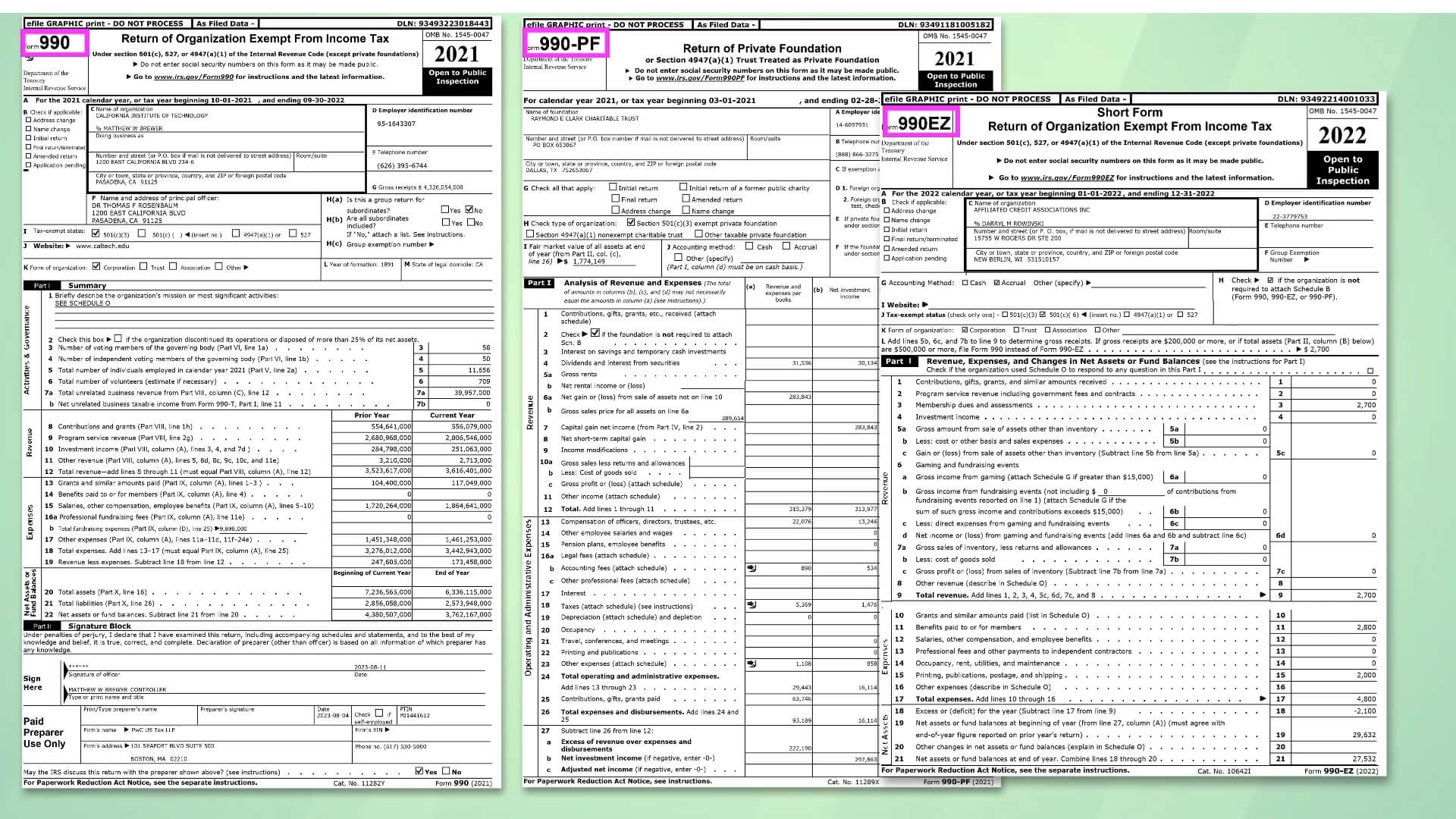

When it comes to filing taxes for non-profit organizations, IRS Form 990 is a crucial document that must be completed accurately and submitted on time. This form provides information about the organization’s mission, programs, and finances, which is then made available to the public. It is important for non-profits to ensure that they are in compliance with IRS regulations and that they are transparent about their activities and finances.

For many non-profit organizations, the process of completing IRS Form 990 can be daunting. However, having a printable version of the form can make the task much easier. Being able to fill out the form electronically or by hand allows organizations to gather all the necessary information and review it before submitting it to the IRS. This can help prevent errors and ensure that the form is completed accurately.

Save and Print Printable Irs Form 990

IRS Database Of Exempt Organizations TaxLifeFinances

IRS Database Of Exempt Organizations TaxLifeFinances

Printable IRS Form 990

Printable IRS Form 990 is available on the IRS website and can be easily accessed and downloaded. This form is used by tax-exempt organizations to provide information about their activities, governance, and finances. It is important for non-profits to take the time to carefully fill out this form, as any mistakes or omissions can result in penalties or even loss of tax-exempt status.

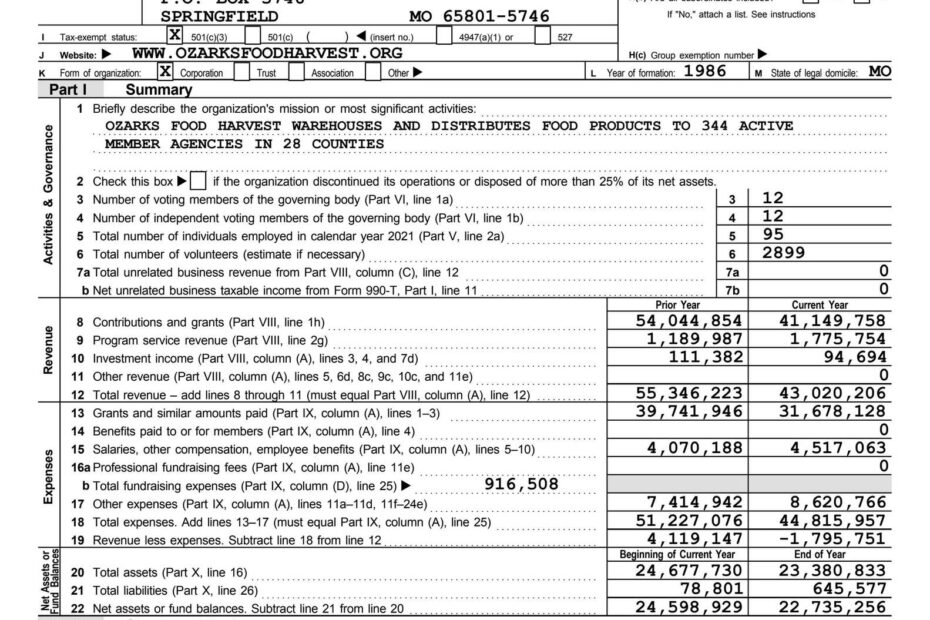

When filling out IRS Form 990, organizations must provide details about their revenue, expenses, assets, and liabilities. They must also disclose information about their board members, key employees, and compensation practices. This information helps the IRS and the public understand how the organization is operated and how its funds are being used to further its mission.

Printable IRS Form 990 is designed to be user-friendly, with clear instructions and guidance on how to complete each section. Organizations can also seek assistance from tax professionals or accountants to ensure that the form is filled out accurately and completely. By taking the time to review their financial records and gather all necessary information, non-profits can make the process of completing IRS Form 990 much smoother.

In conclusion, printable IRS Form 990 is a valuable tool for non-profit organizations to report their activities and finances to the IRS and the public. By ensuring that this form is completed accurately and on time, organizations can maintain their tax-exempt status and demonstrate transparency and accountability to their donors and stakeholders.