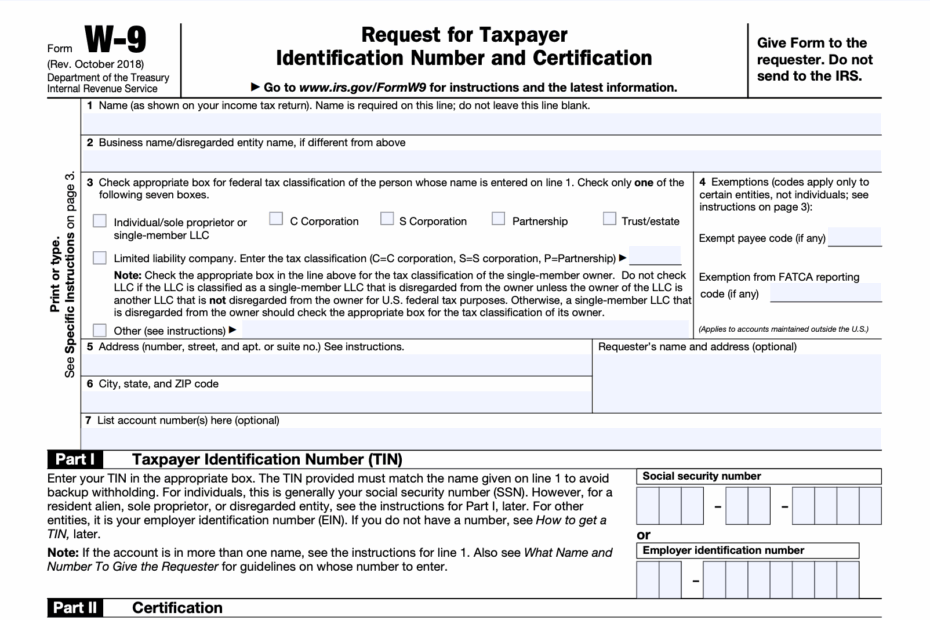

When it comes to tax forms, the W9 is one that is commonly used by businesses and individuals alike. The W9 form is used to request taxpayer identification numbers (TINs) from contractors and freelancers. This form is essential for reporting income to the IRS and for complying with tax laws. If you are in need of a W9 form, you can easily access a printable version from the IRS website.

Having a printable W9 form makes it convenient for both businesses and individuals to collect the necessary information from vendors and contractors. This form is required for anyone who is paid more than $600 in a calendar year for services rendered. By providing a completed W9 form, the payer can accurately report the income to the IRS and avoid any penalties for non-compliance.

Easily Download and Print Printable W9 Form Irs

Fillable W 9 Form Template Formstack Documents

Fillable W 9 Form Template Formstack Documents

Printable W9 Form IRS

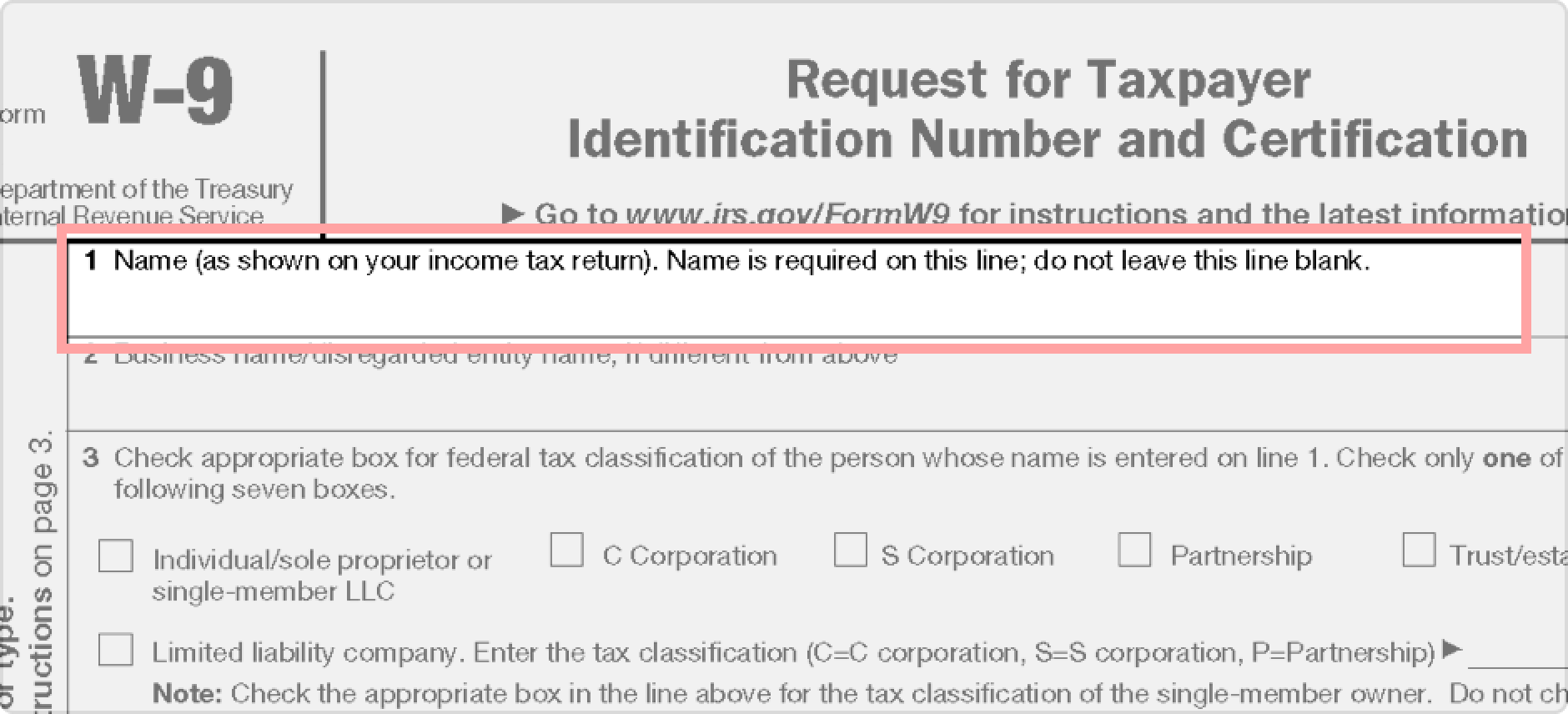

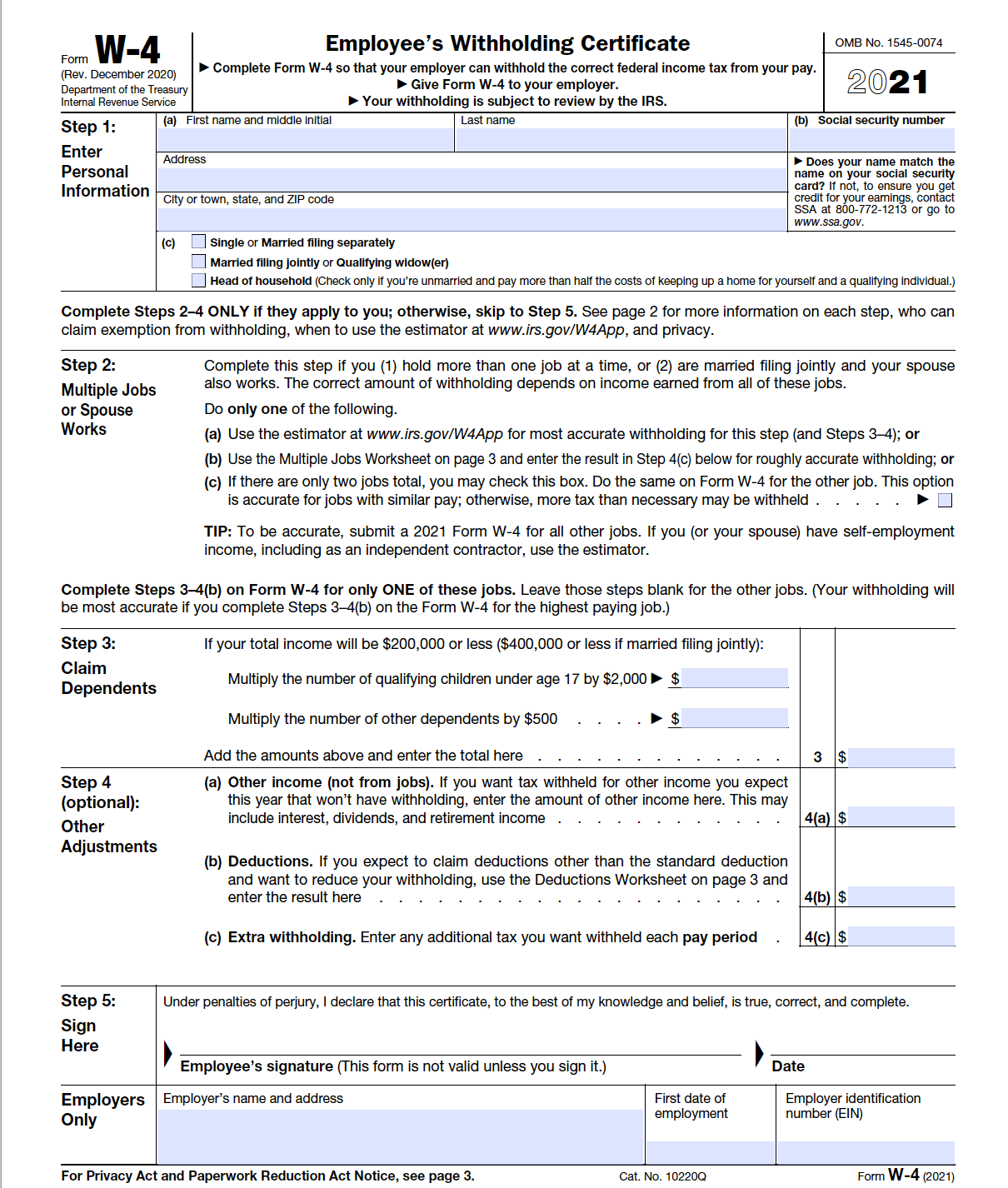

Obtaining a printable W9 form from the IRS website is simple and straightforward. You can easily download the form in PDF format and print it out for your use. The form includes fields for the contractor’s name, address, TIN, and certification of accuracy. Once the form is completed, it can be submitted to the payer for their records.

It is important to note that the information provided on the W9 form must be accurate and up to date. Any discrepancies or errors could result in delays in payment or even penalties from the IRS. By using the printable W9 form from the IRS, you can ensure that all necessary information is captured and reported correctly.

Overall, the printable W9 form from the IRS is a valuable tool for businesses and individuals who need to collect TINs from vendors and contractors. By using this form, you can streamline the process of reporting income to the IRS and avoid any potential issues with compliance. Make sure to have a W9 form on hand whenever you are working with contractors or freelancers to ensure that you are meeting all tax requirements.

In conclusion, the printable W9 form from the IRS is a useful resource for anyone who needs to collect taxpayer information for reporting income. By utilizing this form, you can stay compliant with tax laws and avoid any penalties for non-compliance. Make sure to download and print a W9 form from the IRS website whenever you need to gather TINs from vendors or contractors.