When it comes to filing your taxes in Georgia, it’s important to have the right forms in order to accurately report your income and deductions. One of the most commonly used forms is the Georgia Form 500, which is used to report individual income tax returns for residents of the state. This form is essential for anyone who earns income in Georgia and is required to file their taxes with the state.

Form 500 can be easily downloaded and printed from the Georgia Department of Revenue website. It provides a straightforward way to report your income, deductions, and credits for the tax year. By using this form, you can ensure that you are accurately reporting your income and taking advantage of any deductions or credits that you may be eligible for.

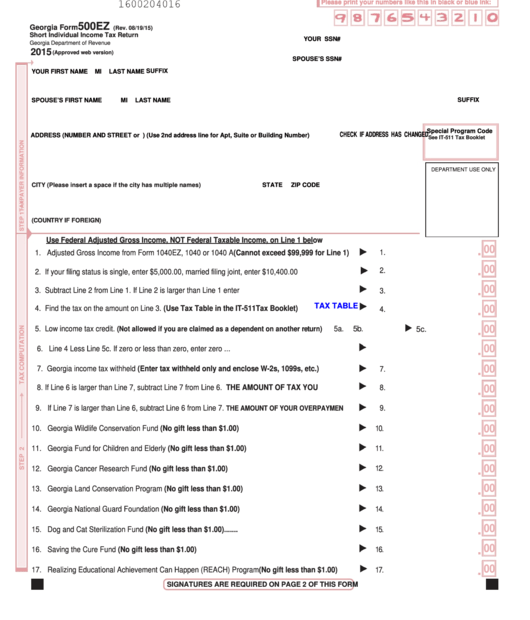

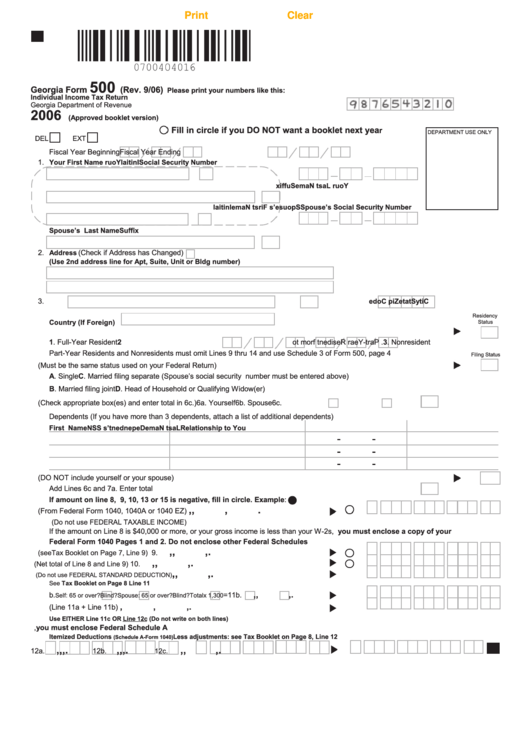

Printable Tax Form 500 For Georgia Income Tax

Printable Tax Form 500 For Georgia Income Tax

Download and Print Printable Tax Form 500 For Georgia Income Tax

When filling out Form 500, be sure to carefully follow the instructions provided to avoid any errors that could delay the processing of your return. You will need to gather information such as W-2 forms, 1099s, and other documentation of income and expenses to complete the form accurately. Additionally, be sure to double-check your math and calculations to ensure that your return is error-free.

Once you have completed Form 500, you can either file it electronically through the Georgia Department of Revenue’s website or mail it in using the address provided on the form. Filing your taxes on time is crucial to avoid penalties and interest, so be sure to submit your return by the deadline to avoid any issues.

Overall, Form 500 is a vital tool for Georgia residents to accurately report their income and file their taxes with the state. By using this form and following the instructions carefully, you can ensure that your tax return is processed accurately and efficiently. Be sure to keep a copy of your completed form for your records, and don’t hesitate to reach out to the Georgia Department of Revenue if you have any questions or need assistance with filing your taxes.