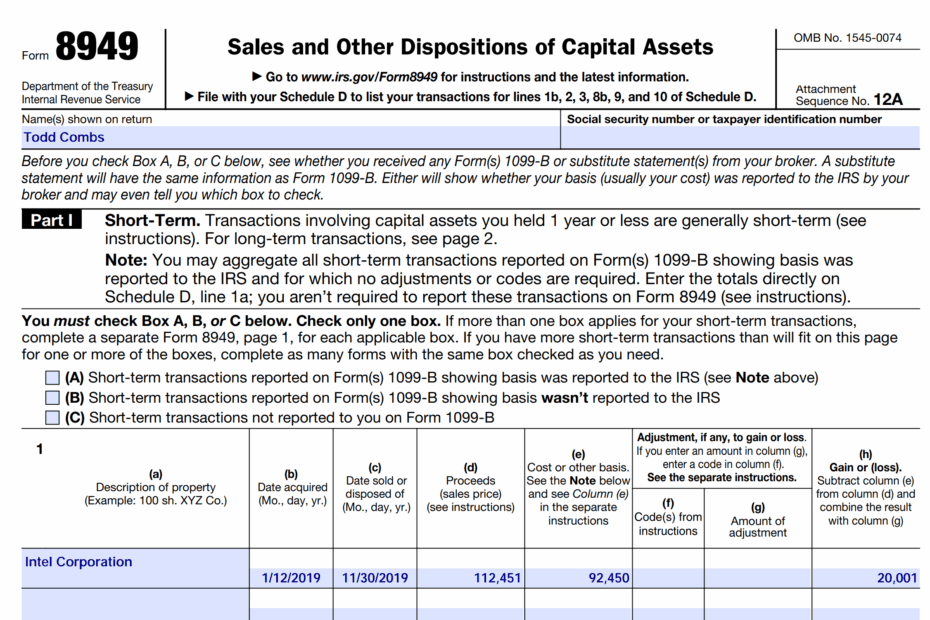

When it comes to filing your taxes, it’s important to make sure you have all the necessary forms in order. One such form that you may need to fill out is IRS Tax Form 8949. This form is used to report capital gains and losses from the sale of investments such as stocks, bonds, and mutual funds.

It’s important to accurately report these transactions to ensure that you are not underpaying or overpaying your taxes. Having a printable version of IRS Tax Form 8949 can make the process easier and more convenient for you.

Get and Print Printable Irs Tax Form 8949

Form 8949 2024 2025 Fill Edit And Download PDF Guru

Form 8949 2024 2025 Fill Edit And Download PDF Guru

When filling out IRS Tax Form 8949, you will need to provide details about each transaction, including the date of the sale, the purchase price, the sale price, and any related expenses. You will also need to indicate whether the transaction resulted in a gain or a loss.

Once you have completed IRS Tax Form 8949, you will need to include the information on your Schedule D when filing your tax return. This form will help you calculate your total capital gains or losses for the year, which will ultimately determine how much tax you owe.

Having a printable version of IRS Tax Form 8949 can be especially helpful if you prefer to fill out your forms by hand rather than using tax preparation software. You can easily download and print the form from the IRS website and fill it out at your own pace.

Remember, it’s important to accurately report all of your investment transactions to avoid any potential penalties or audits from the IRS. By using a printable IRS Tax Form 8949, you can ensure that you are providing the necessary information in a clear and organized manner.

In conclusion, IRS Tax Form 8949 is an essential document for reporting capital gains and losses from the sale of investments. Having a printable version of this form can make the process of filing your taxes much easier and more convenient. Be sure to carefully fill out the form and include it with your tax return to stay in compliance with IRS regulations.