Managing your taxes can be a daunting task, especially when it comes to withholding the right amount from your pension or annuity payments. The IRS Form W-4P is a crucial document that helps you determine how much federal income tax should be withheld from these payments. It is essential to fill out this form accurately to avoid any surprises when tax season rolls around.

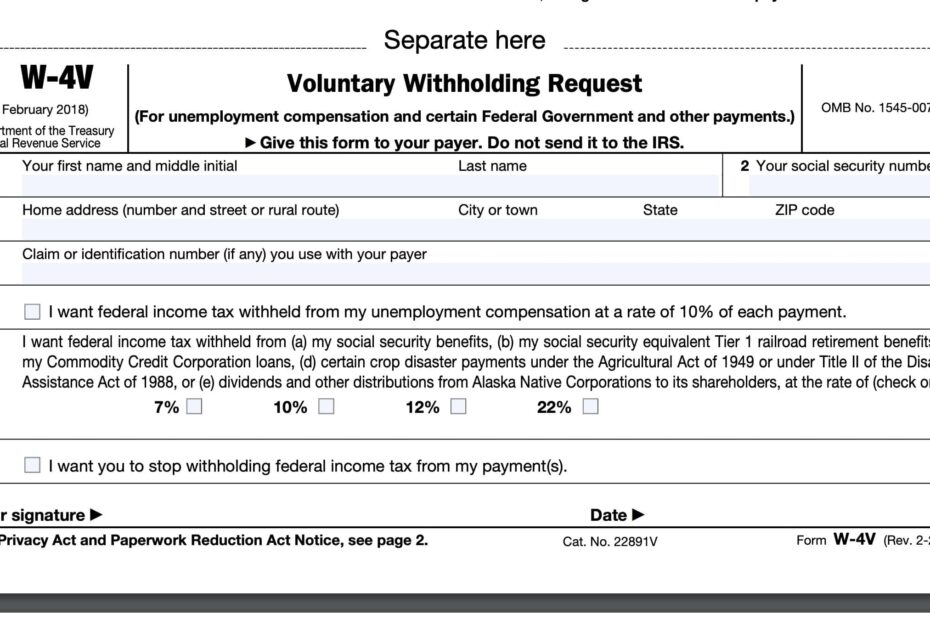

Printable IRS Form W-4P provides a standardized way for individuals to specify how much federal income tax they want withheld from their pension or annuity payments. By completing this form, you can ensure that the correct amount is deducted from your payments, preventing you from owing a large tax bill at the end of the year.

Quickly Access and Print Printable Irs Form W 4p

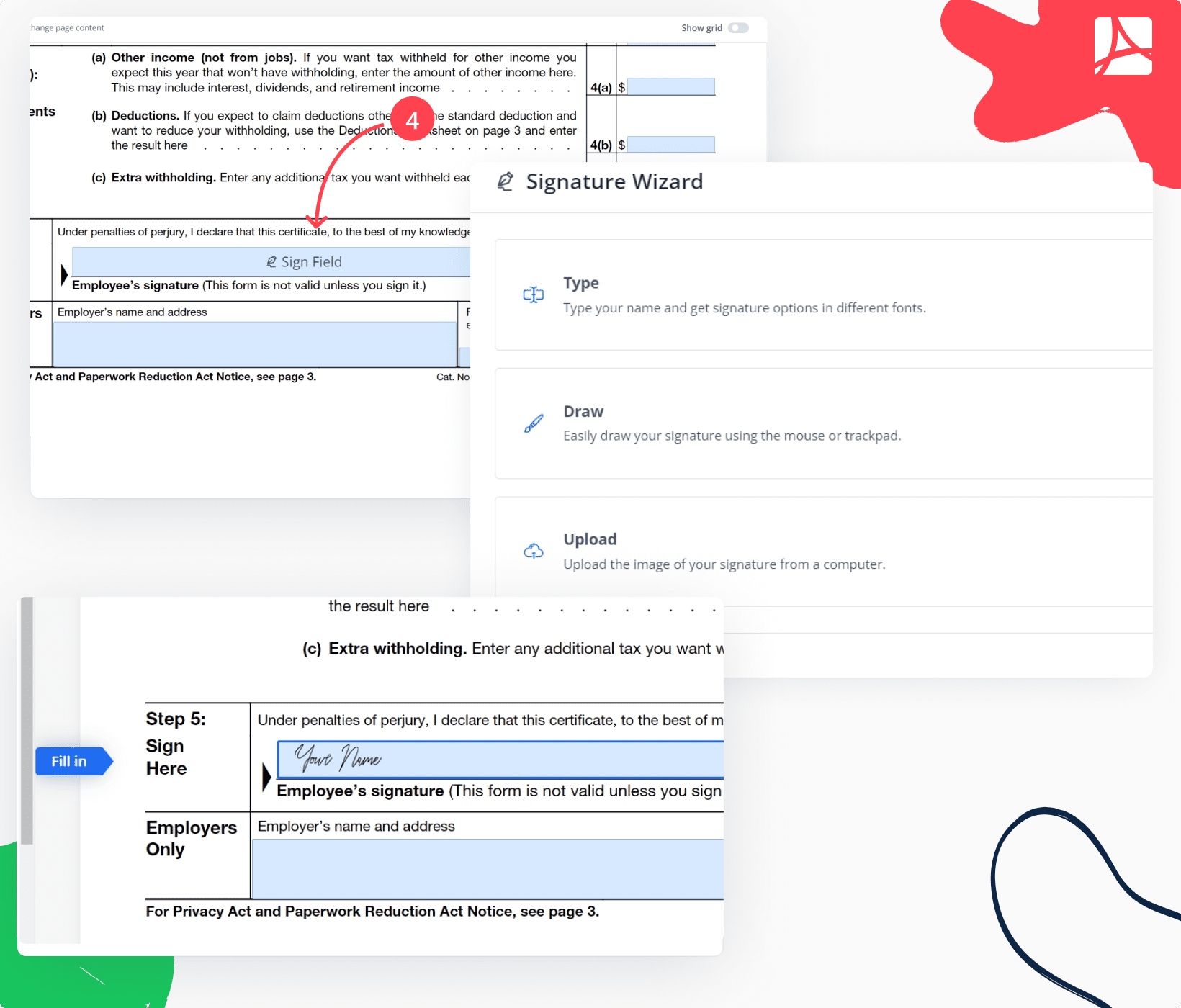

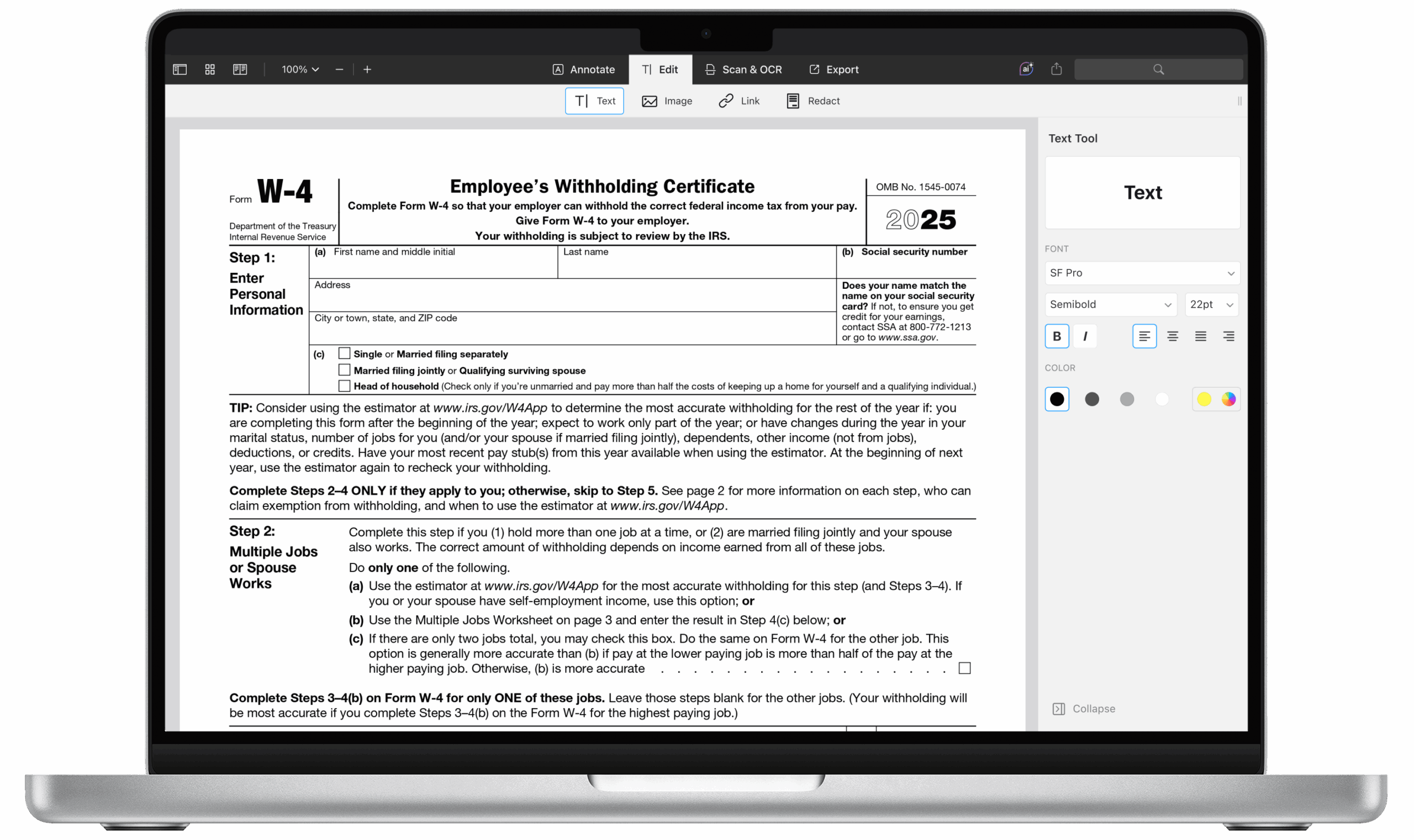

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

Printable IRS Form W-4P

When filling out the IRS Form W-4P, you will need to provide information such as your name, Social Security number, and the amount of tax you want withheld from each payment. You can choose to have a specific dollar amount withheld or a percentage of your payment. Additionally, you can indicate if you are exempt from withholding or if you want to claim additional withholding allowances.

It is important to review and update your W-4P form regularly, especially if there are any changes to your financial situation or tax laws. By staying on top of this form, you can ensure that the correct amount of tax is withheld from your payments throughout the year.

By using the Printable IRS Form W-4P, you can take control of your tax withholding and avoid any surprises come tax season. Make sure to consult with a tax professional if you have any questions or need assistance filling out the form accurately. With the right information and guidance, you can navigate the tax withholding process with ease.

Don’t wait until tax season to address your tax withholding needs. Download and fill out the Printable IRS Form W-4P today to ensure that you are withholding the correct amount from your pension or annuity payments. Taking proactive steps now can help you avoid any potential tax headaches down the road.