When making purchases for your business, it’s important to ensure that you are not paying unnecessary sales tax. One way to avoid this is by using a sales tax exemption form. This form allows you to claim an exemption from sales tax for certain purchases that are used for business purposes. It can save you money and help you stay compliant with tax laws.

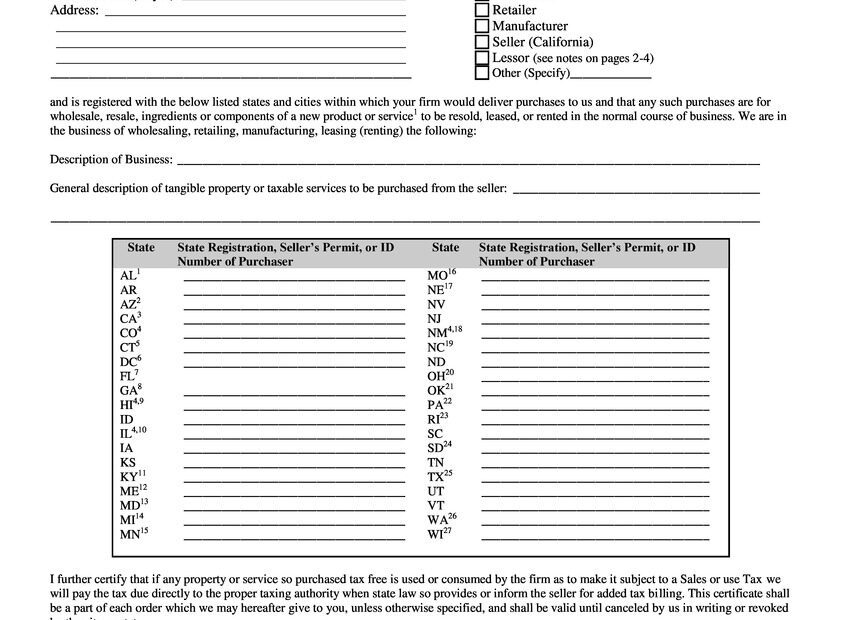

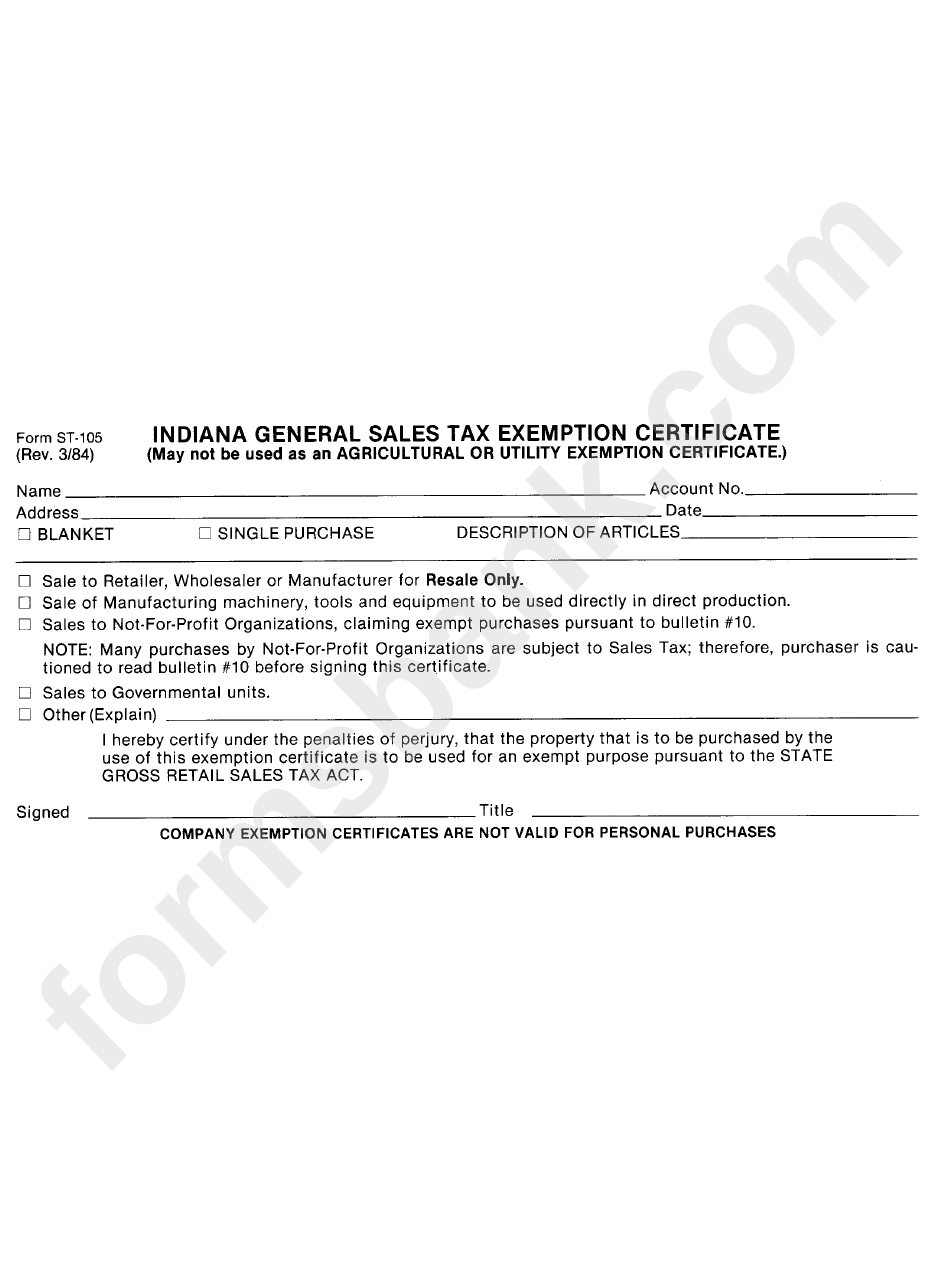

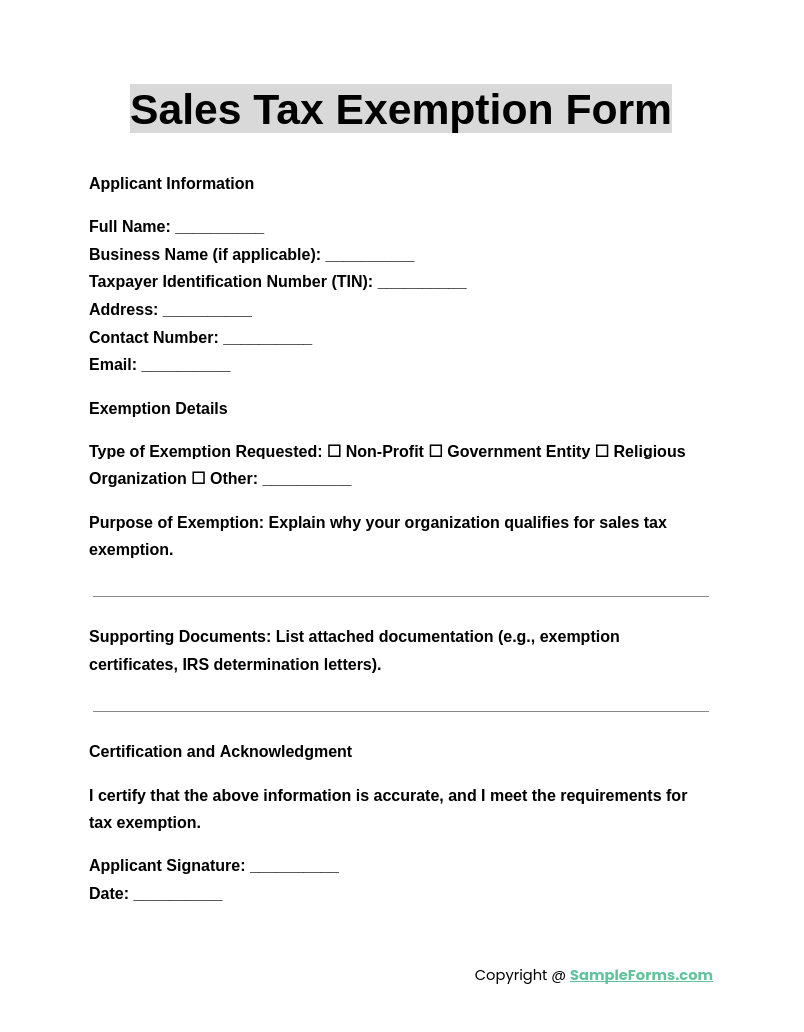

A printable sales tax exemption form is a document that allows you to claim an exemption from sales tax when making purchases for your business. This form typically requires you to provide information about your business, such as your tax ID number and the nature of your business. By submitting this form to the seller, you can avoid paying sales tax on qualifying purchases.

Printable Sales Tax Exemption Form

Printable Sales Tax Exemption Form

Easily Download and Print Printable Sales Tax Exemption Form

One of the main benefits of using a printable sales tax exemption form is that it can save your business money. Sales tax can add up quickly, especially on large purchases. By claiming an exemption, you can reduce your expenses and improve your bottom line. Additionally, using this form can help you avoid potential audits or penalties for failing to pay sales tax when required.

Another advantage of a sales tax exemption form is that it streamlines the purchasing process. Instead of having to pay sales tax upfront and then apply for a refund later, you can simply present the form to the seller at the time of purchase. This can save you time and hassle, allowing you to focus on running your business instead of dealing with tax issues.

It’s important to note that not all purchases are eligible for a sales tax exemption. Each state has its own rules and regulations regarding what qualifies for an exemption. Before using a sales tax exemption form, be sure to familiarize yourself with the requirements in your state. This will help ensure that you are in compliance with the law and avoid any potential issues down the road.

In conclusion, a printable sales tax exemption form can be a valuable tool for businesses looking to save money and stay compliant with tax laws. By using this form, you can claim an exemption from sales tax on qualifying purchases, ultimately improving your bottom line and streamlining the purchasing process. Be sure to understand the requirements in your state before using this form to ensure that you are in compliance with the law.