When it comes to tax season, it’s important to have all the necessary documents in order to ensure a smooth filing process. One of the key forms that many individuals and businesses may need to fill out is the W-9 form. This form is used by the Internal Revenue Service (IRS) to gather information about a taxpayer’s identification number, such as a Social Security number or employer identification number.

Having a printable W-9 form on hand can make the process much easier, allowing you to fill it out at your convenience and avoid any delays in providing the necessary information to the IRS. In this article, we will discuss the importance of the W-9 form and how you can easily access and fill out a printable version.

Quickly Access and Print Printable W 9 Form Irs

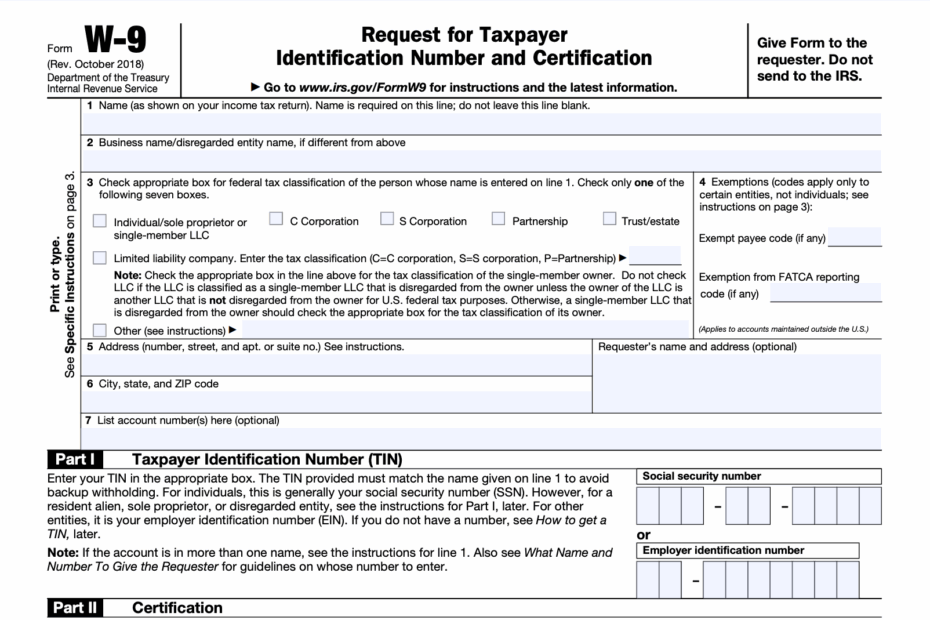

Printable W 9 Form IRS

The W-9 form is typically used by businesses or individuals who are required to report income to the IRS. This form is commonly used for freelancers, independent contractors, consultants, and other self-employed individuals. By providing the necessary information on the W-9 form, you are ensuring that the IRS has accurate information for tax reporting purposes.

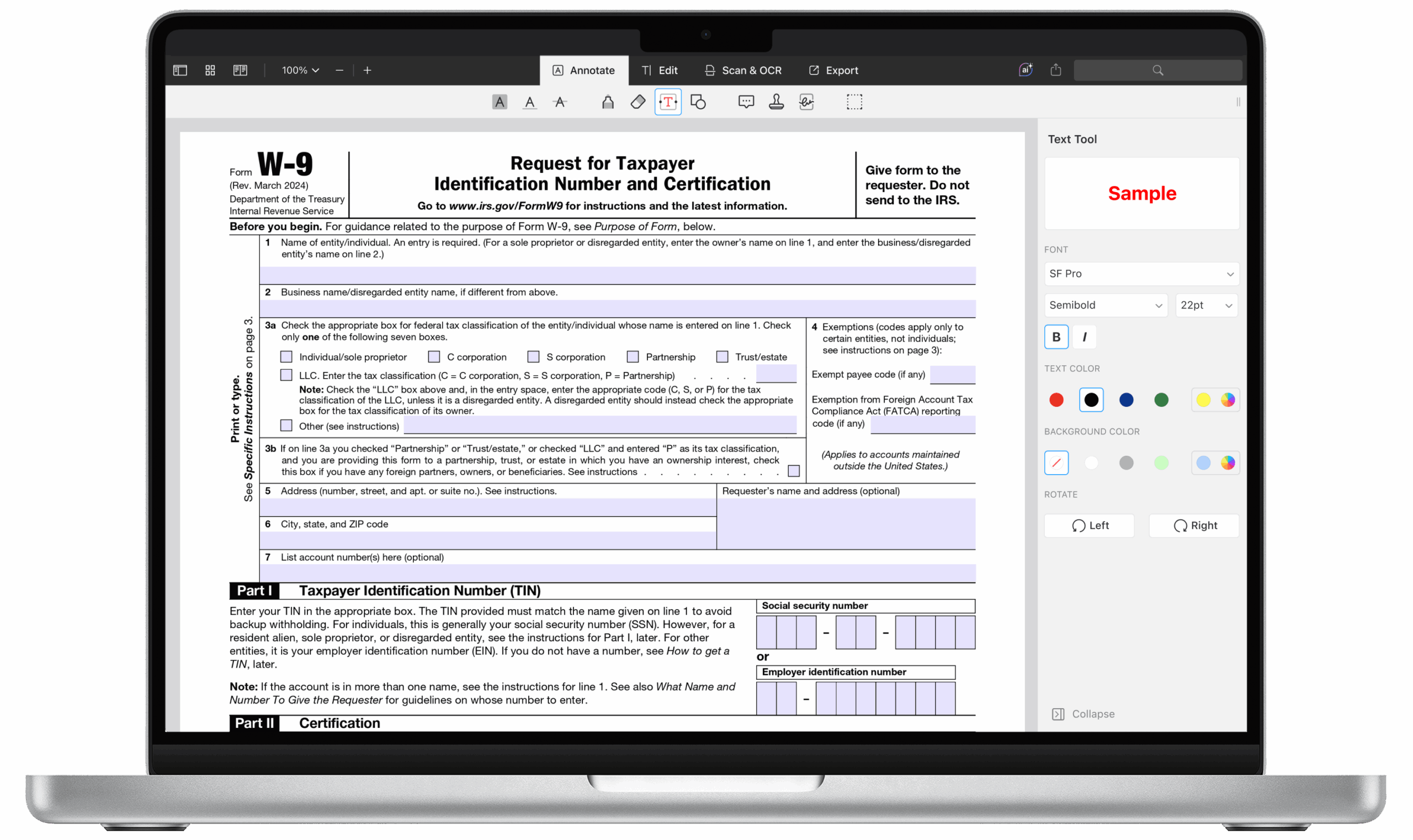

Accessing a printable W-9 form is simple and can be done directly from the IRS website. Once you have downloaded the form, you can easily fill it out electronically or print it out and fill it in by hand. Make sure to double-check all the information you provide on the form to avoid any errors that could lead to delays in processing your tax documents.

It’s important to note that the W-9 form is not actually filed with the IRS, but rather provided to the entity that is requesting your taxpayer identification number. This information is then used by the entity to prepare various tax documents, such as 1099 forms, which are sent to both you and the IRS.

By having a printable W-9 form on hand, you can easily provide the necessary information to the IRS and other entities that require it. This can help streamline the tax reporting process and ensure that your tax documents are accurate and up to date. Make sure to keep a copy of the completed form for your records and provide it to any entities that request it in a timely manner.

In conclusion, having a printable W-9 form can make the tax reporting process much easier and more efficient. By providing accurate information on this form, you are helping to ensure that your tax documents are filed correctly and on time. Make sure to download a printable W-9 form from the IRS website and fill it out accurately to avoid any potential issues with your tax reporting.