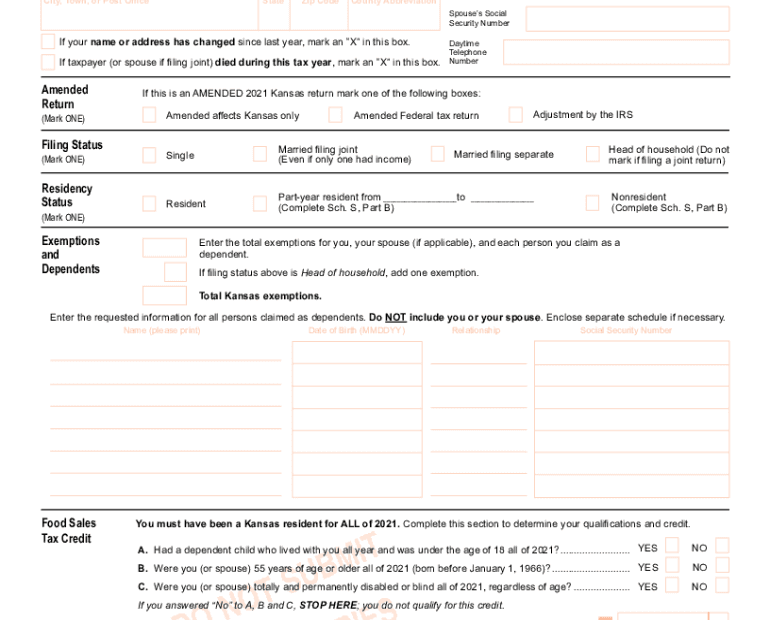

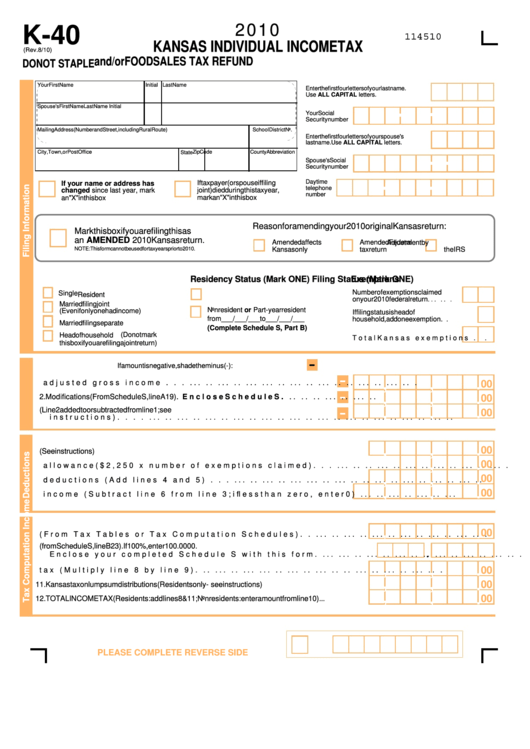

When it comes to filing your income taxes in Kansas, having the necessary forms is crucial. Whether you are a resident or non-resident of the state, you will need the appropriate forms to accurately report your income and deductions. Fortunately, Kansas provides printable income tax forms that can be easily accessed and filled out.

By using printable Kansas income tax forms, you can ensure that you are following the correct guidelines set forth by the state. These forms are designed to capture all the necessary information required for tax purposes, making the filing process more efficient and accurate.

Printable Kansas Income Tax Forms

Printable Kansas Income Tax Forms

Get and Print Printable Kansas Income Tax Forms

When it comes to filing your Kansas income taxes, there are several key forms that you may need to fill out, depending on your individual tax situation. Some of the common forms include the Kansas Individual Income Tax Return (K-40), Schedule S (Supplemental Income and Loss), Schedule CR (Credit for Taxes Paid to Other States), and Schedule K-40PT (Payment Voucher).

It is important to carefully review each form and its instructions to ensure that you are filling them out correctly. Additionally, be sure to double-check all calculations and information before submitting your tax return to avoid any potential errors or delays.

By utilizing printable Kansas income tax forms, you can simplify the tax-filing process and ensure that you are meeting all of your obligations as a taxpayer. These forms can be easily accessed online through the Kansas Department of Revenue website or through various tax preparation software programs.

Overall, printable Kansas income tax forms are a valuable resource for individuals looking to accurately report their income and deductions for the tax year. By utilizing these forms and following the instructions provided, you can streamline the filing process and ensure that you are in compliance with state tax laws.