When it comes to filing your taxes, it’s important to have all the necessary forms and documents ready. The IRS Tax Form 1040EZ is a simplified form that is designed for individuals with straightforward tax situations. It is a shorter and easier form to fill out compared to the regular Form 1040.

Many taxpayers prefer to use the 1040EZ form because it is less complex and can be completed in less time. It is especially useful for those who have no dependents, do not itemize deductions, and have a taxable income of less than $100,000.

Printable Irs Tax Forms 1040ez

Printable Irs Tax Forms 1040ez

Easily Download and Print Printable Irs Tax Forms 1040ez

Preparing A 1040EZ Tax Form Based On A Sample W2 Adult And Pediatric Printable Resources For Speech And Occupational Therapists

Preparing A 1040EZ Tax Form Based On A Sample W2 Adult And Pediatric Printable Resources For Speech And Occupational Therapists

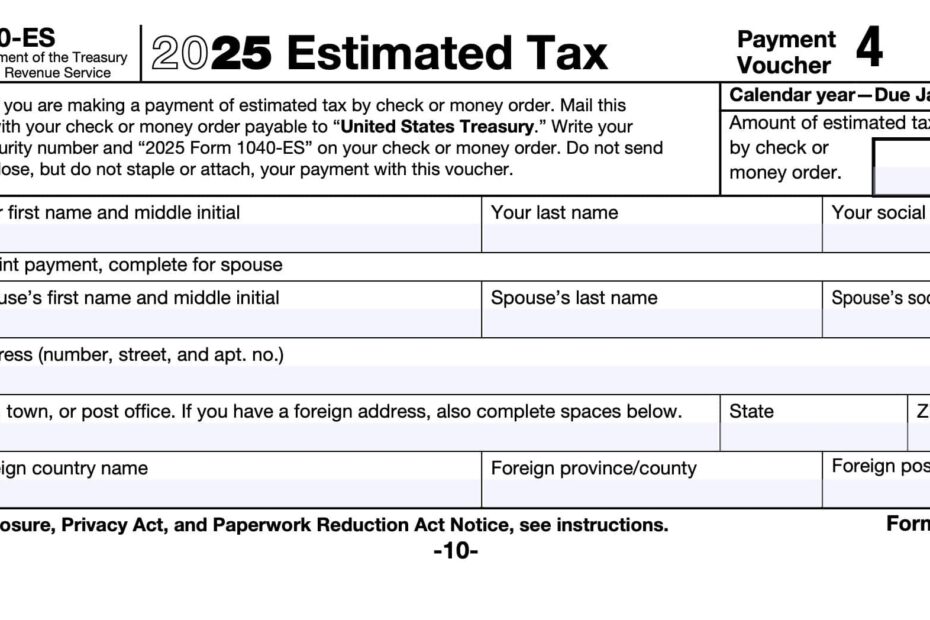

The 1040EZ form is available for download on the IRS website, making it easy for individuals to access and print it from the comfort of their own homes. This form includes sections for reporting income, deductions, and credits, as well as a simple worksheet to calculate the amount of tax owed or refunded.

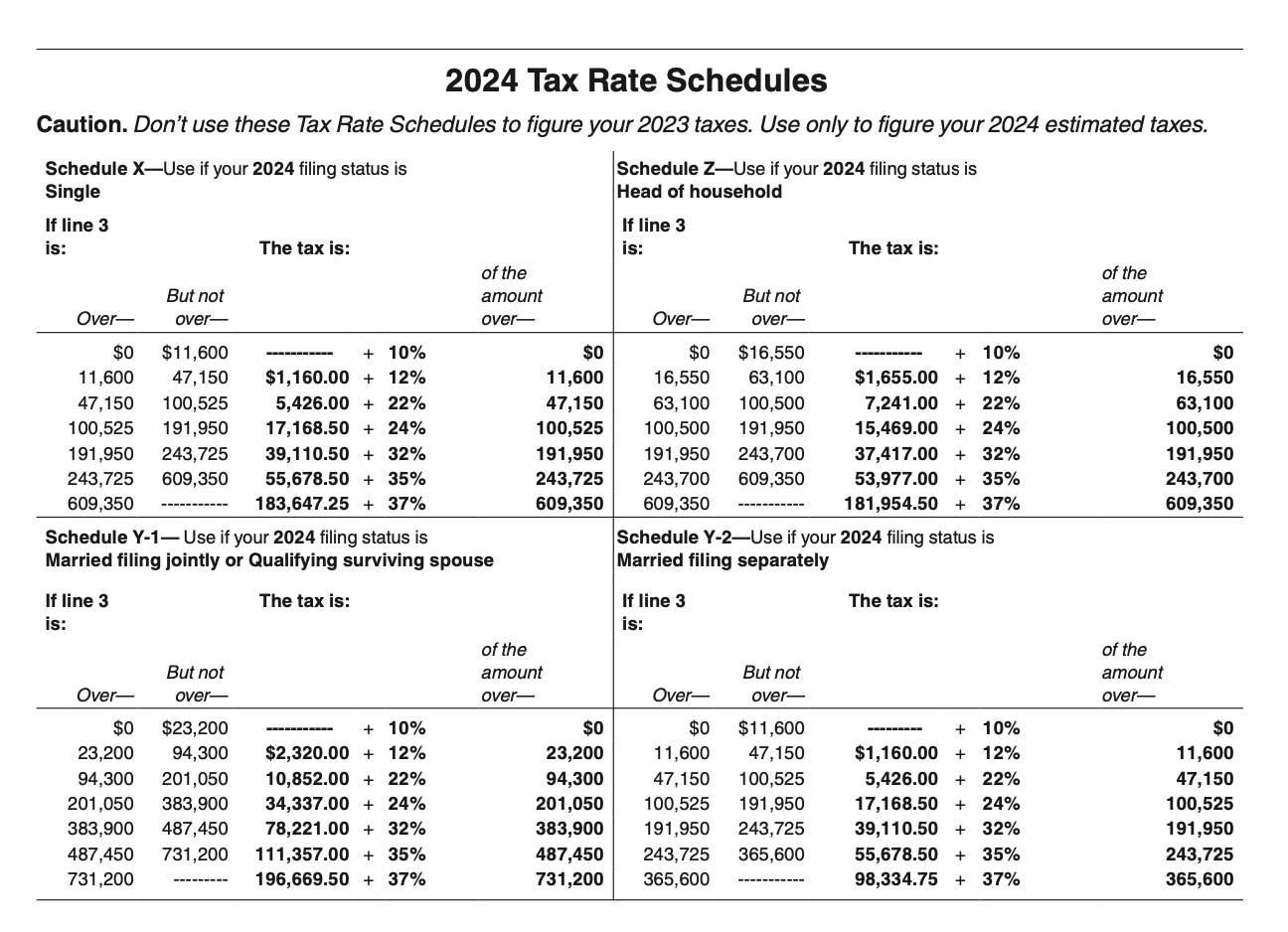

It is important to note that not everyone is eligible to use the 1040EZ form. For example, if you have income from self-employment, rental properties, or investments, you may need to use the regular Form 1040 instead. Additionally, if you have dependents or itemize deductions, you will not be able to use the 1040EZ form.

Before filling out the 1040EZ form, it is recommended to gather all necessary documents, such as W-2 forms, 1099 forms, and any receipts for deductions or credits. This will help ensure that you accurately report your income and claim any eligible deductions or credits.

In conclusion, the IRS Tax Form 1040EZ is a convenient and simplified form for individuals with straightforward tax situations. By downloading and printing this form from the IRS website, taxpayers can easily file their taxes without the need for professional assistance. However, it is important to review the eligibility requirements and gather all necessary documents before completing the form to avoid any errors or delays in processing.