Filing taxes can be a daunting task for many individuals and businesses. The Internal Revenue Service (IRS) requires taxpayers to report their income and expenses each year, and failure to do so can result in penalties. To make the tax filing process easier, the IRS provides printable tax forms that can be easily accessed and filled out.

Printable tax forms from the IRS are available for various types of tax returns, including individual income tax, corporate tax, and self-employment tax. These forms are essential for accurately reporting financial information to the IRS and ensuring compliance with tax laws.

Save and Print Printable Tax Forms Irs

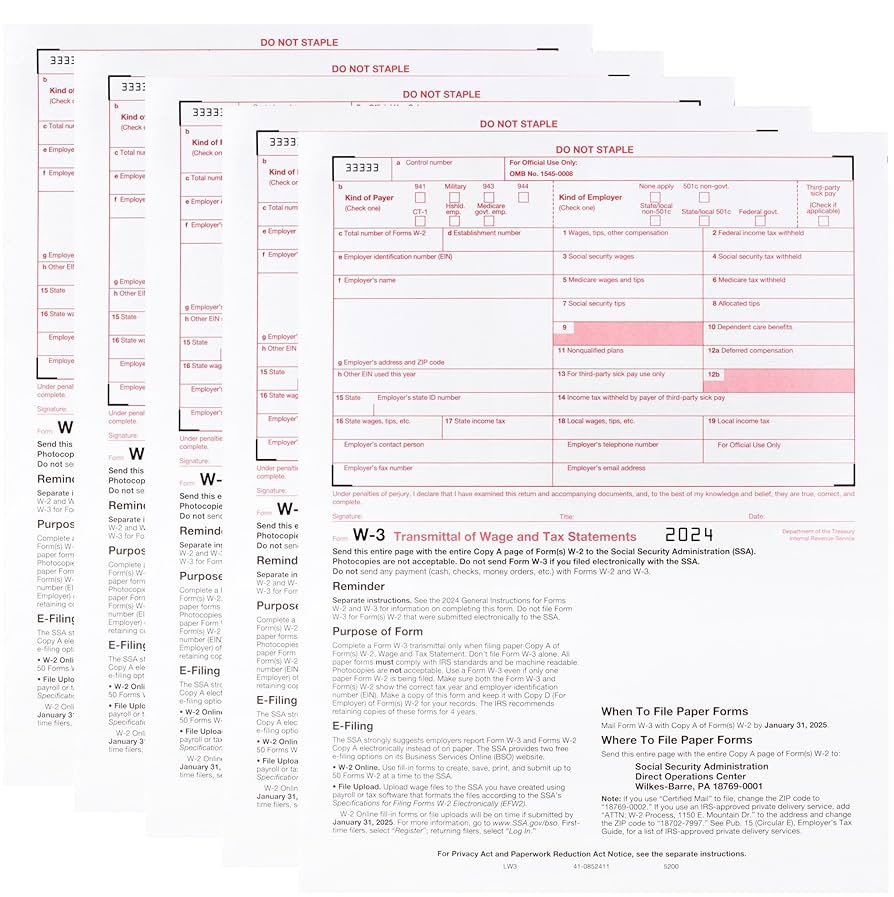

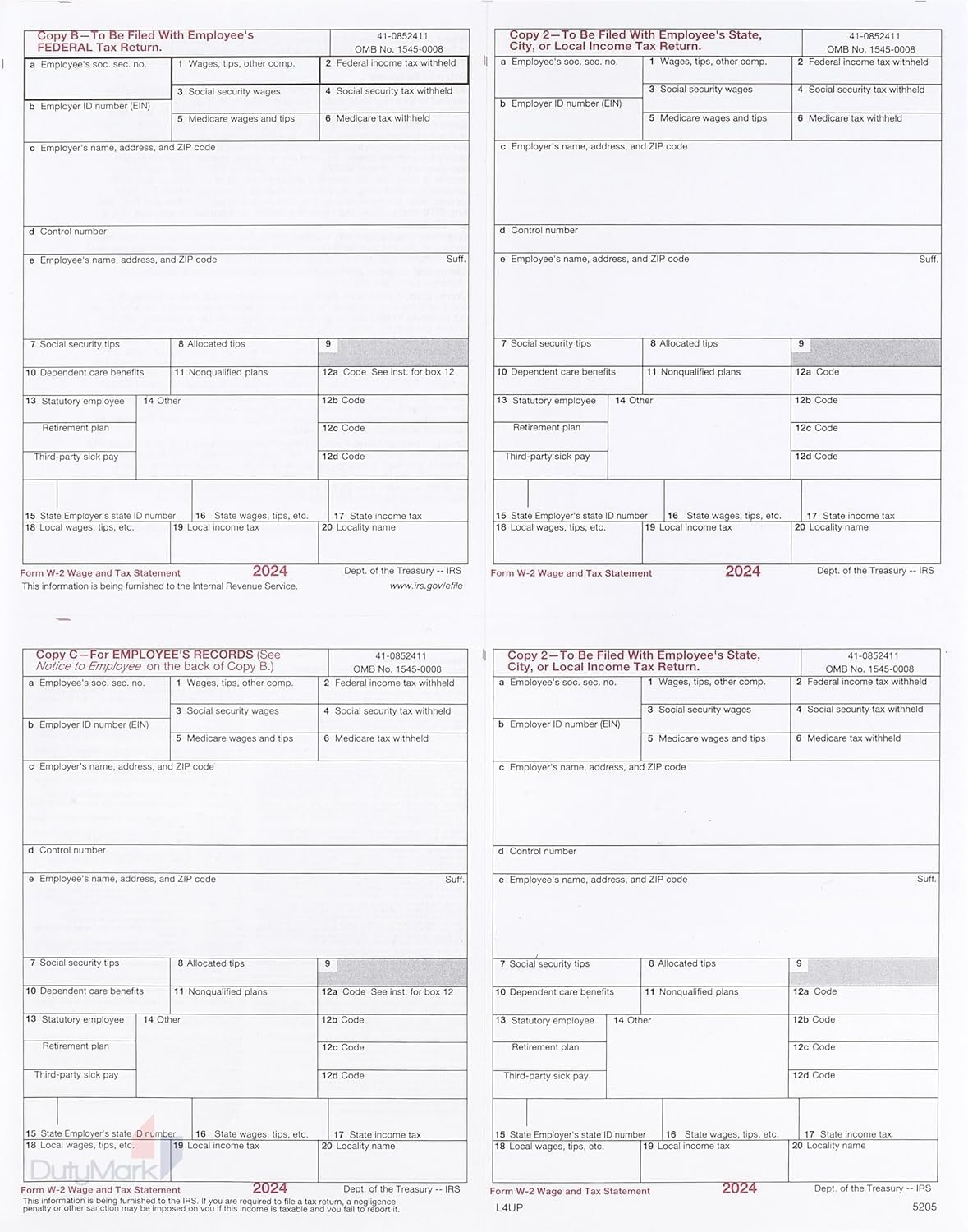

Qualifying Orders Of 25 Same Day 2024 W 2 Tax Forms Pack Laser

Qualifying Orders Of 25 Same Day 2024 W 2 Tax Forms Pack Laser

One of the most commonly used printable tax forms from the IRS is Form 1040, which is used for individual income tax returns. This form requires taxpayers to report their income, deductions, and credits for the year. Additionally, there are schedules and worksheets that may need to be attached to Form 1040, depending on the taxpayer’s specific situation.

For businesses, the IRS provides printable tax forms such as Form 1120 for corporate tax returns and Form 1065 for partnership tax returns. These forms require businesses to report their income, expenses, and other financial information to calculate their tax liability accurately.

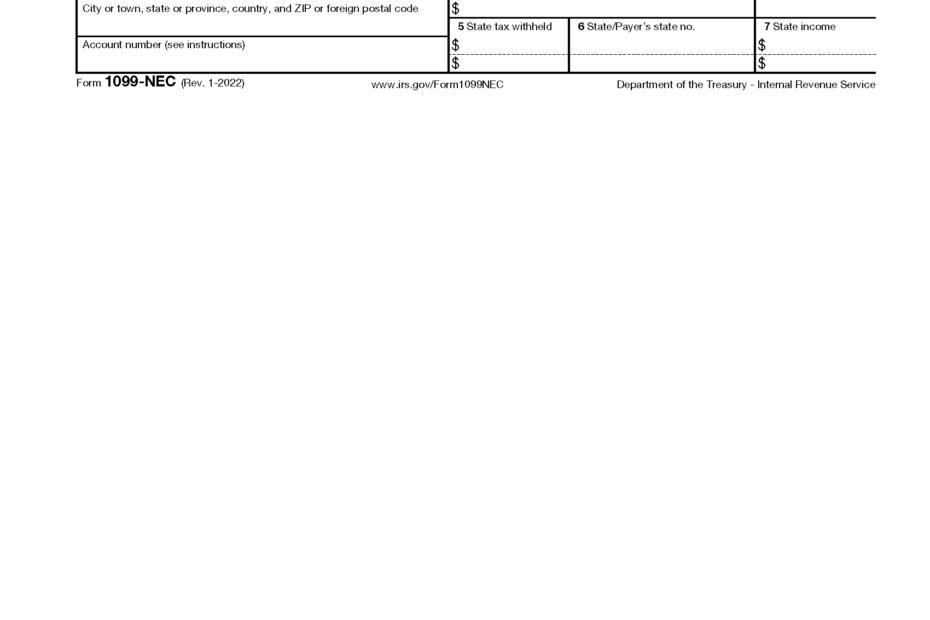

Self-employed individuals can also benefit from printable tax forms provided by the IRS, such as Schedule C for reporting business income and expenses. By accurately completing these forms, self-employed individuals can claim deductions and credits to reduce their tax liability.

In conclusion, printable tax forms from the IRS are essential tools for taxpayers to accurately report their income and expenses each year. By using these forms, individuals and businesses can ensure compliance with tax laws and avoid penalties for incorrect reporting. Whether filing individual income tax returns or corporate tax returns, taxpayers can find the necessary forms on the IRS website and easily fill them out for submission.