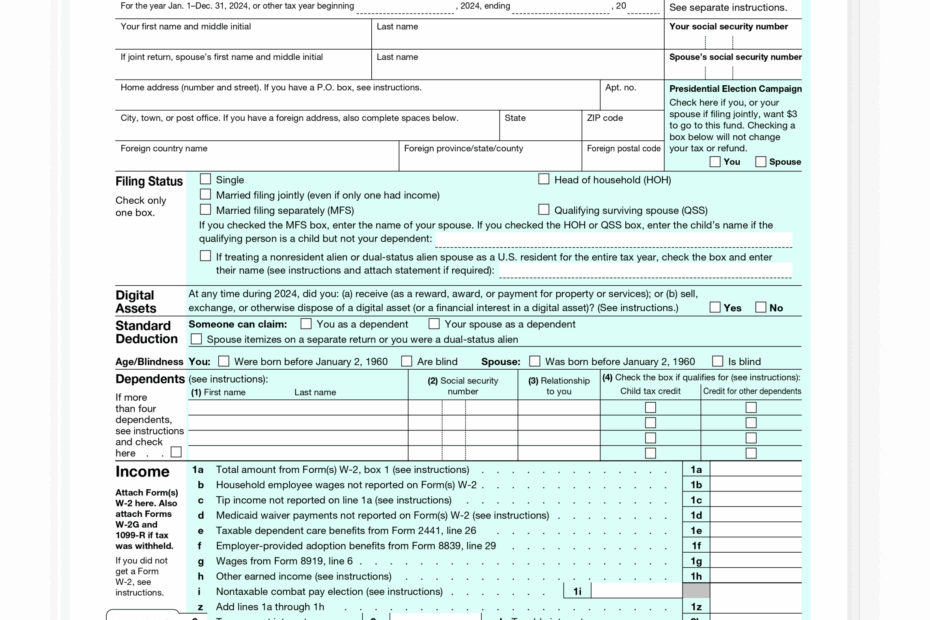

As tax season approaches, many individuals are gearing up to file their annual tax returns. One of the most commonly used forms is the IRS Form 1040, which is used to report an individual’s income and determine their tax liability. Understanding how to properly fill out this form is crucial in order to avoid any potential issues with the IRS.

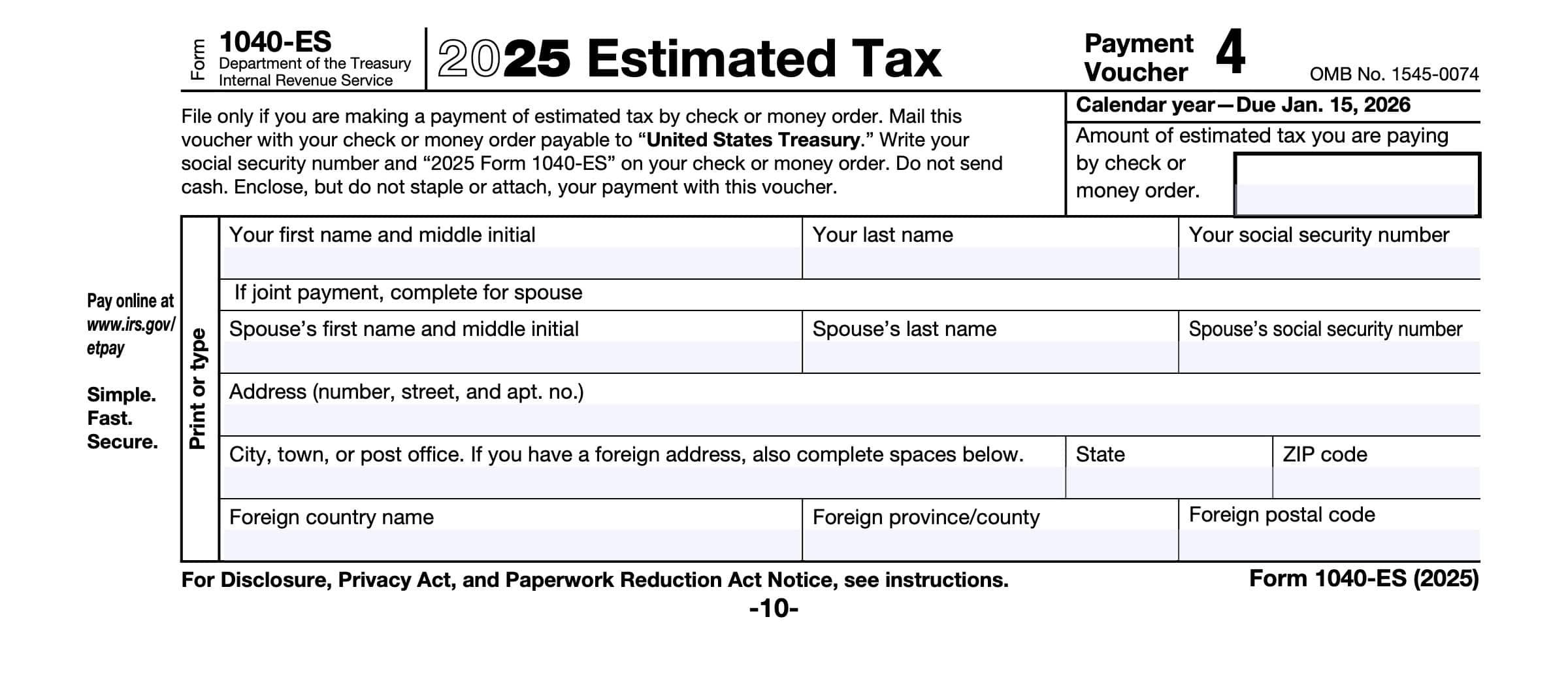

Printable IRS Forms 1040 are readily available online, making it easy for taxpayers to access and fill out the necessary information. These forms are essential for accurately reporting income, deductions, credits, and any taxes owed. By utilizing these printable forms, individuals can ensure that they are providing the IRS with all the required information in a clear and organized manner.

Get and Print Printable Irs Forms 1040

IRS Form 1040 SR Instructions Tax Return For Seniors

IRS Form 1040 SR Instructions Tax Return For Seniors

Printable IRS Forms 1040

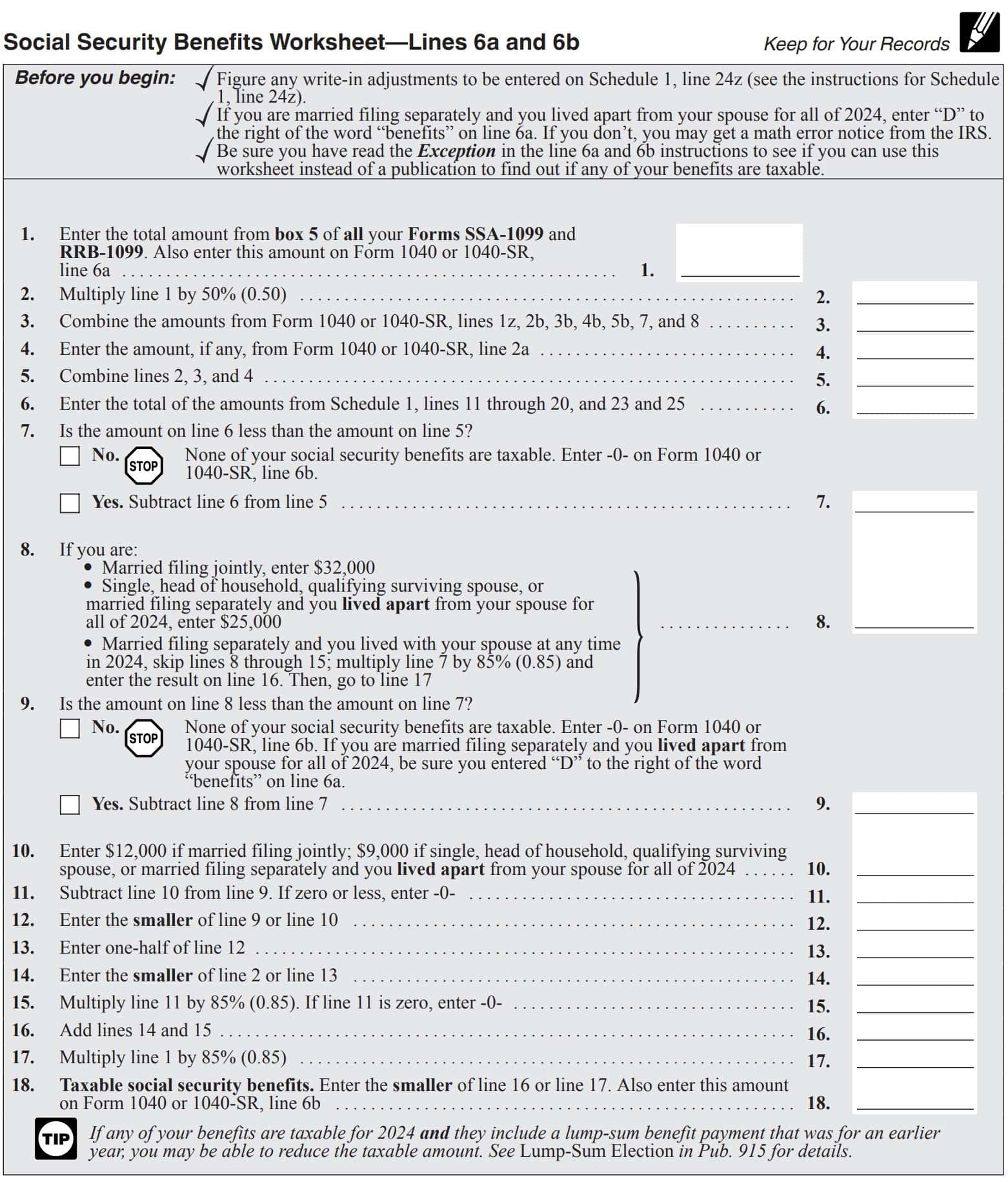

When filling out the IRS Form 1040, individuals must provide details about their income, including wages, interest, dividends, and any other sources of income. They must also report any deductions they are eligible for, such as mortgage interest, medical expenses, and charitable contributions. Additionally, individuals must calculate their tax liability based on their income and deductions, and determine if they owe any additional taxes or are entitled to a refund.

Using printable IRS Forms 1040 can help streamline the tax-filing process and ensure that individuals provide accurate information to the IRS. By carefully reviewing the form and entering all necessary details, taxpayers can avoid errors that may lead to delays in processing their returns or trigger an IRS audit. It is important to take the time to fill out the form correctly and double-check all information before submitting it to the IRS.

Overall, printable IRS Forms 1040 are a valuable tool for individuals to use when preparing their annual tax returns. By utilizing these forms, taxpayers can accurately report their income, deductions, and tax liability, and ensure that they are in compliance with IRS regulations. It is essential to take the time to carefully fill out the form and review all information before submitting it to the IRS to avoid any potential issues.

In conclusion, printable IRS Forms 1040 are essential for individuals to accurately report their income and determine their tax liability. By using these forms, taxpayers can ensure that they provide the IRS with all the necessary information in a clear and organized manner. It is important to take the time to fill out the form correctly and review all details to avoid any potential issues with the IRS.