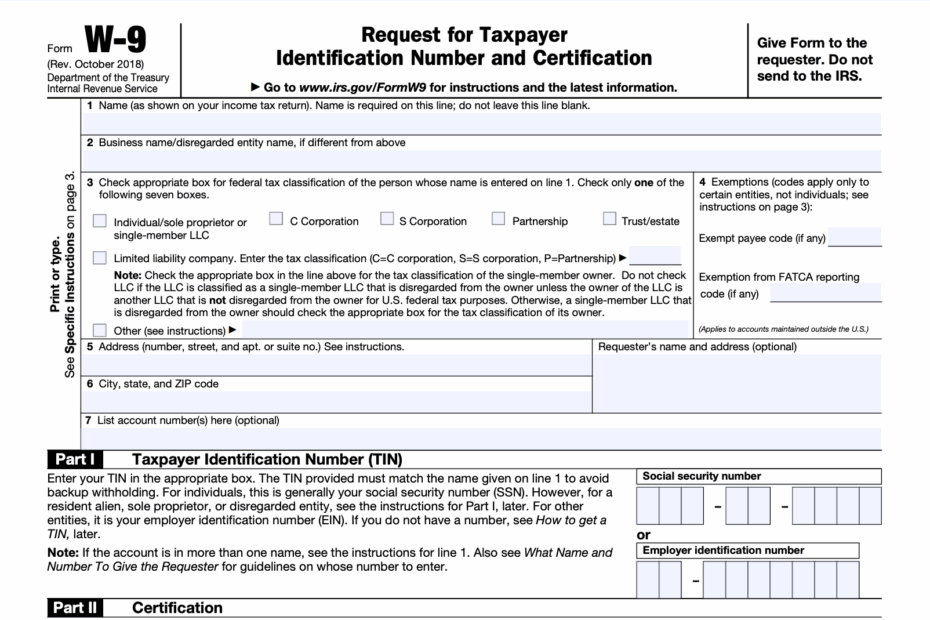

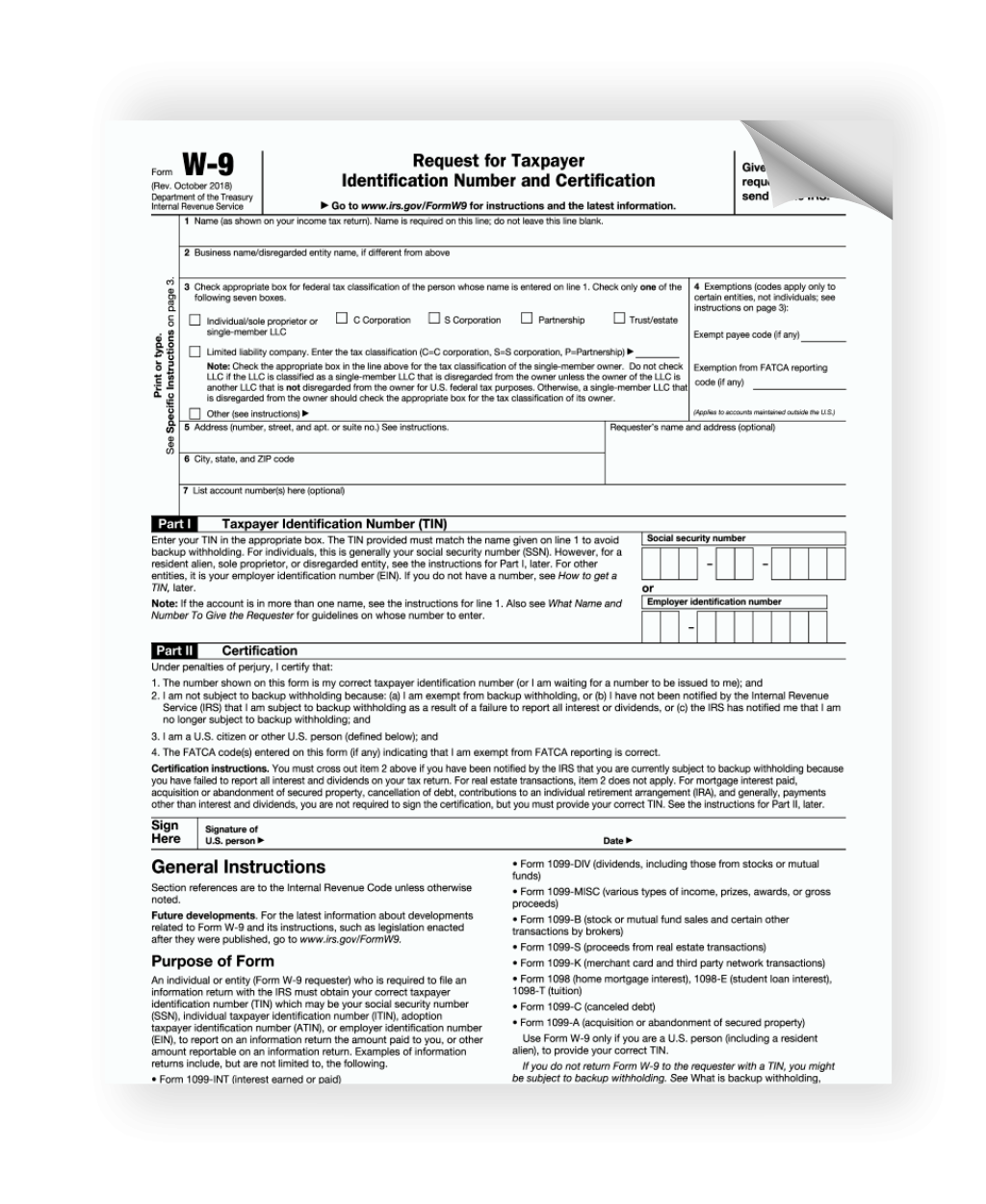

When it comes to tax season, one of the most important forms that individuals and businesses need to fill out is the IRS W9 form. This form is used to gather information about a taxpayer’s identification number, such as their Social Security number or employer identification number. It is crucial for businesses to obtain this information from their vendors and contractors in order to accurately report payments made to them.

Having a printable IRS W9 form on hand can make the process much easier for both parties involved. Whether you are a business owner looking to collect necessary information from your vendors, or an individual contractor needing to provide your information to clients, having a printable form readily available can save time and hassle.

Save and Print Printable Irs W9 Form

Fillable W 9 Form Template Formstack Documents

Fillable W 9 Form Template Formstack Documents

One of the key benefits of using a printable IRS W9 form is the convenience it offers. Instead of having to search for the form online or request a physical copy from the IRS, you can simply print it out whenever you need it. This can be especially helpful for businesses that work with multiple vendors and contractors, as it allows for easy access to the form whenever it is needed.

In addition to convenience, using a printable IRS W9 form can also help ensure accuracy. By having a physical copy of the form in hand, both parties can review the information provided and make any necessary corrections before submitting it. This can help prevent errors and potential delays in processing payments.

Overall, having a printable IRS W9 form can streamline the process of gathering and providing taxpayer identification information. Whether you are a business owner or an individual contractor, having this form readily available can help ensure compliance with IRS regulations and make tax season a little bit easier.

So, next time you need to collect or provide taxpayer identification information, consider using a printable IRS W9 form to simplify the process.