Filing your state income taxes can be a daunting task, but having the right forms can make the process much easier. For residents of Kentucky, the 2018 state income tax form is an essential document that must be filled out accurately to ensure compliance with state tax laws.

Whether you are a full-time employee, self-employed individual, or a business owner, understanding and completing the Kentucky state income tax form is crucial for meeting your tax obligations and avoiding penalties.

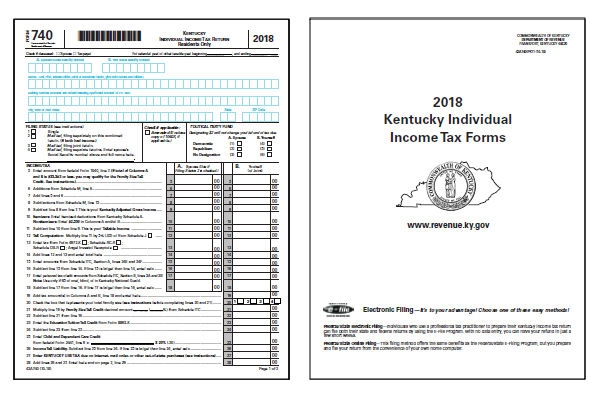

Printable Ky State Income Tax Form 2018

Printable Ky State Income Tax Form 2018

Easily Download and Print Printable Ky State Income Tax Form 2018

Printable Ky State Income Tax Form 2018

The Printable Ky State Income Tax Form 2018 is available online for taxpayers to download and fill out. This form includes sections for reporting income, deductions, credits, and other relevant information needed to calculate your state tax liability for the year 2018.

When filling out the form, make sure to double-check all the information provided and ensure accuracy to avoid any discrepancies or delays in processing your tax return. It’s also important to keep all necessary documentation, such as W-2 forms, receipts, and supporting documents, handy while completing the form.

For individuals who prefer to file their taxes electronically, the Kentucky Department of Revenue offers an e-file option for taxpayers to submit their state income tax return online. This method can be faster and more convenient for those who want to avoid the hassle of mailing in a paper form.

After completing the form and reviewing all the information, don’t forget to sign and date the document before submitting it to the Kentucky Department of Revenue. Once your tax return is processed, you will receive any refund owed to you or be notified of any additional tax payment required.

In conclusion, the Printable Ky State Income Tax Form 2018 is a vital document for Kentucky residents to fulfill their state tax obligations. By accurately completing the form and submitting it on time, you can ensure compliance with state tax laws and avoid potential penalties. Make sure to take advantage of online resources and tools provided by the Kentucky Department of Revenue to make the tax filing process as smooth as possible.