As tax season approaches, many individuals are gearing up to file their annual tax returns. One of the most commonly used forms for this purpose is the IRS Form 1040. Whether you are a salaried employee, a freelancer, or a business owner, Form 1040 is essential for reporting your income and claiming deductions.

Understanding how to correctly fill out Form 1040 is crucial to ensure that you are compliant with tax laws and maximize your tax savings. Fortunately, the IRS provides a printable version of Form 1040 on their website, making it easy for taxpayers to access and complete this important document.

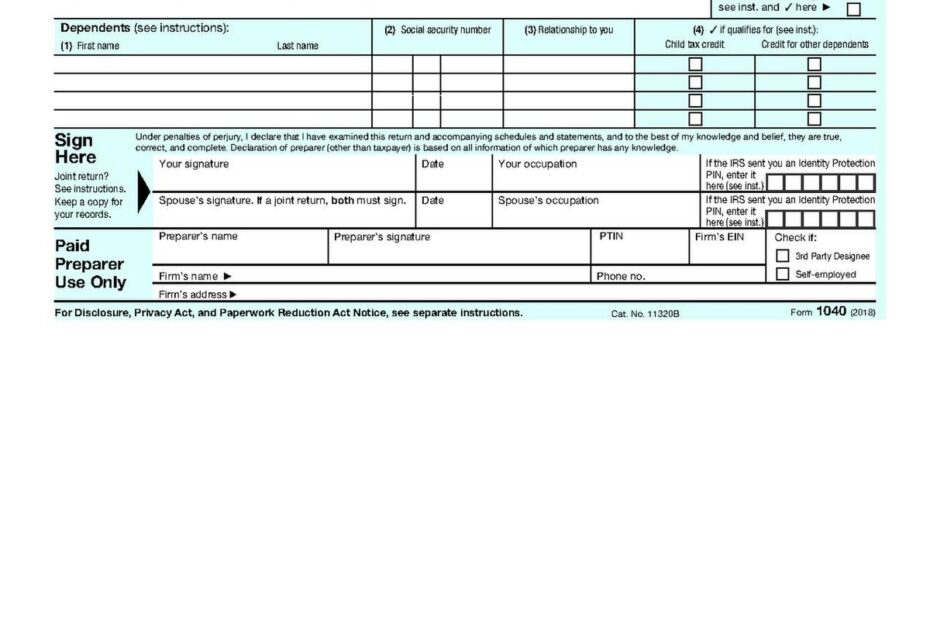

Get and Print Printable Tax Form 1040

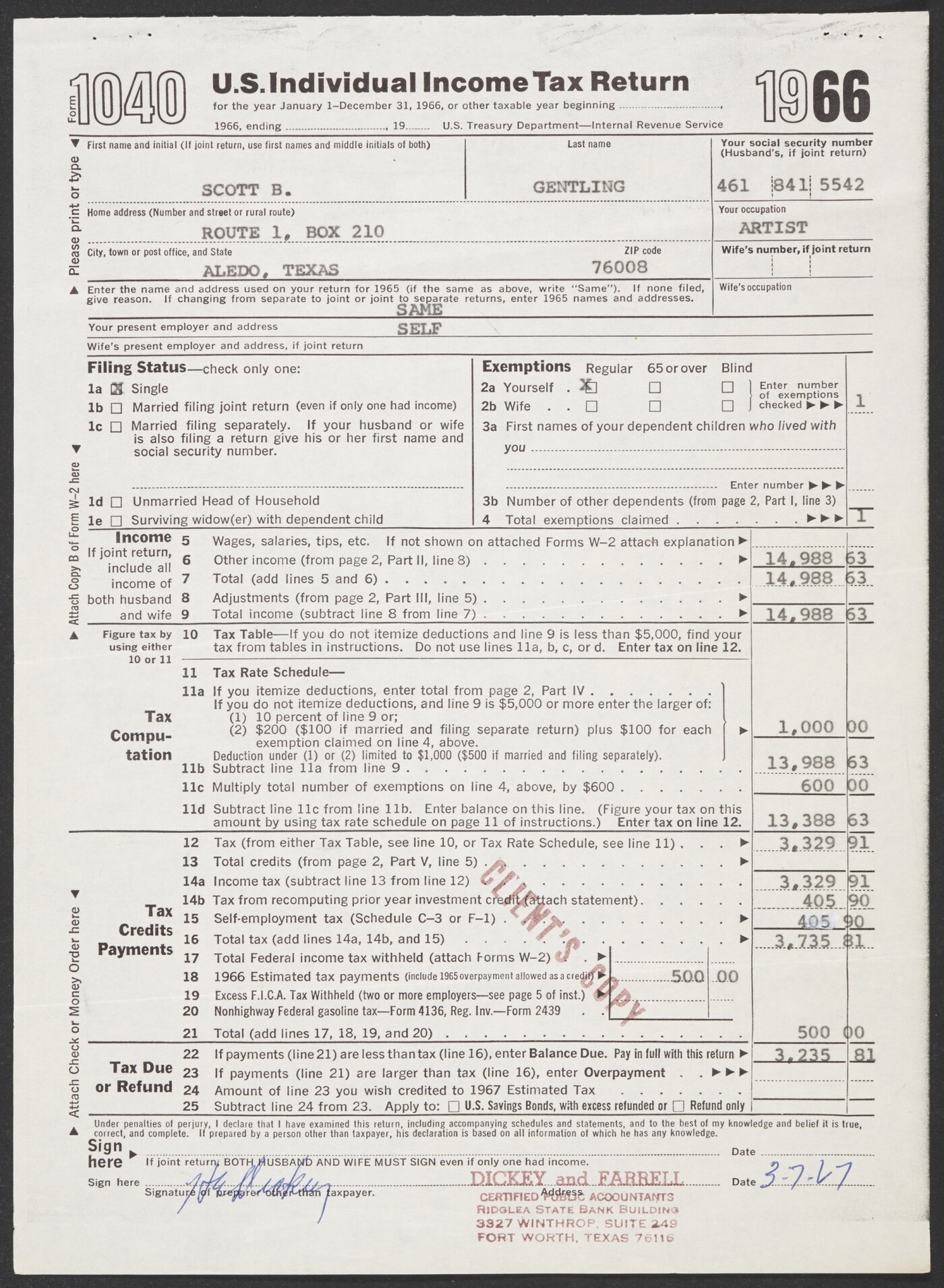

Form 1040 U S Individual Income Tax Return For Scott Gentling

Form 1040 U S Individual Income Tax Return For Scott Gentling

Printable Tax Form 1040

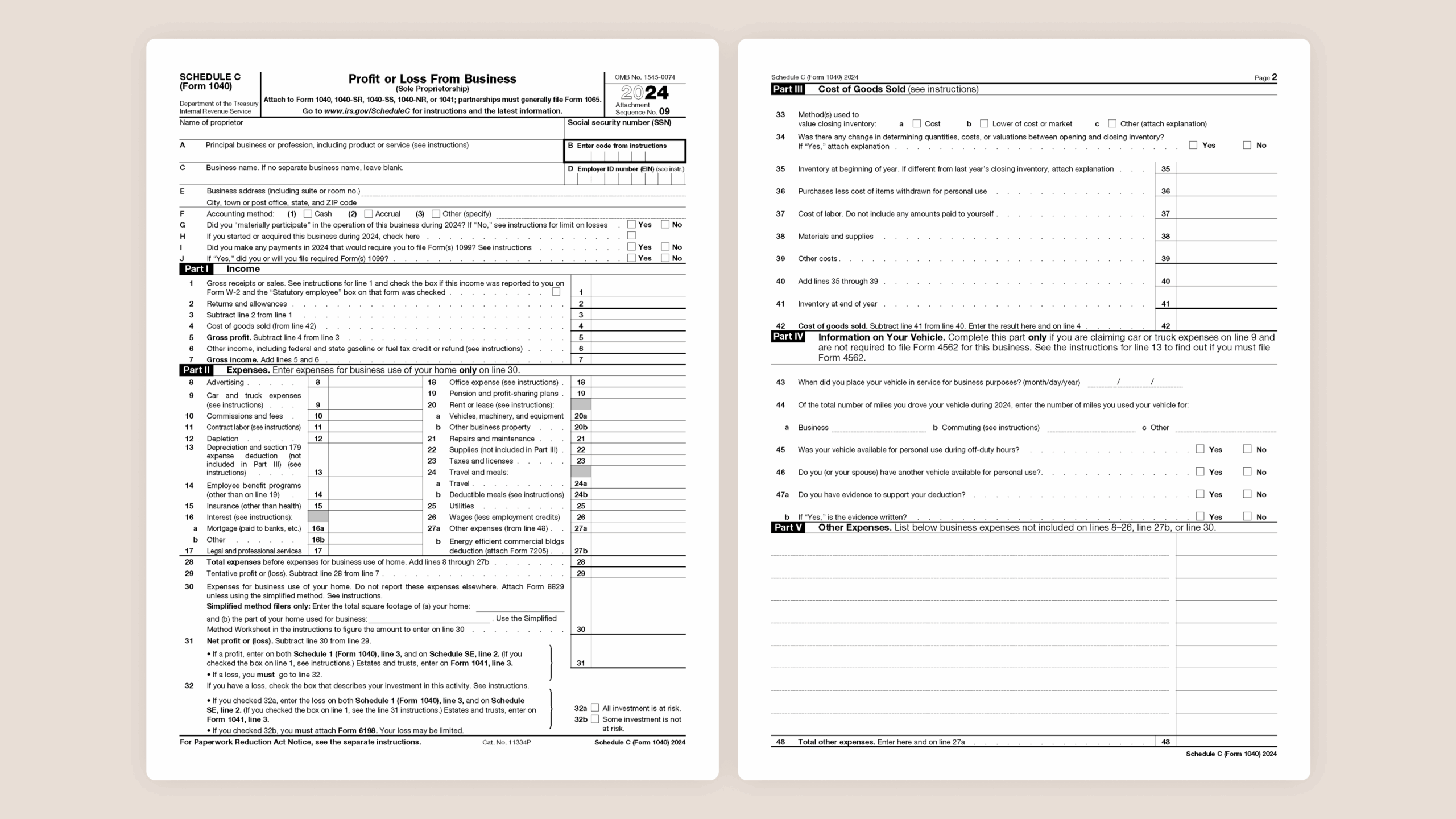

The printable version of Form 1040 is available on the IRS website in PDF format, allowing taxpayers to easily download and print the form for their use. This form includes various sections for reporting income, deductions, credits, and other financial information that is necessary for calculating your tax liability.

When filling out Form 1040, taxpayers must provide details such as their name, address, Social Security number, filing status, and sources of income. Additionally, individuals must report any deductions or credits they are eligible for to reduce their taxable income and potentially lower their tax bill.

For those who prefer to file their taxes electronically, many tax preparation software programs also offer a digital version of Form 1040 that can be completed online. This electronic filing option can streamline the tax filing process and help taxpayers avoid errors that may arise from manual data entry.

Once you have completed Form 1040, you can submit it to the IRS along with any required documentation, such as W-2s, 1099s, and receipts for deductions. It is important to review your tax return carefully before filing to ensure accuracy and prevent any delays in processing your refund or payment.

In conclusion, Form 1040 is a vital document for reporting your income and taxes to the IRS. By utilizing the printable version of this form, taxpayers can easily prepare and file their taxes in a timely manner. Remember to seek assistance from a tax professional if you have any questions or concerns about completing Form 1040 accurately.