When it comes to filing your state income tax for Pennsylvania in 2014, having the necessary forms is crucial. Fortunately, the Pennsylvania Department of Revenue provides printable forms for taxpayers to easily fill out and submit. These forms are essential for accurately reporting your income and deductions to ensure compliance with state tax laws.

Whether you are a resident or non-resident of Pennsylvania, having access to the printable state income tax forms for 2014 can simplify the filing process. By utilizing these forms, you can easily calculate your tax liability, claim any credits or deductions you may be eligible for, and ensure that your tax return is submitted accurately and on time.

Printable Pa State Income Tax Forms 2014

Printable Pa State Income Tax Forms 2014

Quickly Access and Print Printable Pa State Income Tax Forms 2014

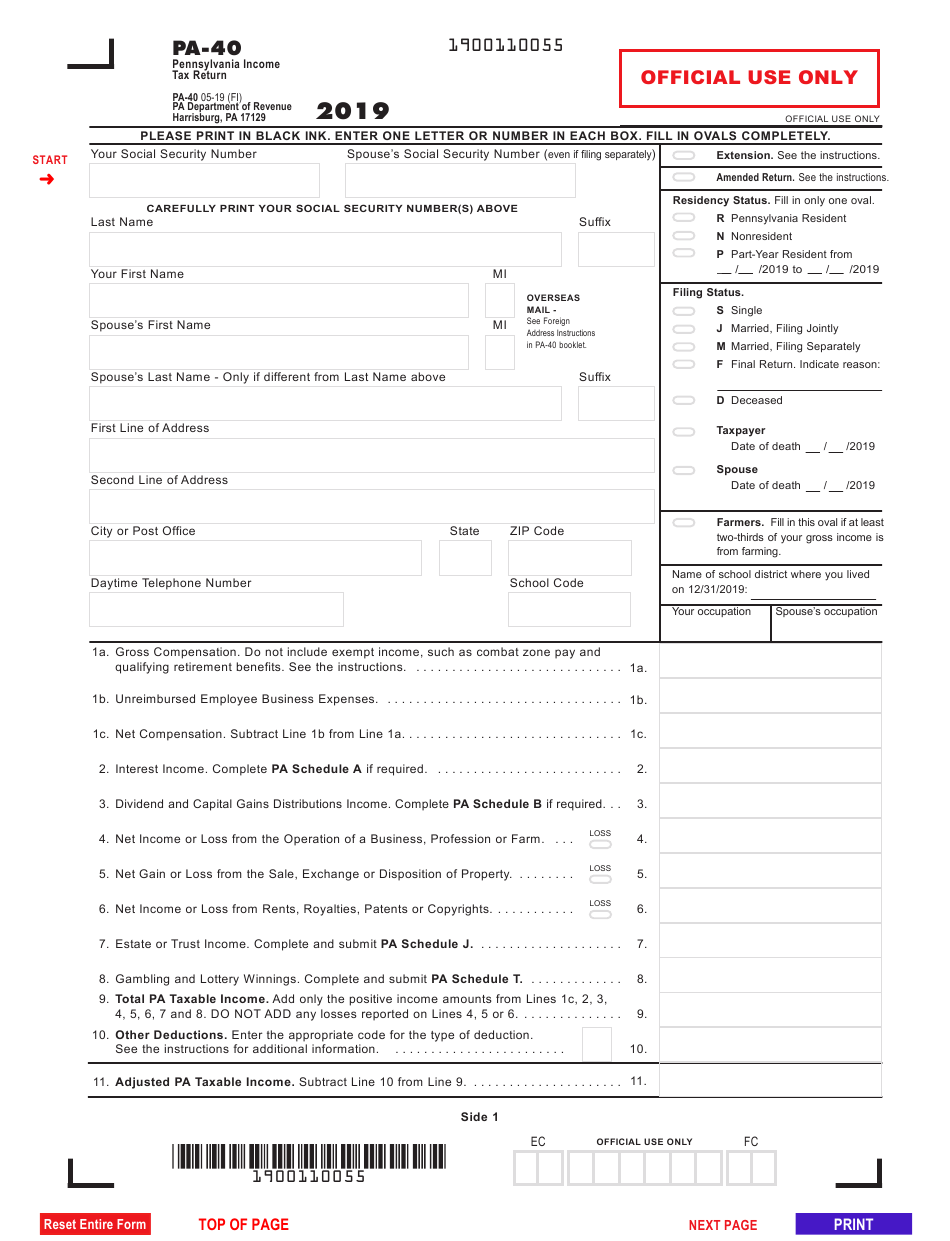

One of the most commonly used forms for Pennsylvania state income tax filing is the PA-40 form. This form is used by residents to report their income, deductions, and credits for the tax year. Additionally, non-residents who earned income in Pennsylvania may need to file a PA-40 form to report their earnings and calculate any tax owed to the state.

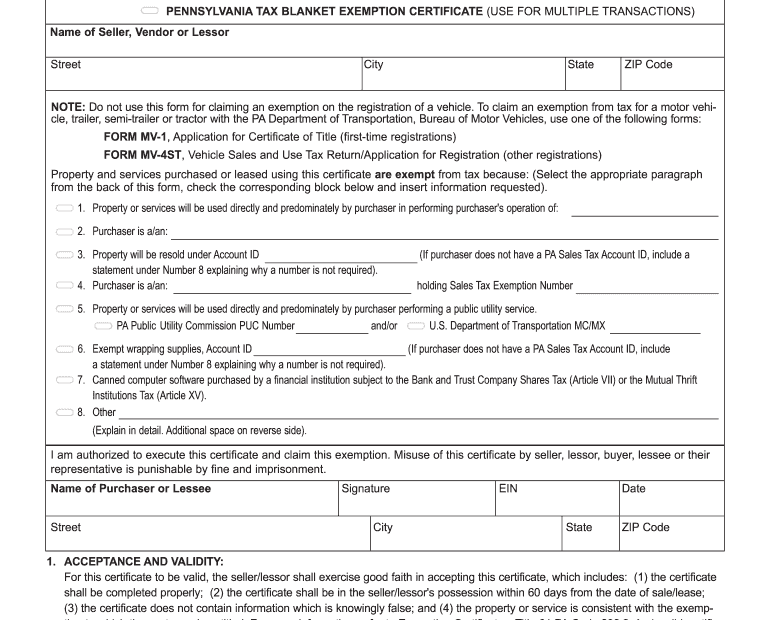

In addition to the PA-40 form, there are several other printable forms available for various tax situations, such as the PA-40 Schedule SP for claiming special tax forgiveness, the PA-40 Schedule UE for reporting unemployment compensation, and the PA-40 Schedule OC for reporting other credits. By accessing these forms, taxpayers can ensure that they are accurately reporting all relevant information to the Pennsylvania Department of Revenue.

Overall, having access to printable Pa state income tax forms for 2014 is essential for taxpayers looking to fulfill their tax obligations accurately and efficiently. By utilizing these forms, individuals can ensure that they are reporting all necessary information and claiming any credits or deductions they may be eligible for. With the convenience of printable forms, filing your Pennsylvania state income tax has never been easier.