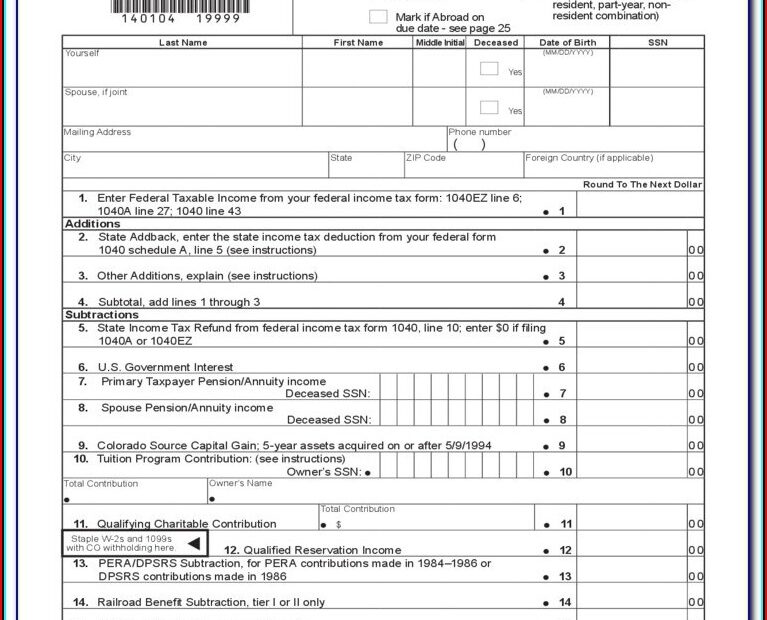

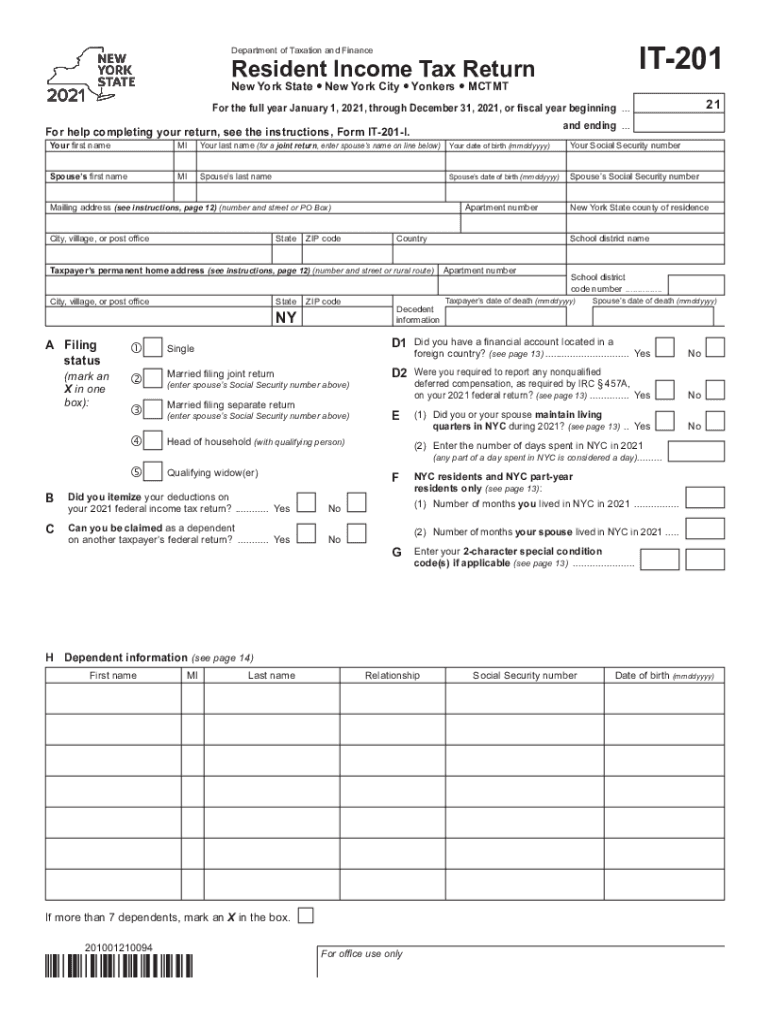

As tax season approaches, it’s important to be prepared with all the necessary forms to file your taxes accurately. For New York State residents, this means having access to Printable Nys Income Tax Forms. These forms are essential for reporting your income, deductions, and credits to the state government.

Printable Nys Income Tax Forms can be easily found online on the official website of the New York State Department of Taxation and Finance. These forms are available in PDF format, making it convenient for taxpayers to download, print, and fill out at their own pace. By using these printable forms, taxpayers can ensure that they are providing accurate information to the state government.

Printable Nys Income Tax Forms

Printable Nys Income Tax Forms

Easily Download and Print Printable Nys Income Tax Forms

Printable Nys Income Tax Forms

There are several types of Printable Nys Income Tax Forms that taxpayers may need to file their taxes. Some of the common forms include Form IT-201 for resident taxpayers, Form IT-203 for nonresident and part-year resident taxpayers, and Form IT-214 for claiming tax credits. These forms are designed to capture different aspects of an individual’s income and tax liabilities.

When filling out Printable Nys Income Tax Forms, taxpayers should pay close attention to the instructions provided on each form. It’s important to accurately report all sources of income, deductions, and credits to avoid any discrepancies that could lead to penalties or audits. By carefully reviewing and filling out these forms, taxpayers can ensure a smooth and accurate tax filing process.

Once taxpayers have completed their Printable Nys Income Tax Forms, they can either mail them to the New York State Department of Taxation and Finance or submit them electronically through the department’s website. It’s important to keep copies of all forms and supporting documents for your records in case of any future inquiries or audits.

In conclusion, Printable Nys Income Tax Forms are essential tools for New York State residents to accurately report their income and tax liabilities to the state government. By using these forms and following the instructions provided, taxpayers can ensure a smooth and accurate tax filing process. Make sure to stay organized and keep copies of all forms for your records to avoid any potential issues in the future.