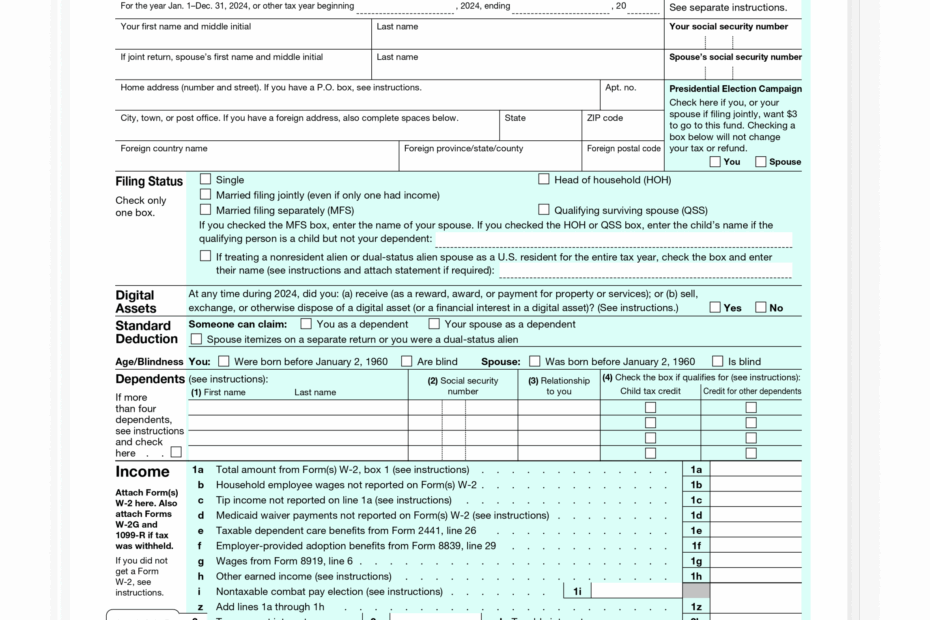

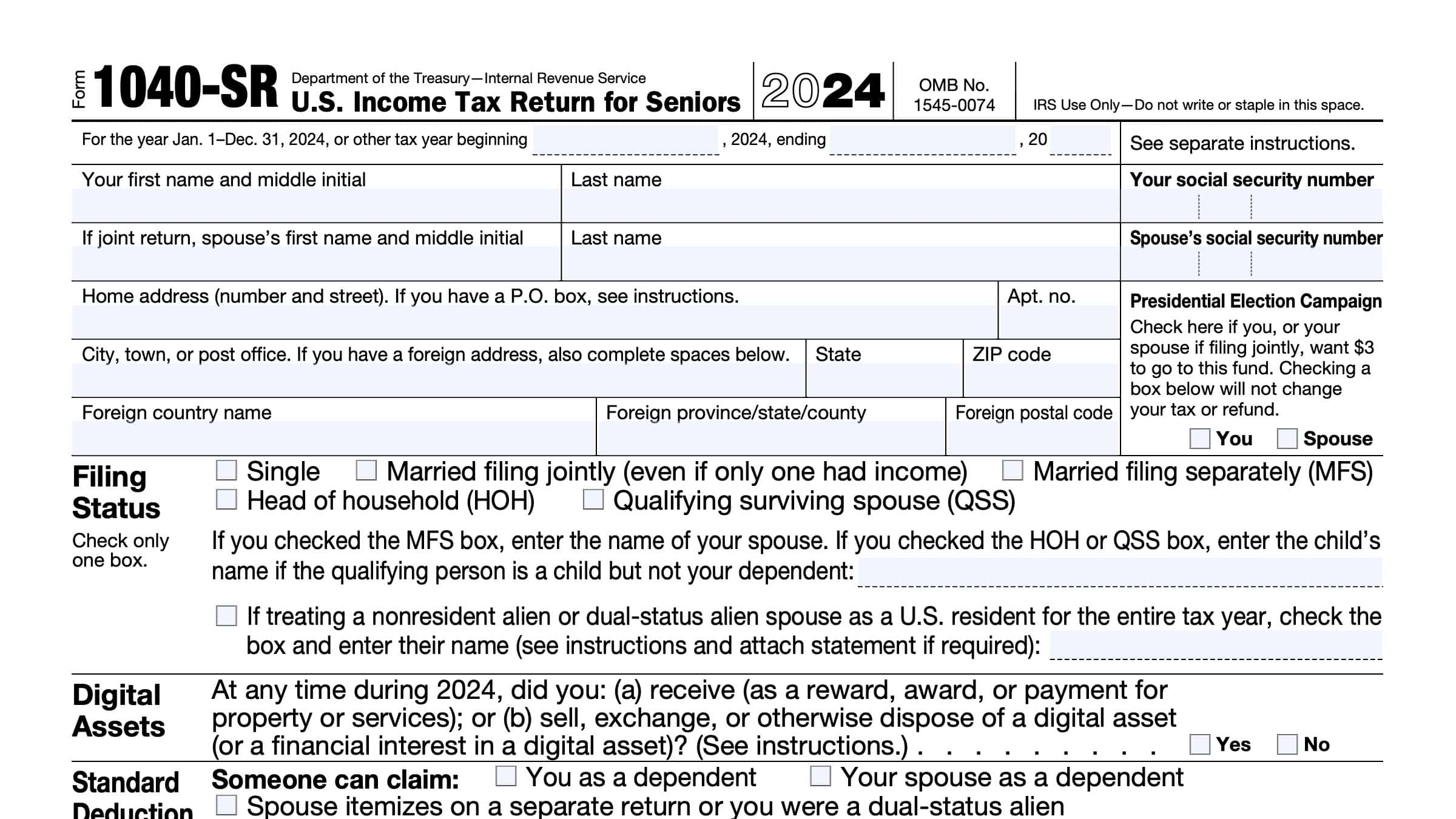

When it comes to filing your taxes, one of the most important documents you will need is the IRS Tax Form 1040a. This form is used by individuals who have income from wages, tips, salaries, and other sources but do not have any dependents. It is a simplified version of the standard Form 1040, making it easier for those with straightforward tax situations to file their taxes.

Printable IRS Tax Form 1040a can be easily found online on the official IRS website or through various tax preparation software. This form allows you to report your income, deductions, and credits in order to calculate your tax liability or refund. It is important to ensure that you fill out the form accurately and completely to avoid any issues with the IRS.

Save and Print Printable Irs Tax Form 1040a

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

When filling out the IRS Tax Form 1040a, you will need to provide information such as your name, address, Social Security number, and filing status. You will also need to report your income, deductions, and credits in the appropriate sections of the form. Once you have completed the form, you can then either file it electronically or mail it to the IRS.

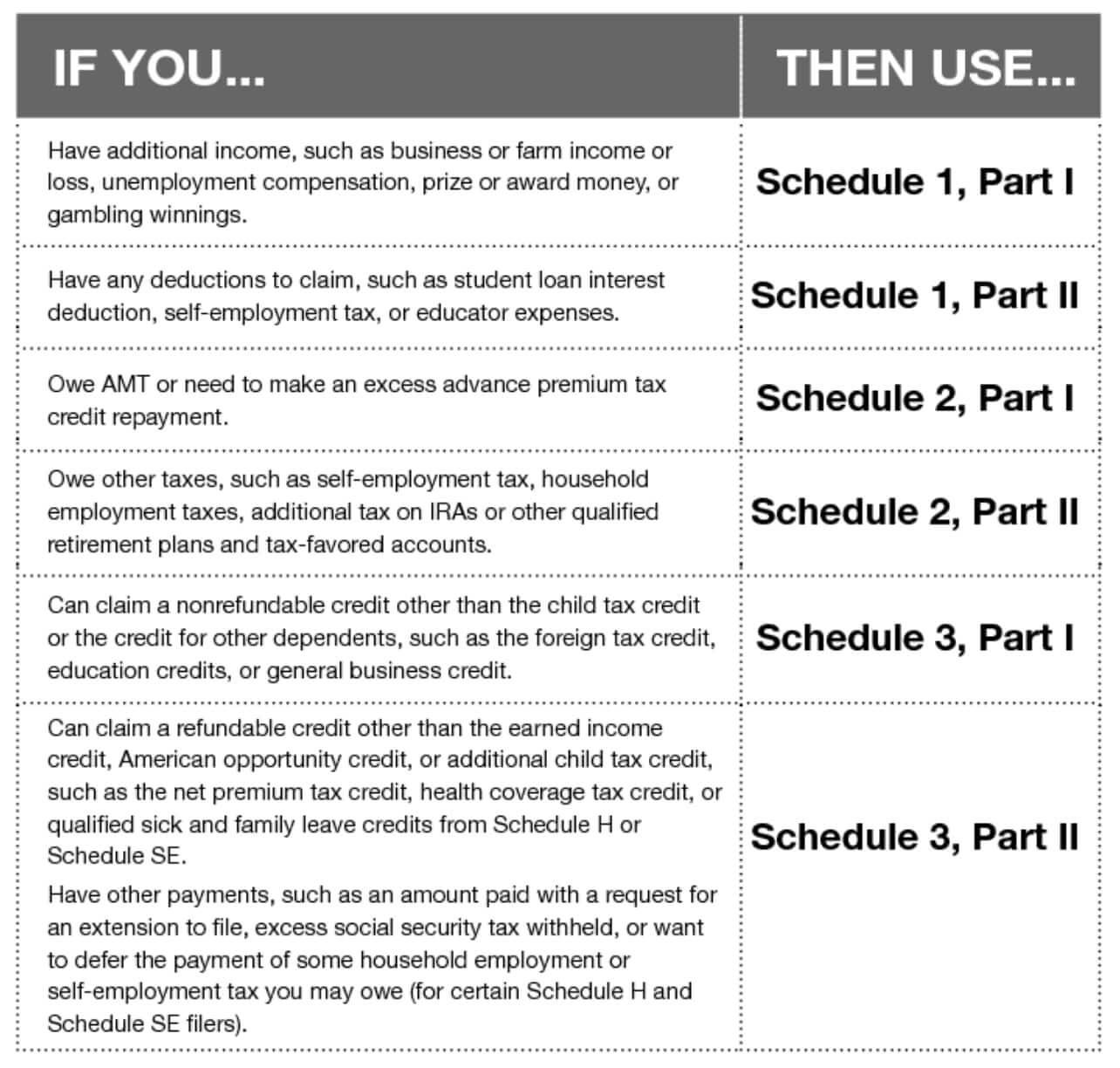

One of the benefits of using the IRS Tax Form 1040a is that it is designed for individuals with relatively simple tax situations. This means that you may be able to file your taxes without the need for additional schedules or forms, saving you time and hassle. However, if your tax situation is more complex, you may need to use the standard Form 1040 instead.

Overall, Printable IRS Tax Form 1040a is a convenient and straightforward way to file your taxes if you have a simple tax situation. By accurately completing the form and submitting it to the IRS on time, you can ensure that you are in compliance with tax laws and avoid any potential penalties or fines. So make sure to download the form, fill it out carefully, and file your taxes on time to stay in good standing with the IRS.