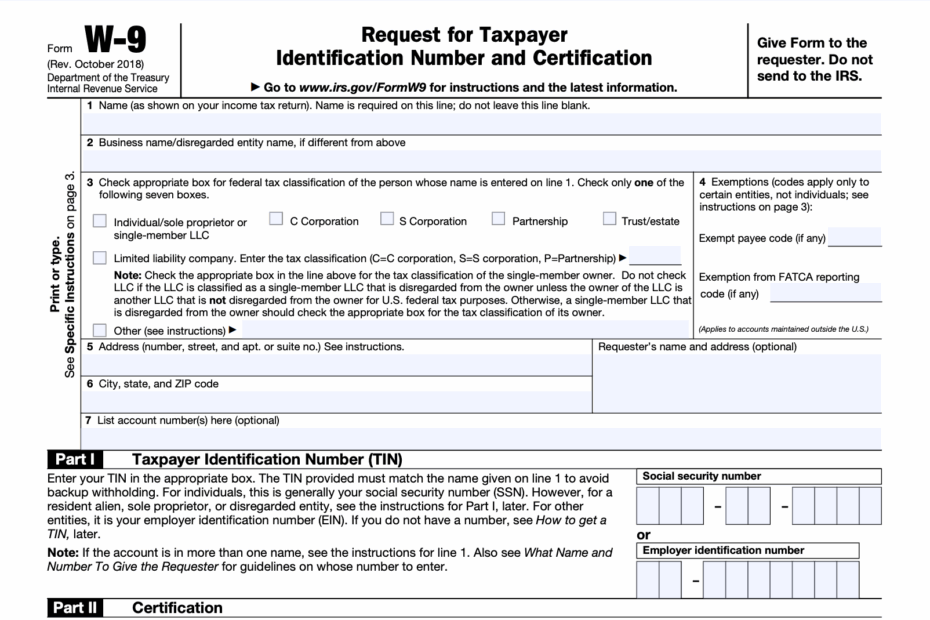

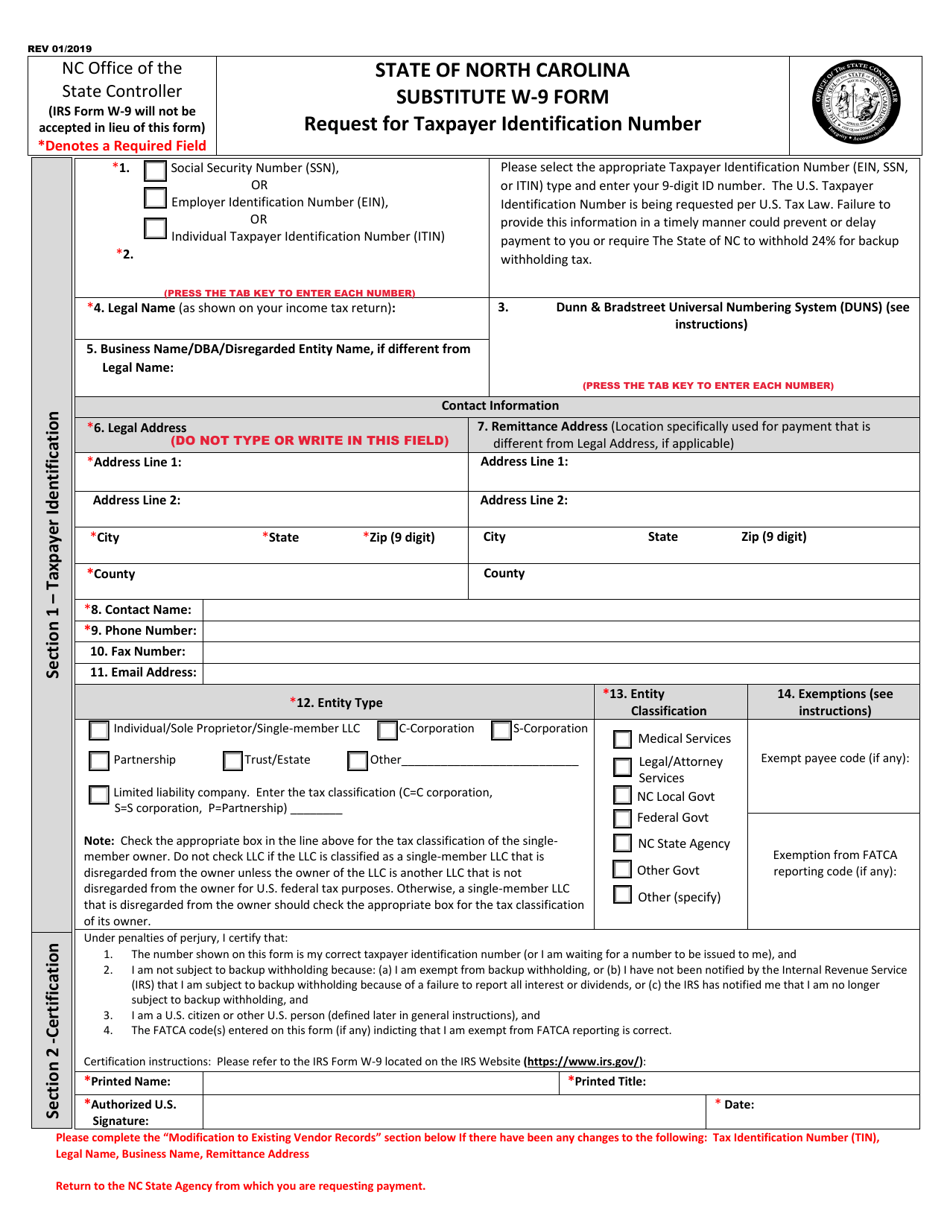

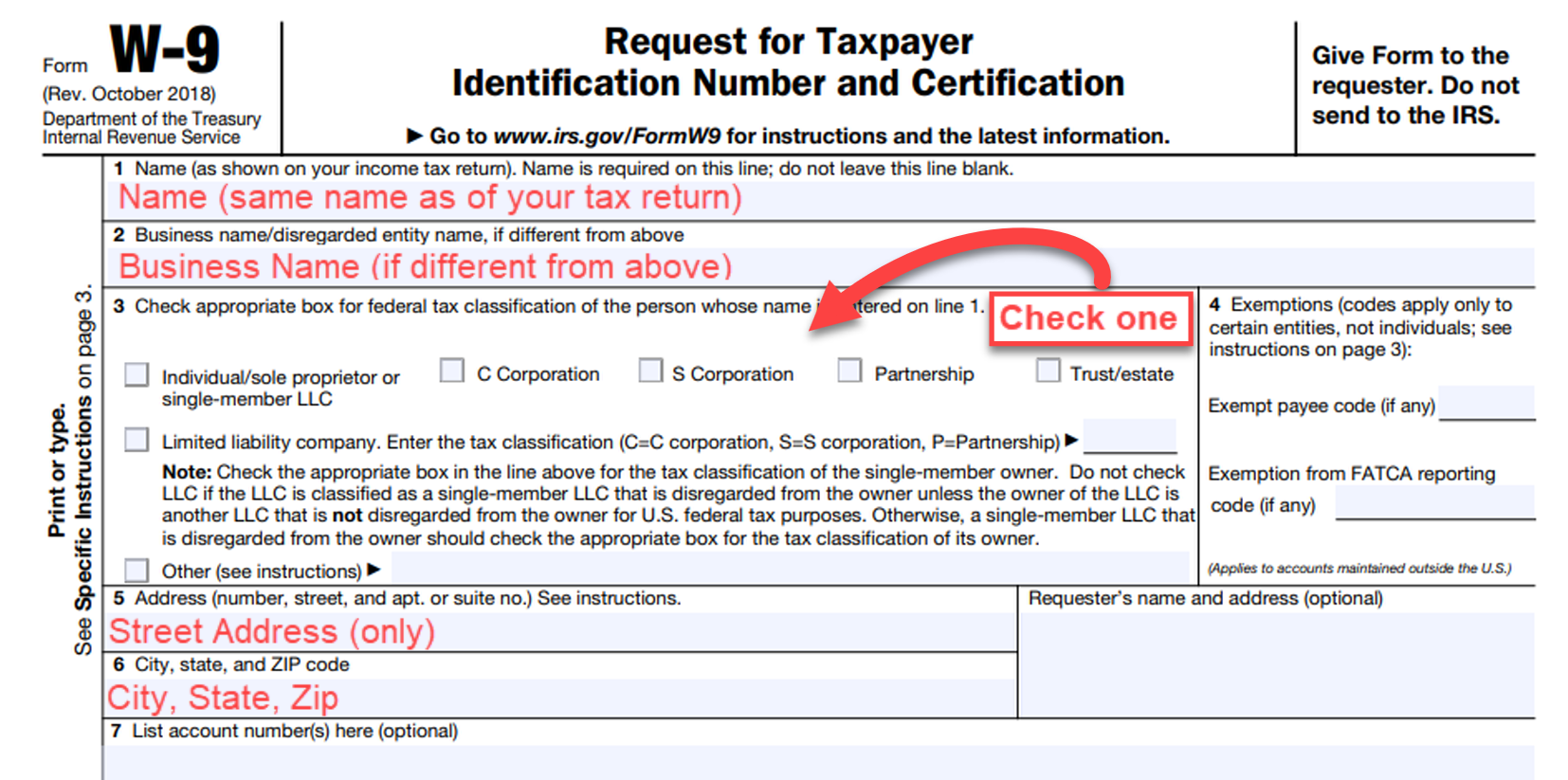

When it comes to taxes, it’s important to have all the necessary forms in order to accurately report your income and expenses. One such form that is commonly used is the W-9 form. This form is used by businesses to request the taxpayer identification number (TIN) of a contractor or freelancer they plan to hire. It is important for both parties to fill out this form correctly in order to avoid any potential issues with the IRS.

Whether you are a business owner looking to hire independent contractors or a freelancer looking to provide your services, having a Printable W 9 Tax Form on hand can make the process much easier. This form ensures that the correct information is provided to the IRS and helps to streamline the tax reporting process for both parties involved.

Save and Print Printable W 9 Tax Form

Free IRS Form W9 2024 PDF EForms

Free IRS Form W9 2024 PDF EForms

Printable W 9 Tax Form

One of the key benefits of using a Printable W 9 Tax Form is that it can be easily accessed and filled out online. This eliminates the need for paper forms and allows for a more efficient process. Additionally, having a printable form means that you can quickly make any necessary changes or updates without having to start from scratch.

Another advantage of using a Printable W 9 Tax Form is that it ensures that all the required information is accurately provided. This can help to prevent any delays or issues with tax reporting and ensures that both parties are compliant with IRS regulations. By having a standardized form to fill out, the process becomes much simpler and less prone to errors.

Overall, having a Printable W 9 Tax Form is a valuable tool for businesses and freelancers alike. It streamlines the process of reporting income and expenses, ensures compliance with IRS regulations, and helps to avoid any potential issues down the line. By utilizing this form, both parties can rest assured that they are providing the necessary information to the IRS in a timely and accurate manner.

In conclusion, the Printable W 9 Tax Form is an essential tool for anyone involved in hiring independent contractors or providing freelance services. By utilizing this form, you can ensure that all the necessary information is accurately provided and streamline the tax reporting process. Whether you are a business owner or a freelancer, having a Printable W 9 Tax Form on hand can help to simplify the process and avoid any potential issues with the IRS.