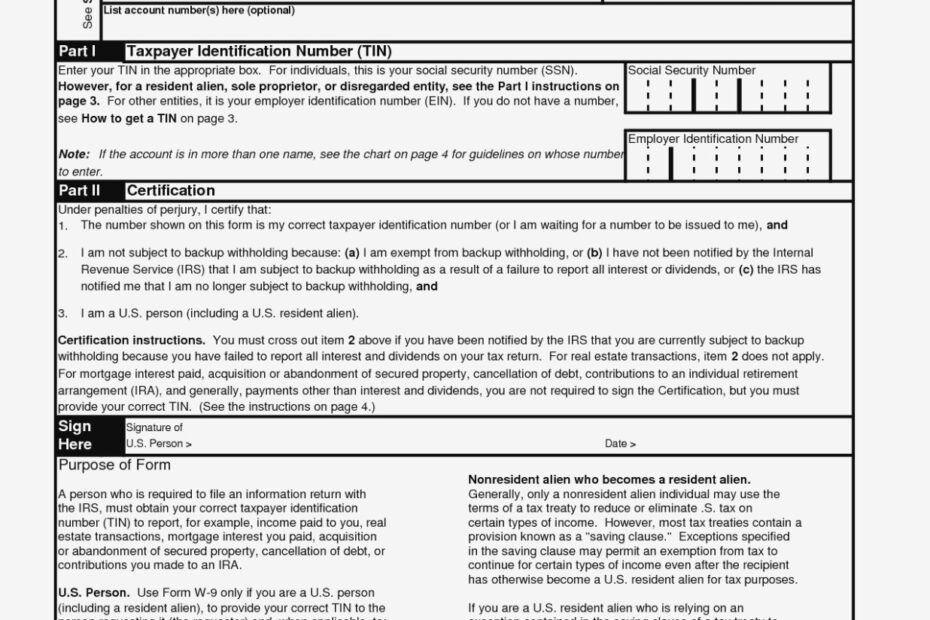

When it comes to tax season, one of the important forms that individuals and businesses need to be familiar with is the W-9 form. This form is used by the United States Income Tax Bureau to gather information from independent contractors and vendors. It is essential for ensuring that the correct taxpayer identification number is used for reporting purposes.

The W-9 form for the year 2016 is still relevant for certain transactions and reporting requirements. It is important to have the most up-to-date form on hand to avoid any discrepancies in tax reporting. The printable version of the W-9 form can be easily accessed online and filled out as needed.

United States Income Tax Bureau W-9 Form 2016 Printable

United States Income Tax Bureau W-9 Form 2016 Printable

Download and Print United States Income Tax Bureau W-9 Form 2016 Printable

When filling out the W-9 form, individuals or businesses are required to provide their name, address, taxpayer identification number, and certification of their tax status. This information is crucial for the IRS to accurately report income and ensure compliance with tax laws. It is important to fill out the form accurately and completely to avoid any penalties or fines.

Once the W-9 form is completed, it should be kept on file for future reference. It may be requested by clients or business partners for reporting purposes. It is important to understand the implications of providing false information on the form, as it can lead to serious consequences.

Overall, the W-9 form is a vital document for tax reporting purposes in the United States. It is essential for individuals and businesses to understand its importance and fill it out accurately. By having the 2016 printable version of the W-9 form on hand, taxpayers can ensure that they are compliant with IRS regulations and avoid any issues during tax season.

Make sure to download and print the W-9 form for 2016 to stay up to date with your tax reporting requirements. It is a simple yet crucial step in ensuring that your tax information is accurate and compliant with IRS regulations.