As tax season approaches, it’s essential to have all the necessary forms in order to file your taxes accurately and on time. The IRS provides a variety of forms for taxpayers to report their income, deductions, and credits. Having these forms readily available can make the process much smoother and less stressful.

Printable IRS forms for 2025 can be easily accessed online through the IRS website or various tax preparation software. These forms are essential for individuals, businesses, and other entities to report their financial information to the IRS. Whether you are filing as a single individual, married couple, or a business owner, having the correct forms is crucial for completing your tax return.

Download and Print Printable Irs Forms For 2025

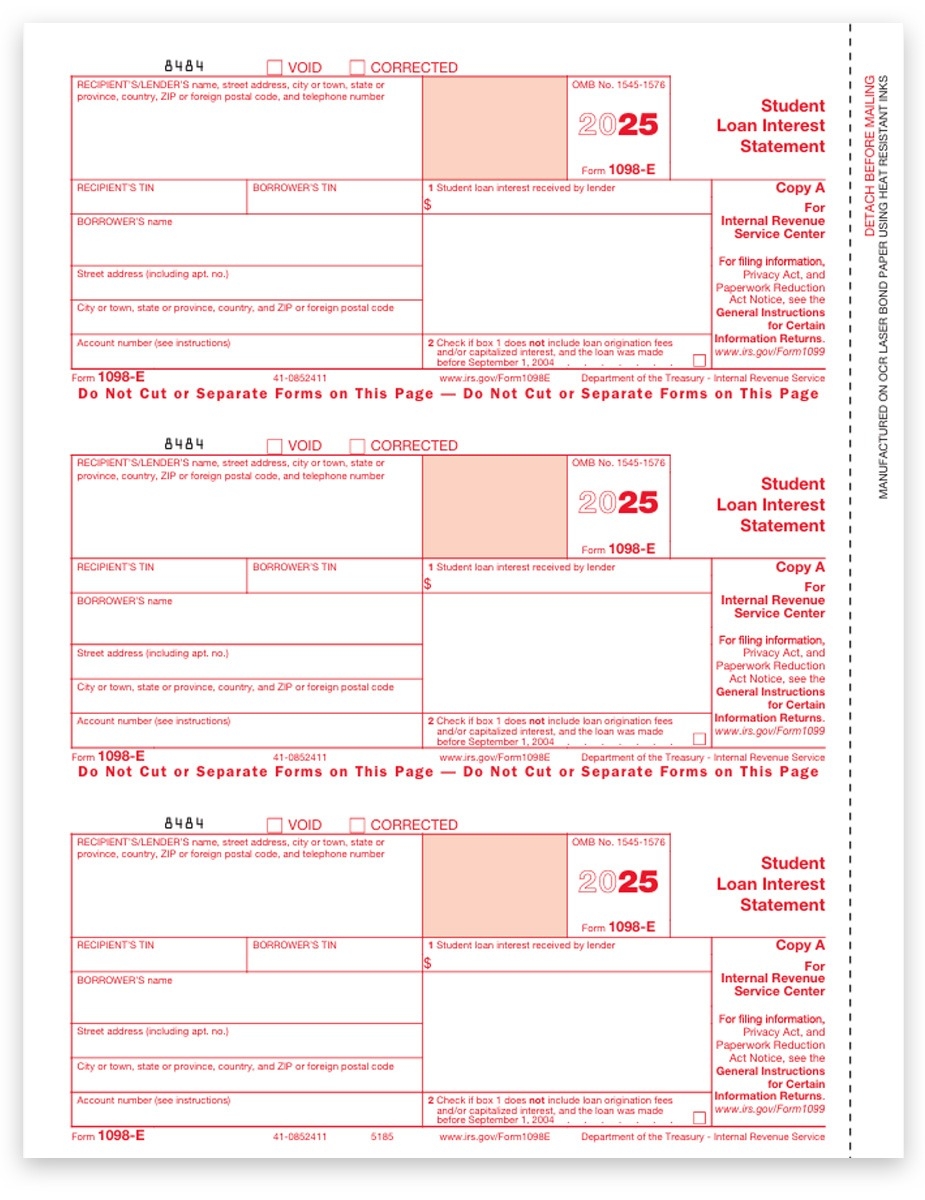

1098E Tax Forms For Student Loan Interest IRS Copy DiscountTaxForms

1098E Tax Forms For Student Loan Interest IRS Copy DiscountTaxForms

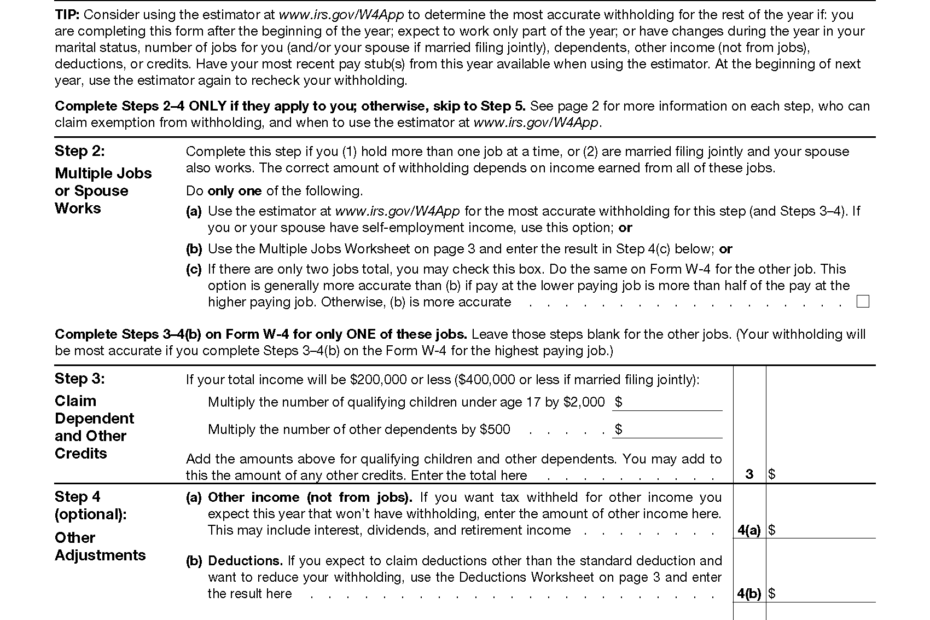

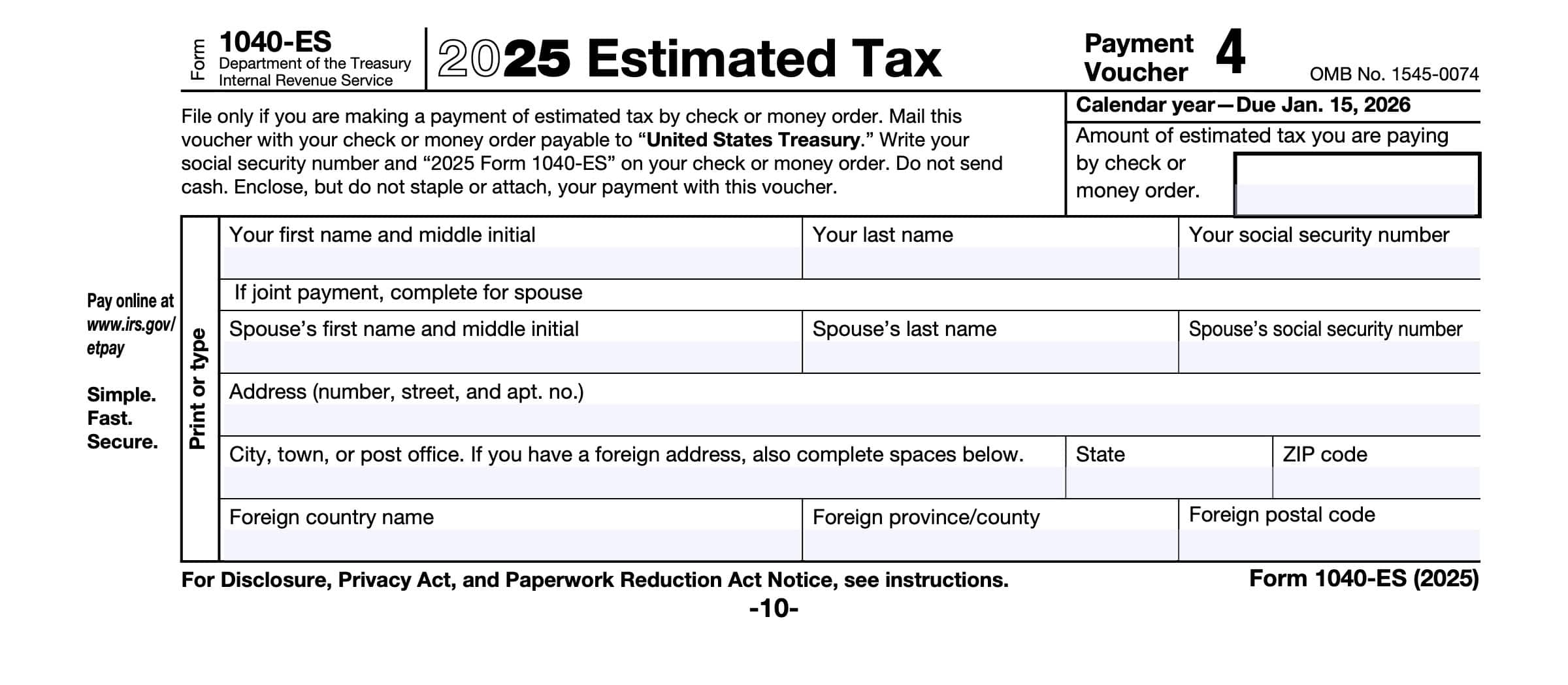

When it comes to printable IRS forms for 2025, some of the most commonly used forms include Form 1040 for individual income tax returns, Form 1099 for reporting various types of income, and Form W-2 for reporting wages and salary income. Additionally, businesses may need forms such as Form 941 for reporting employment taxes and Form 1120 for corporate tax returns. These forms provide the IRS with the necessary information to assess tax liability and ensure compliance with tax laws.

It’s important to note that each taxpayer’s situation is unique, so not all forms will be applicable to every individual or business. Before filing your taxes, it’s essential to review the IRS instructions for each form to ensure you are completing them correctly. Filing incorrect or incomplete forms can result in delays in processing your tax return or potential penalties from the IRS.

In conclusion, printable IRS forms for 2025 are essential tools for taxpayers to accurately report their financial information to the IRS. By having the necessary forms on hand, you can ensure a smooth and efficient tax filing process. Be sure to gather all the required forms and information before filing your taxes to avoid any issues with the IRS. Stay informed and organized to make tax season a little less stressful.