Sales tax is an essential part of doing business in the state of New York. Business owners are required to collect and remit sales tax to the state on a regular basis. The Nys Sales Tax Form St-100 is a crucial document that businesses must fill out to report their sales tax liability to the New York State Department of Taxation and Finance.

Failure to accurately report and remit sales tax can result in penalties and interest charges, so it is important for businesses to stay compliant with their sales tax obligations. The Nys Sales Tax Form St-100 provides a structured format for businesses to report their sales tax collections and calculate the amount owed to the state.

Printable Nys Sales Tax Form St-100

Printable Nys Sales Tax Form St-100

Save and Print Printable Nys Sales Tax Form St-100

NYC 210 Form 2023 Printable And Fillable Forms Online PDFliner

NYC 210 Form 2023 Printable And Fillable Forms Online PDFliner

Printable Nys Sales Tax Form St-100

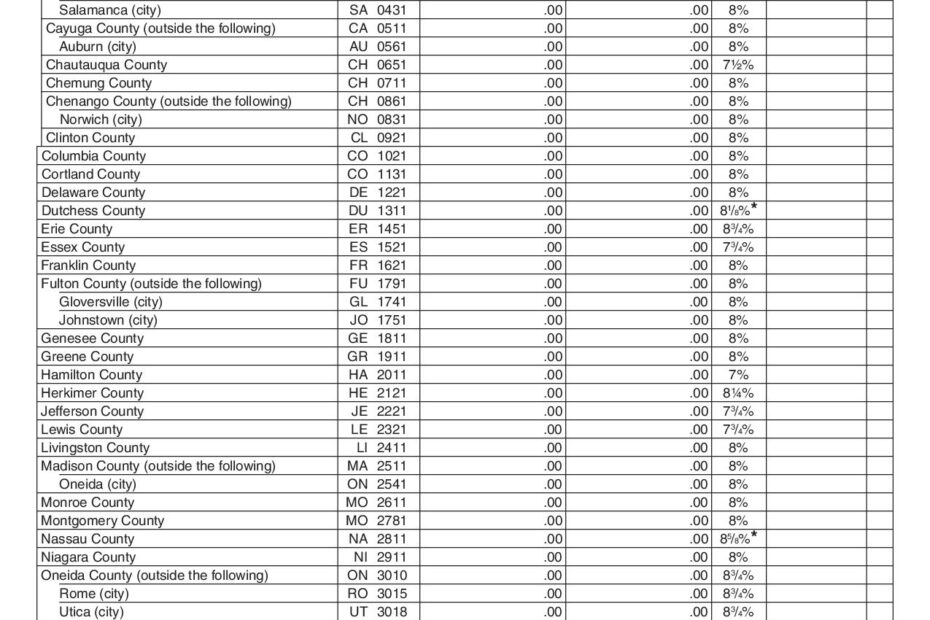

The Printable Nys Sales Tax Form St-100 is readily available on the New York State Department of Taxation and Finance website. This form can be downloaded and printed for businesses to fill out manually. The form includes sections for businesses to enter their total sales, taxable sales, and sales tax collected. It also provides instructions on how to calculate the amount owed to the state.

Business owners must carefully review the information entered on the form to ensure accuracy. Any mistakes or discrepancies could lead to audits or penalties from the state. It is recommended that businesses keep detailed records of their sales transactions to support the information reported on the Nys Sales Tax Form St-100.

Once the form is completed, businesses can submit it along with payment to the New York State Department of Taxation and Finance. Payments can be made electronically or by mail, depending on the preference of the business owner. It is important to submit the form and payment by the due date to avoid any late fees or penalties.

In conclusion, the Printable Nys Sales Tax Form St-100 is a vital tool for businesses to report their sales tax liability to the state of New York. By staying compliant with sales tax obligations and accurately reporting sales tax collections, businesses can avoid costly penalties and maintain a good standing with the state tax authorities.