IRS Form Schedule A, also known as “Itemized Deductions,” is a form used by taxpayers to report their itemized deductions. This form is typically filed along with Form 1040 when filing taxes. Itemized deductions can include expenses such as medical and dental expenses, state and local taxes, mortgage interest, and charitable contributions.

For those who choose to itemize their deductions instead of taking the standard deduction, Form Schedule A is a crucial document. It allows taxpayers to report all of their eligible deductions in order to reduce their taxable income and potentially lower their tax liability. It is important to carefully review the instructions for Schedule A to ensure that all deductions are reported accurately.

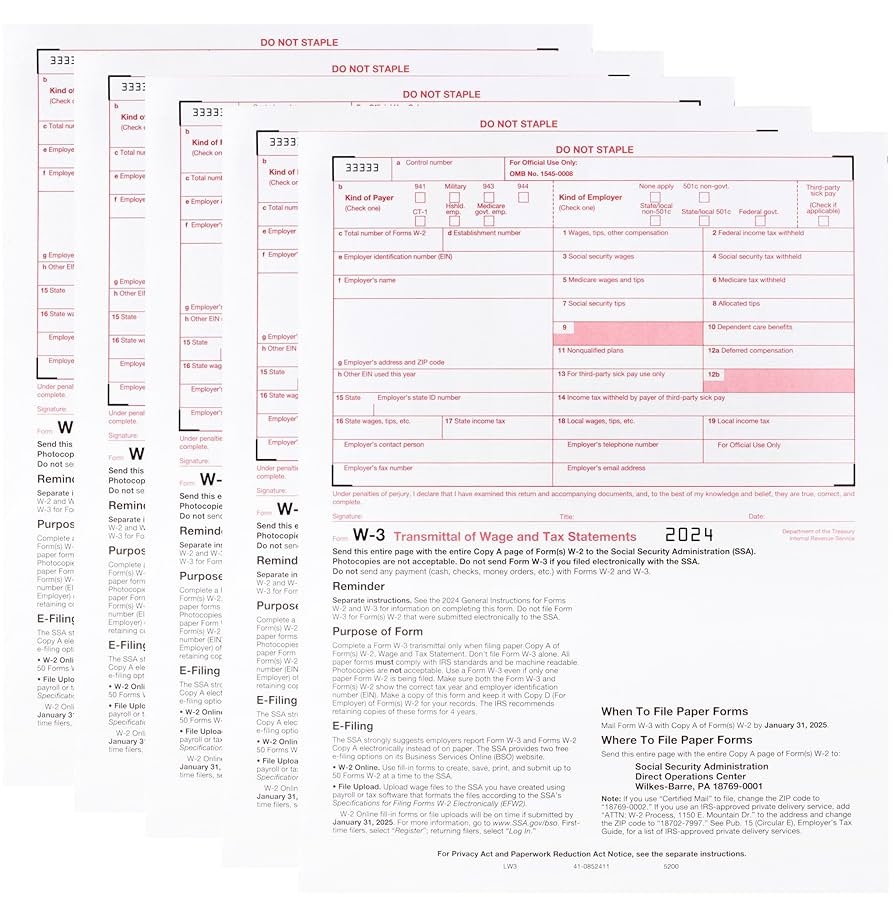

Quickly Access and Print Printable Irs Form Schedule A

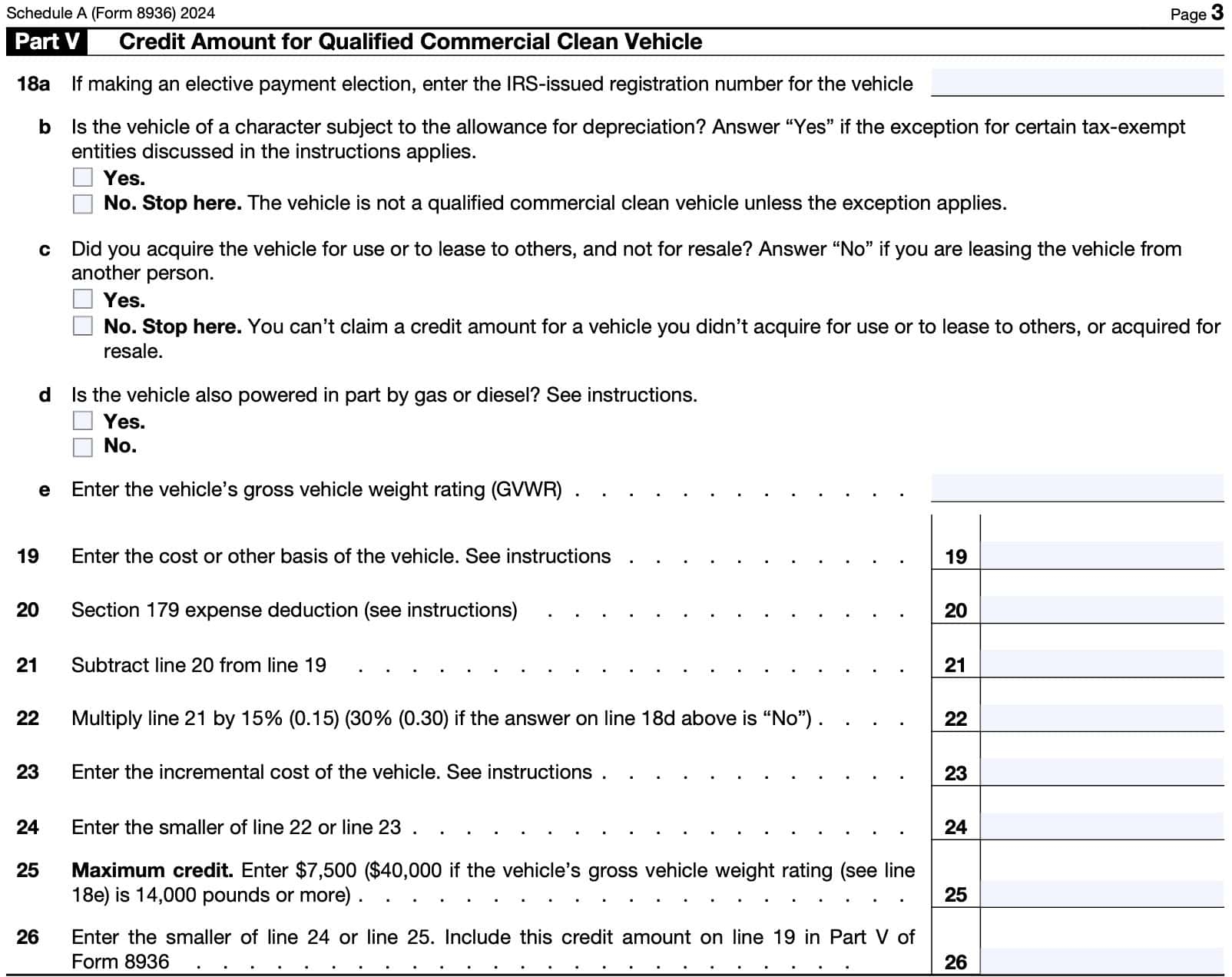

IRS Form 8936 Instructions Clean Vehicle Credits

IRS Form 8936 Instructions Clean Vehicle Credits

When filling out Form Schedule A, taxpayers will need to provide detailed information about each deduction they are claiming. This may include documentation such as receipts, invoices, or statements to support the deduction. It is important to keep accurate records of all expenses throughout the year in order to properly report them on Schedule A.

Common deductions that can be reported on Form Schedule A include medical and dental expenses that exceed a certain percentage of the taxpayer’s adjusted gross income, state and local income taxes or sales taxes, mortgage interest, and charitable contributions. These deductions can help taxpayers lower their taxable income and potentially reduce the amount of taxes owed.

It is important to note that not all taxpayers will benefit from itemizing their deductions. For some individuals, taking the standard deduction may result in a lower tax liability than itemizing. Taxpayers should carefully evaluate their financial situation and consult with a tax professional to determine the best approach for maximizing deductions and minimizing taxes.

In conclusion, IRS Form Schedule A is a valuable tool for taxpayers who choose to itemize their deductions. By accurately reporting all eligible deductions on Schedule A, taxpayers can potentially lower their taxable income and reduce their tax liability. It is important to keep detailed records of expenses throughout the year and consult with a tax professional if needed to ensure that deductions are reported correctly.

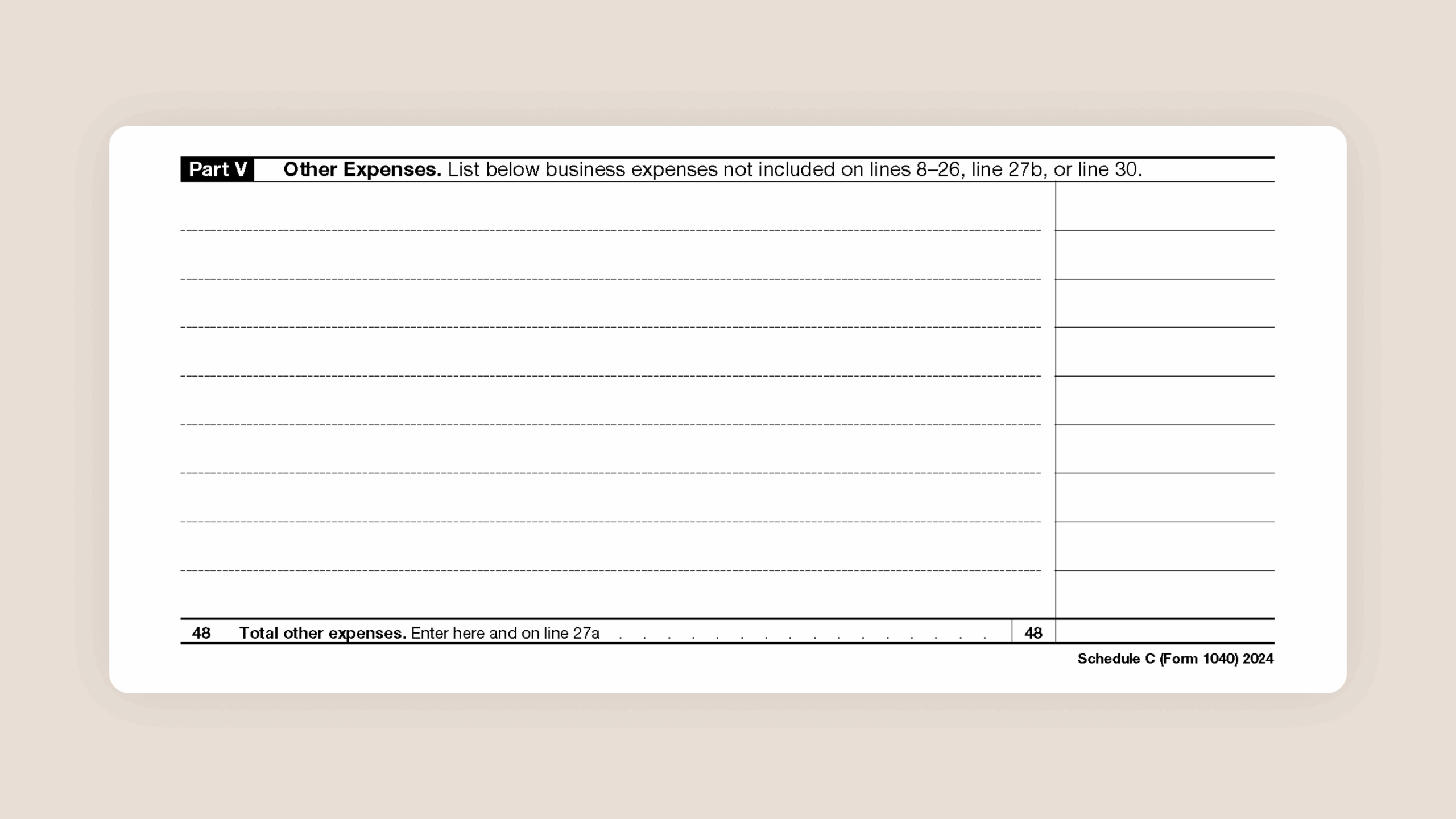

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

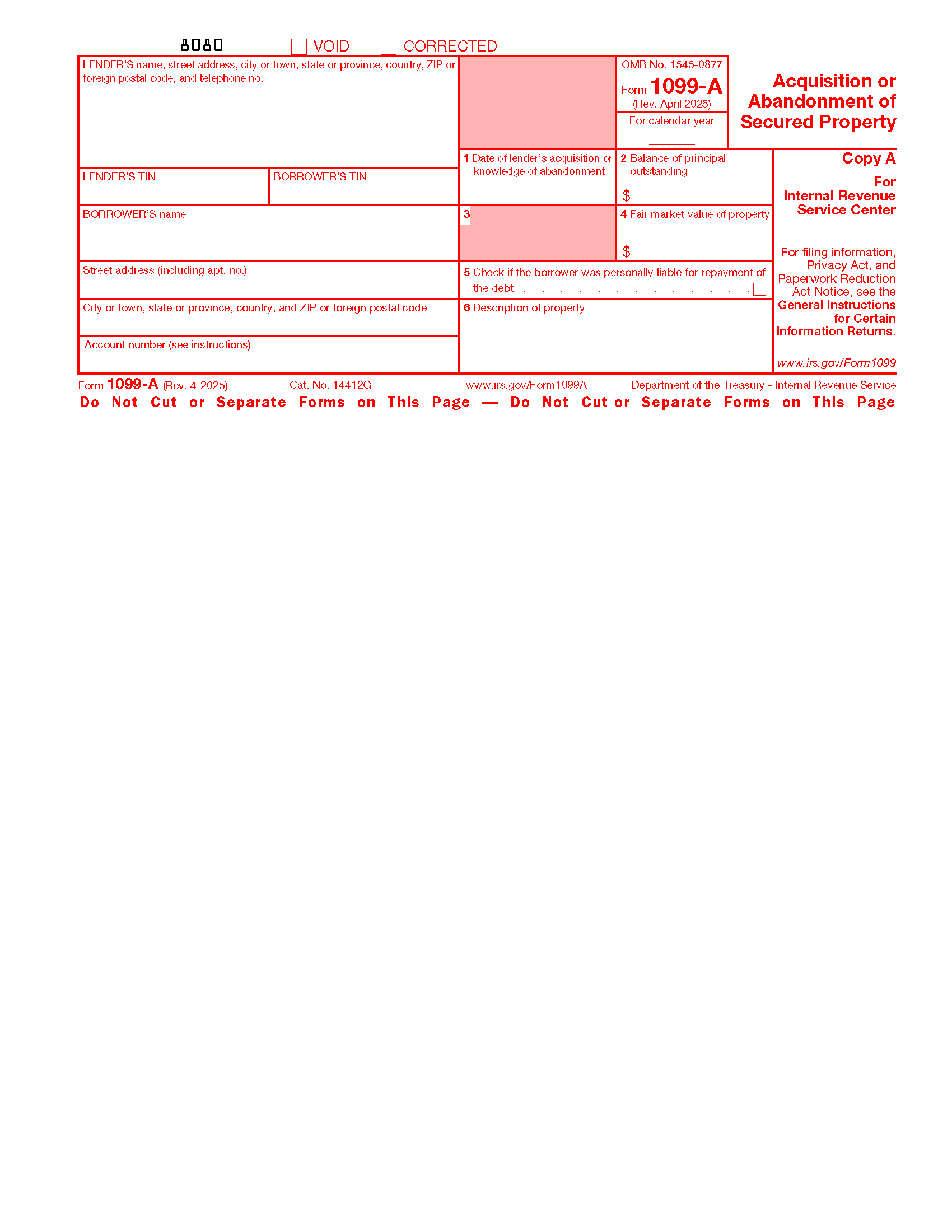

Free IRS Form 1099 A PDF EForms

Free IRS Form 1099 A PDF EForms

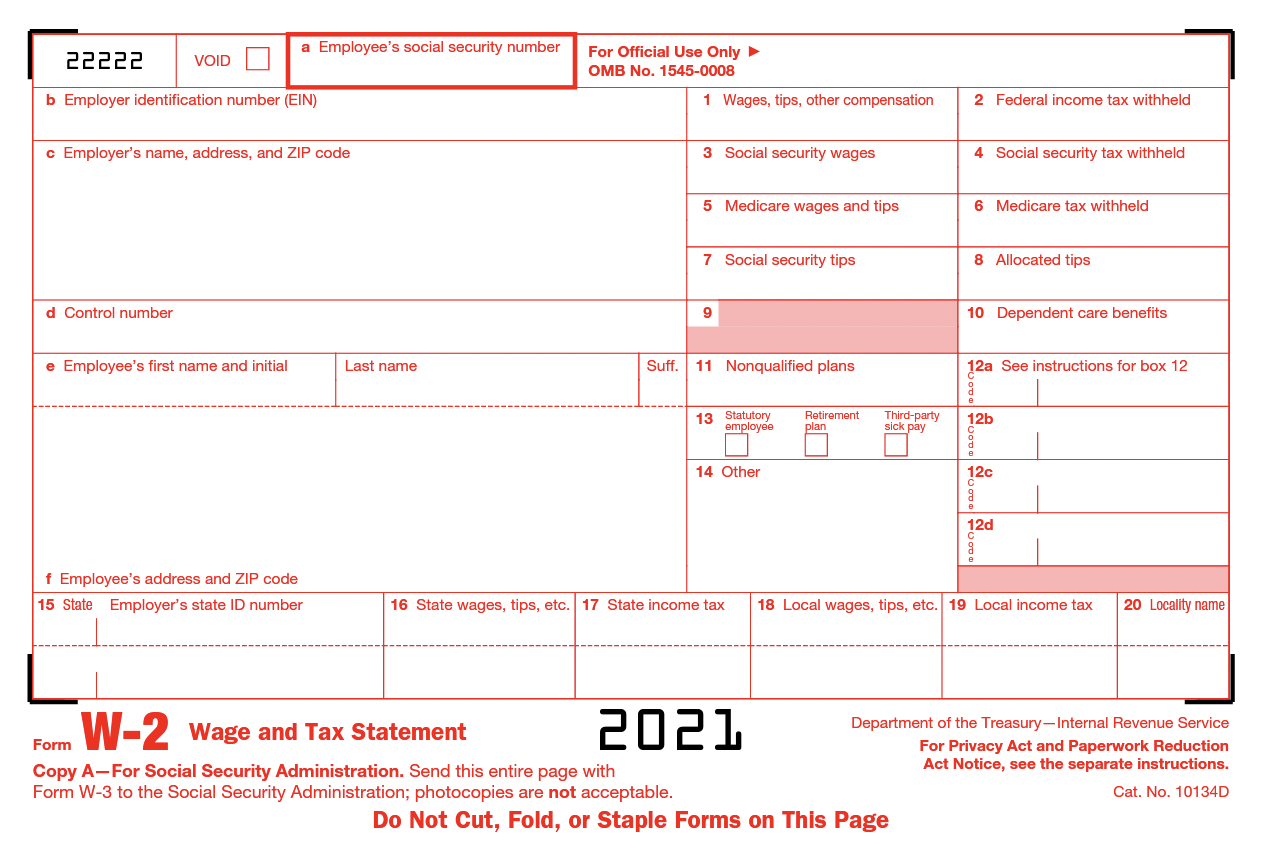

Most Commonly Requested Tax Forms Tuition ASU

Most Commonly Requested Tax Forms Tuition ASU

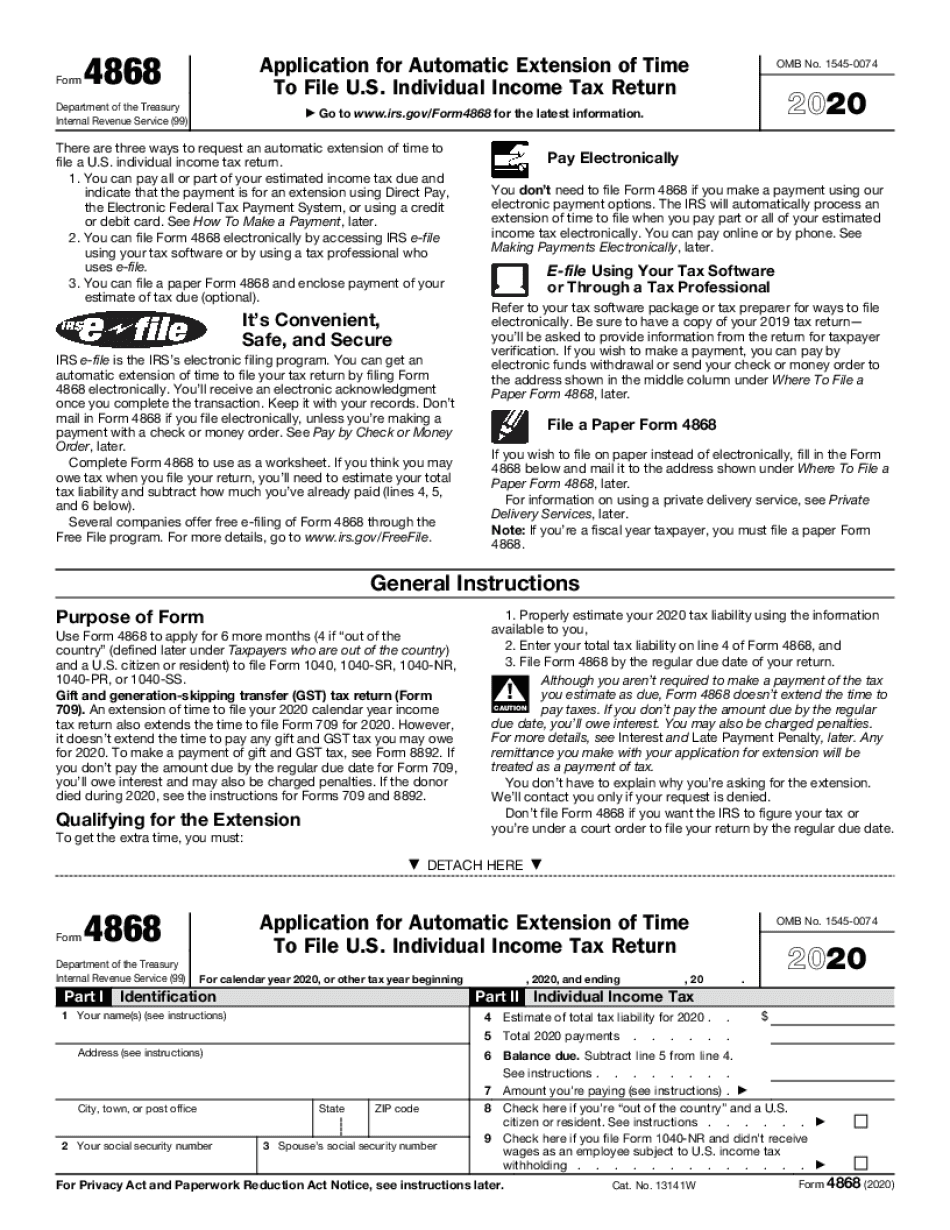

Irs Tax Extension Form Printable Printable Party Favors

Irs Tax Extension Form Printable Printable Party Favors

Searching for a stress-free way to manage your financial needs? Our Printable Irs Form Schedule A offer a simple, safe, and customizable solution from the comfort of your home. Whether for your own needs, small businesses, or budgeting, Printable Irs Form Schedule A help you save both time and cash without lowering security. Supports popular bookkeeping tools and easy to print, they’re a wise alternative to pre-ordered checks. Begin printing now and fully manage your check issuing—no delays, zero charges. Explore our ready-to-use templates and choose the one that matches your purpose. With our beginner-friendly features, financial management has never been this convenient. Access your free printable checks and streamline your check-writing process with ease!.