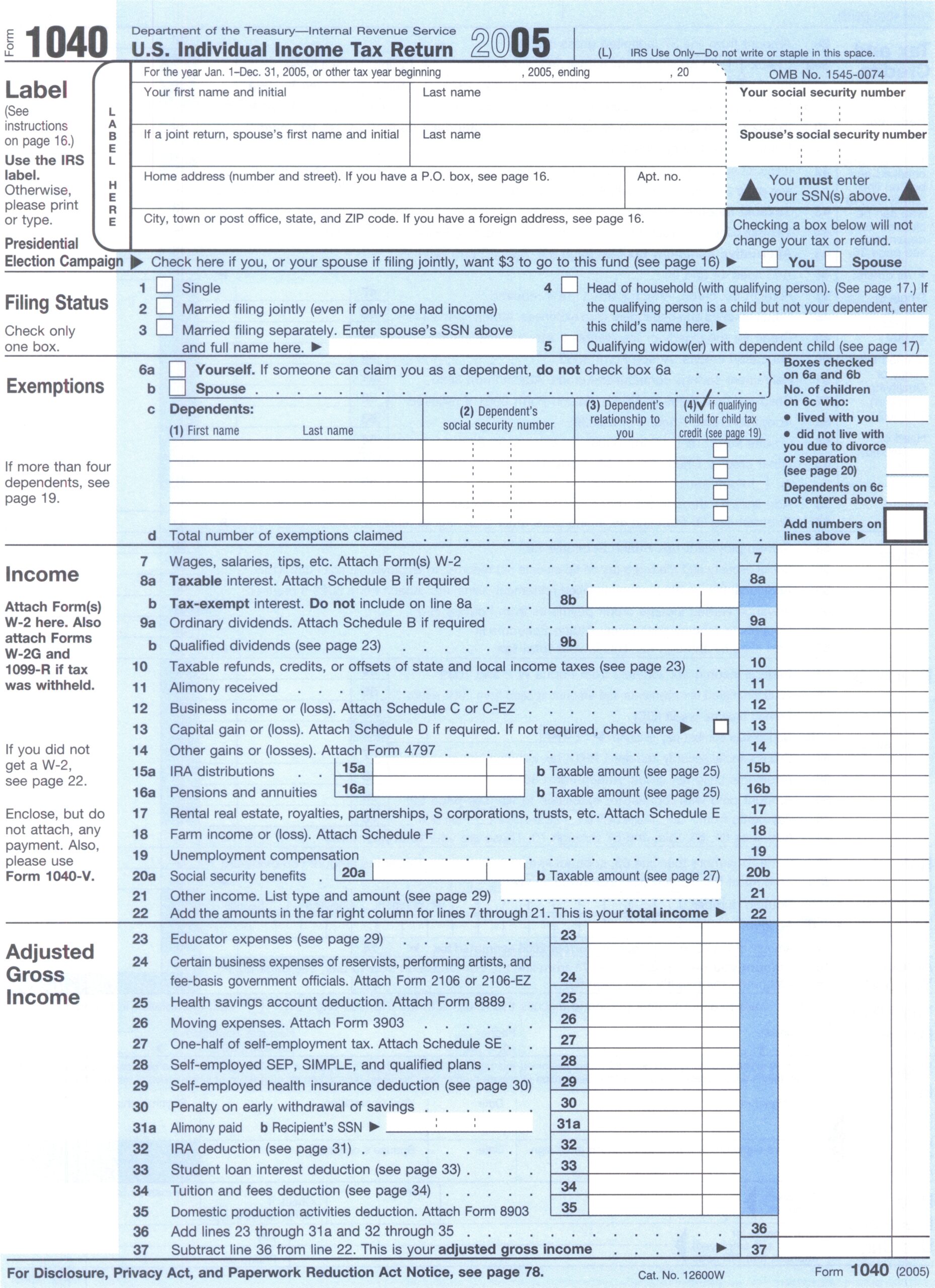

When tax season rolls around, it’s important to have all the necessary forms ready to file your taxes accurately and on time. One of the most common forms used by individuals to report their income and calculate their tax liability is the IRS Form 1040.

Form 1040 is the standard federal income tax form used by individuals to report their annual income and claim deductions and credits. It is essential for anyone who earns income in the United States to fill out this form and submit it to the IRS.

Easily Download and Print Printable Tax Forms 1040

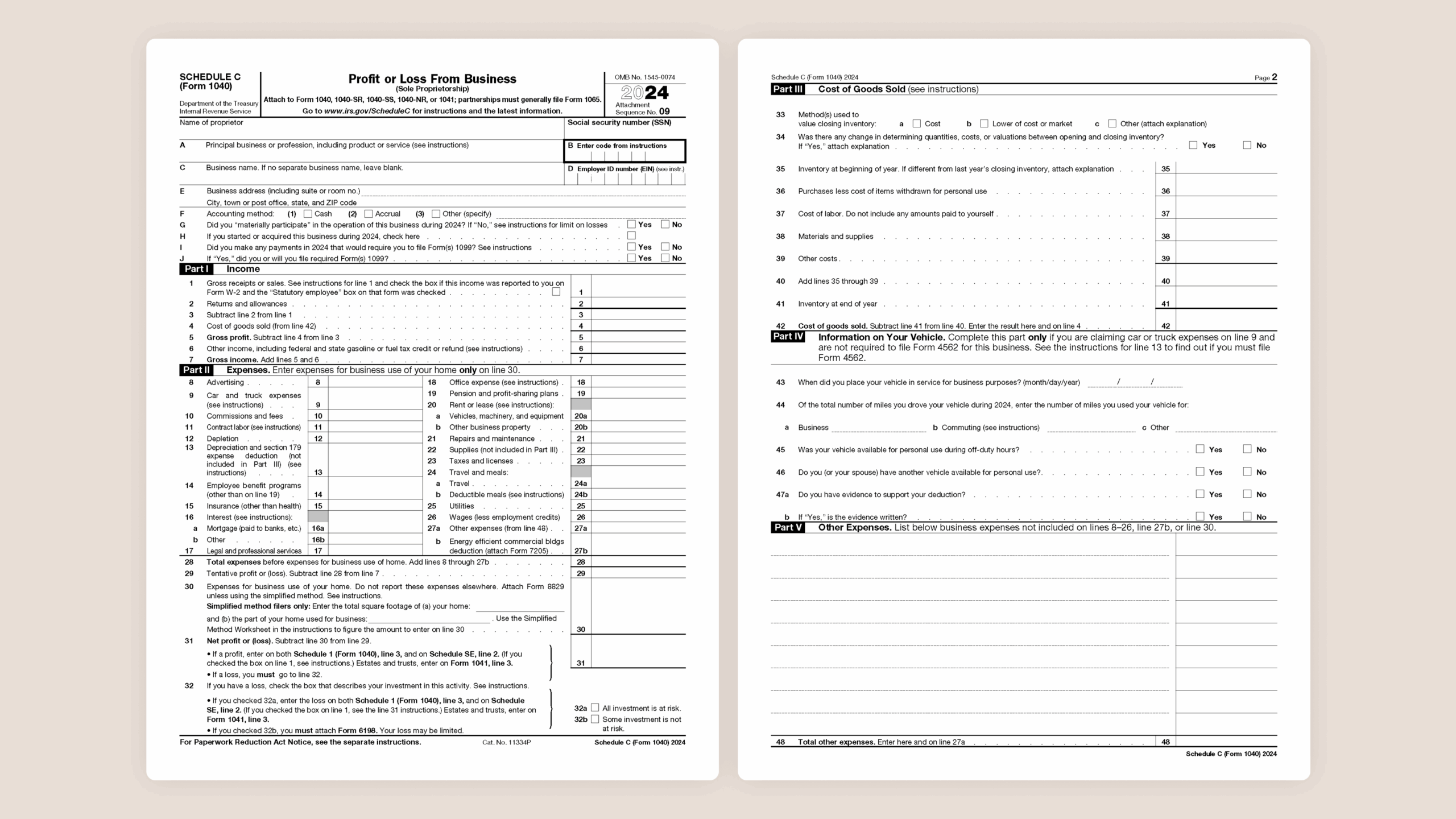

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

Form 1040 is available for download on the IRS website, but many individuals prefer to have a printable version on hand for easy reference and completion. Having a hard copy of the form allows for easier organization and documentation of tax-related information.

Printable tax forms 1040 can be found on various websites that offer tax resources and tools. These forms are typically available in PDF format, making it easy to download, print, and fill out by hand. Having a physical copy of the form can also serve as a helpful reference when gathering the necessary documents and information needed to complete your tax return.

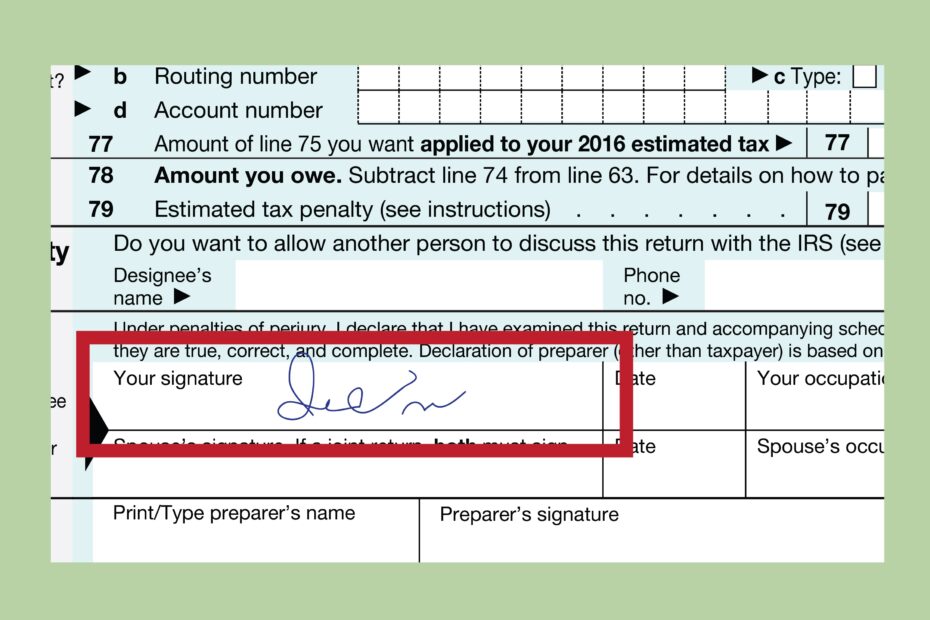

Using printable tax forms 1040 can streamline the tax-filing process and ensure that you have all the information you need to accurately report your income and claim any deductions or credits you are eligible for. It is important to carefully review the form and instructions to avoid any errors or omissions that could result in delays or penalties.

In conclusion, having access to printable tax forms 1040 can make the tax-filing process more efficient and organized. By having a hard copy of the form on hand, you can easily reference it as you gather your tax documents and complete your return. Be sure to double-check your information and seek assistance if needed to ensure that your taxes are filed accurately and on time.