When it comes to tax season, having the necessary forms on hand is crucial for filing your taxes accurately and efficiently. The IRS provides a variety of forms for different tax situations, and having access to printable forms can make the process much easier.

For the tax year 2016, the IRS released a range of forms that taxpayers need to report their income, deductions, credits, and other tax-related information. These forms are essential for individuals, businesses, and organizations to file their taxes and comply with federal tax laws.

Quickly Access and Print Printable Irs Forms 2016

One of the most common forms that individuals may need for the tax year 2016 is Form 1040, which is used for filing individual income tax returns. This form includes sections for reporting income, deductions, credits, and tax payments. Additionally, there are various schedules and worksheets that may need to be attached to Form 1040 depending on the taxpayer’s specific situation.

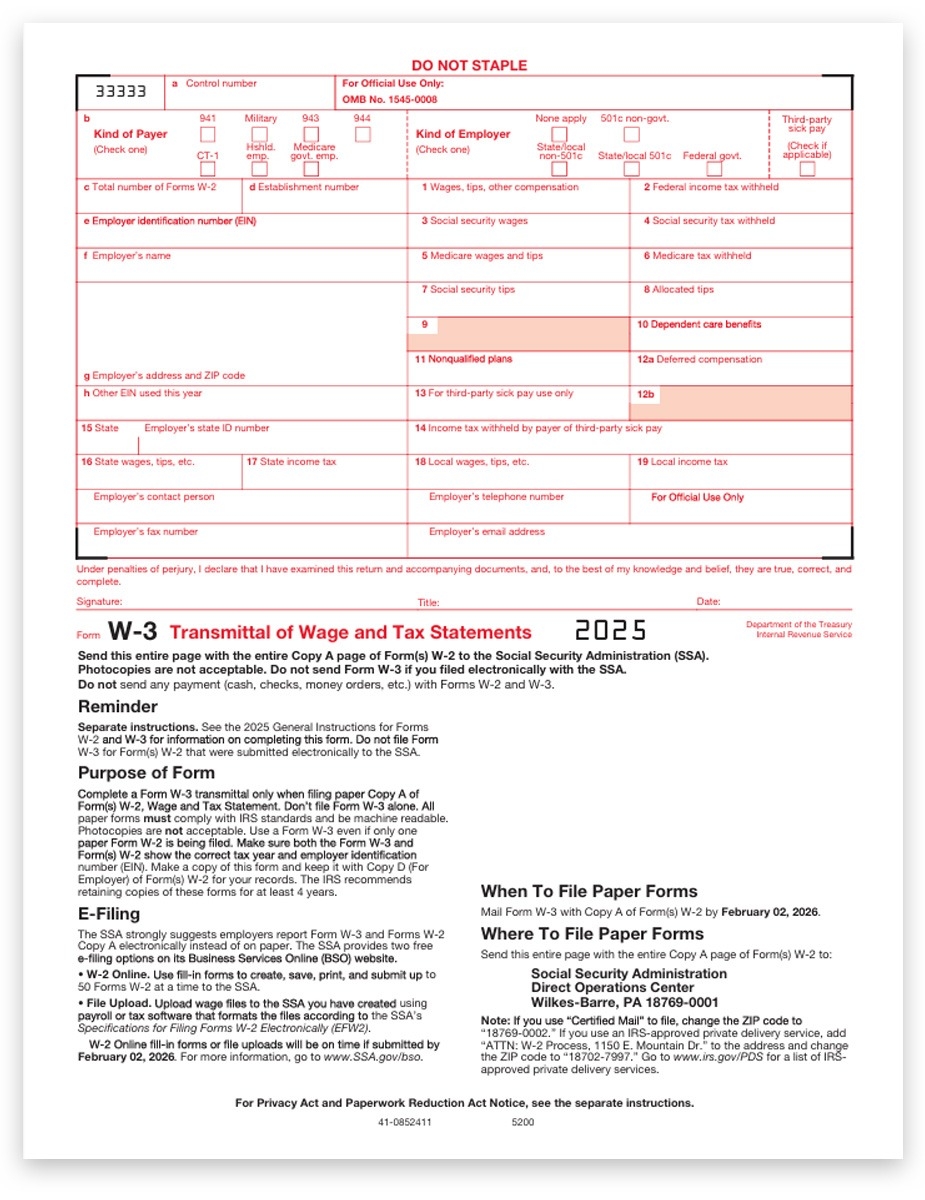

Businesses may need to use forms such as Form 1120 for corporations, Form 1065 for partnerships, and Form 990 for tax-exempt organizations. These forms require detailed information about the organization’s income, expenses, assets, and liabilities, and are essential for reporting their tax obligations accurately.

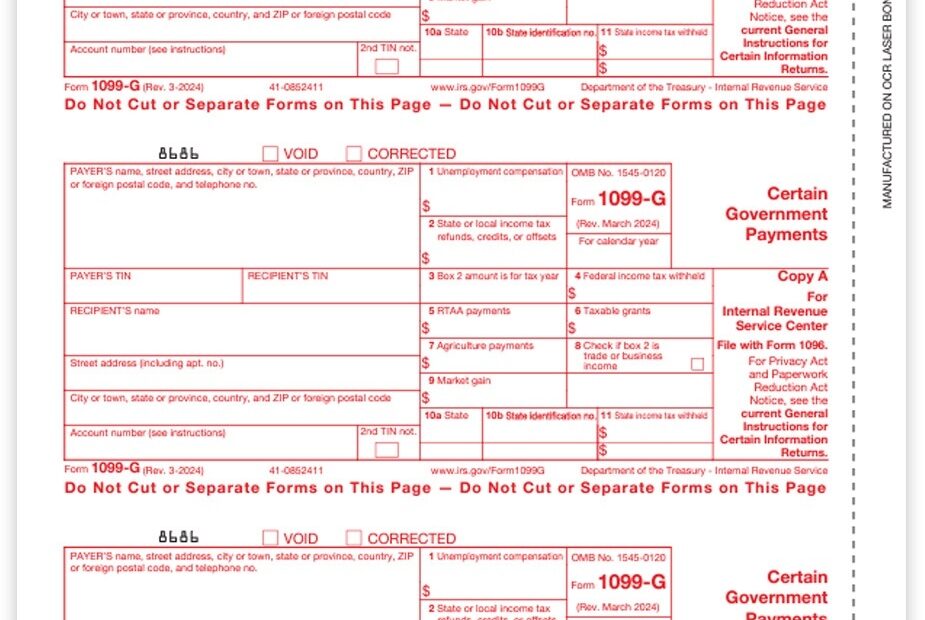

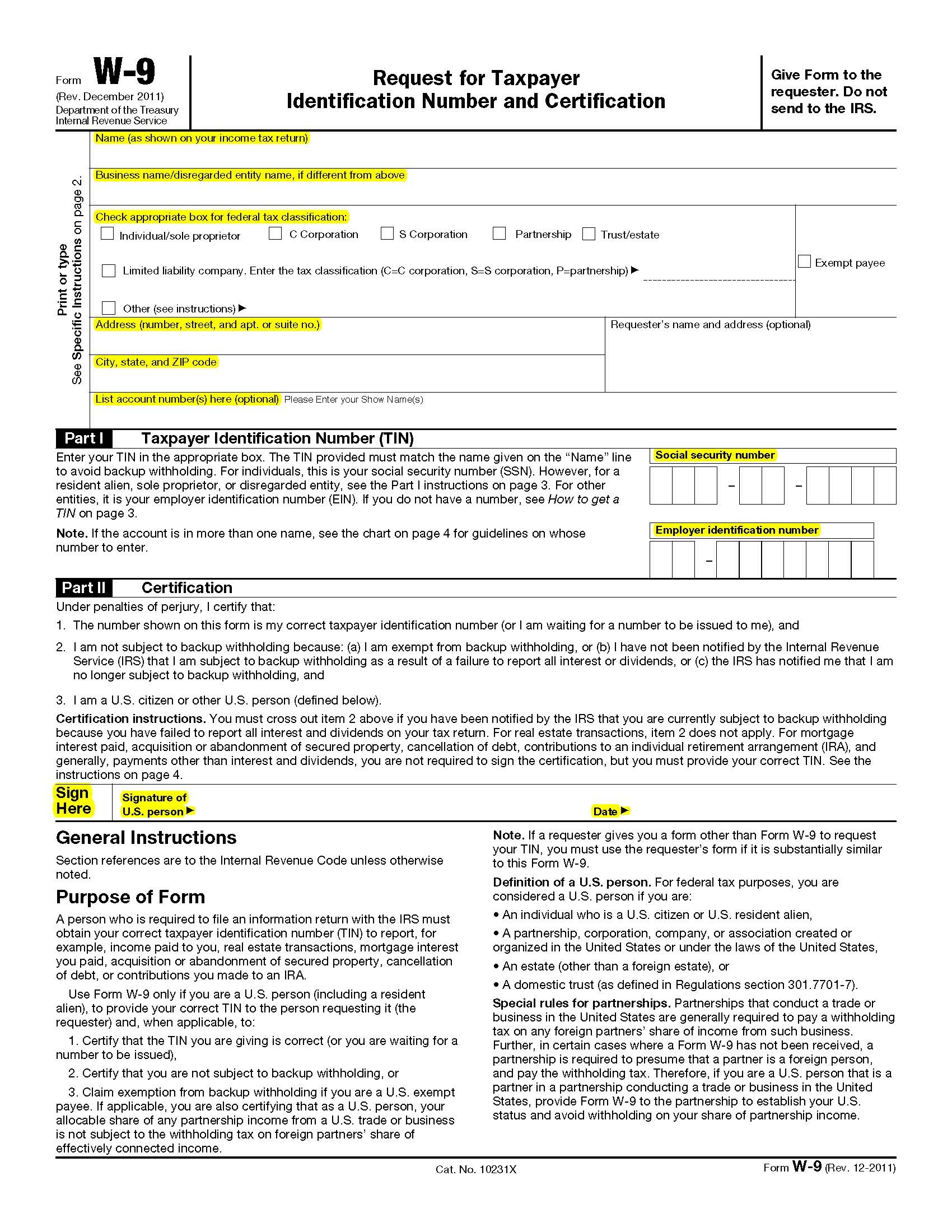

It is important to note that the IRS provides printable versions of these forms on their official website, making it easy for taxpayers to access and fill out the necessary documents. These forms can be downloaded, printed, and filled out manually, or they can be filled out electronically using tax preparation software.

Having access to printable IRS forms for the tax year 2016 can help individuals and businesses ensure that they are filing their taxes correctly and on time. By using the appropriate forms and following the instructions provided by the IRS, taxpayers can avoid errors and potential penalties for inaccurate tax reporting.

Overall, printable IRS forms for the tax year 2016 are essential tools for taxpayers to fulfill their tax obligations and comply with federal tax laws. By utilizing these forms and following the guidelines provided by the IRS, taxpayers can navigate the tax filing process with confidence and accuracy.