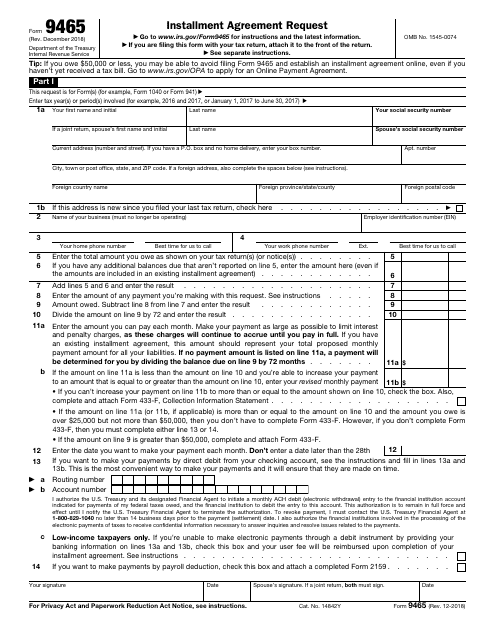

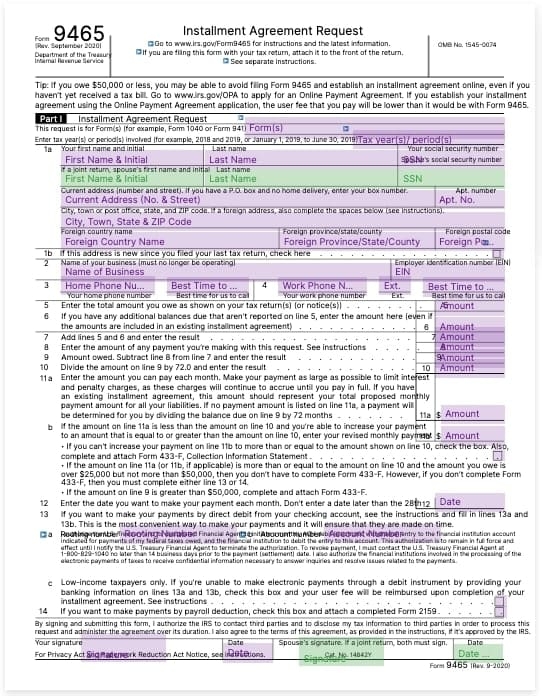

When it comes to filing taxes, many individuals find themselves in a situation where they owe more money than they can comfortably pay in one lump sum. In these cases, the IRS offers the option to set up a payment plan to help ease the financial burden. Form 9465, also known as the Installment Agreement Request, is the tool that taxpayers can use to request a payment plan with the IRS.

Printable IRS Form 9465 is readily available online, making it easy for taxpayers to access and complete the form from the comfort of their own homes. This convenient option allows individuals to take the necessary steps to set up a payment plan without the need to visit an IRS office or wait for forms to arrive in the mail.

Get and Print Printable Irs Form 9465

Form 9465 Fill Out And Sign Printable PDF Template SignNow

Form 9465 Fill Out And Sign Printable PDF Template SignNow

When filling out Form 9465, taxpayers will need to provide information about their financial situation, including their total tax liability, monthly income, and expenses. This information will help the IRS determine the appropriate payment plan for the individual based on their ability to pay.

It is important for taxpayers to carefully review the terms of the payment plan outlined in Form 9465, including the amount of the monthly payments and the duration of the plan. Once the form is completed, it should be submitted to the IRS along with any required documentation to request approval for the installment agreement.

Printable IRS Form 9465 provides a convenient solution for individuals who are unable to pay their tax bill in full. By taking advantage of this option, taxpayers can work with the IRS to establish a manageable payment plan that fits their financial situation. With the ease of access to the form online, setting up an installment agreement has never been simpler.

In conclusion, Printable IRS Form 9465 offers a practical and straightforward way for taxpayers to request a payment plan with the IRS. By providing all the necessary information and submitting the form in a timely manner, individuals can take control of their tax obligations and avoid the stress of dealing with a large tax bill. Utilizing this form is a proactive step towards resolving tax debt and achieving financial peace of mind.