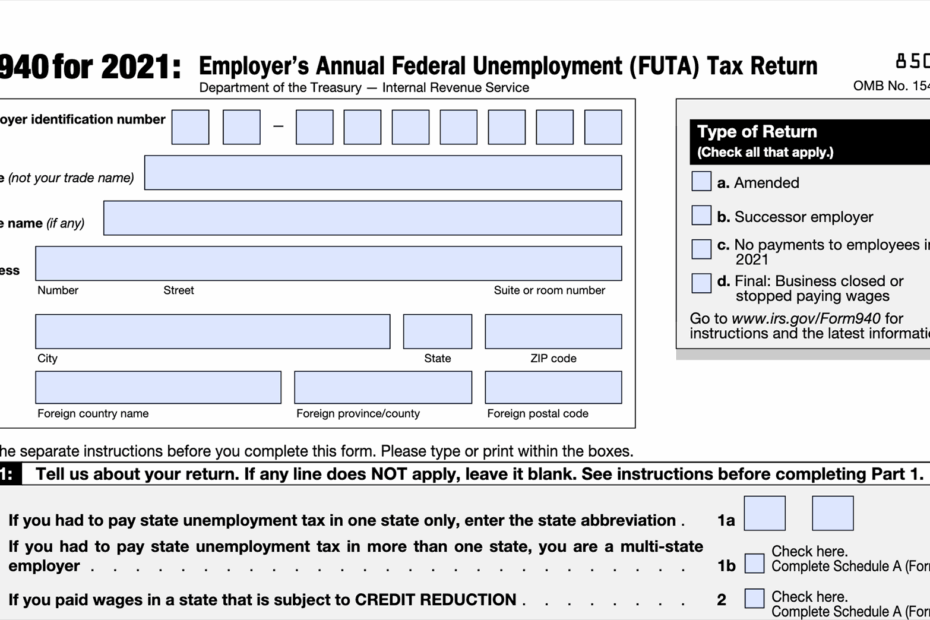

When it comes to filing taxes, there are many forms that need to be filled out and submitted to the Internal Revenue Service (IRS). One such form is Form 940, which is used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax. This form is crucial for businesses to ensure they are in compliance with federal tax laws.

Preparing your Form 940 can be a daunting task, but with the availability of printable IRS Form 940, the process becomes much simpler. These printable forms can be easily accessed online and filled out electronically or printed and completed by hand.

Quickly Access and Print Printable Irs Form 940

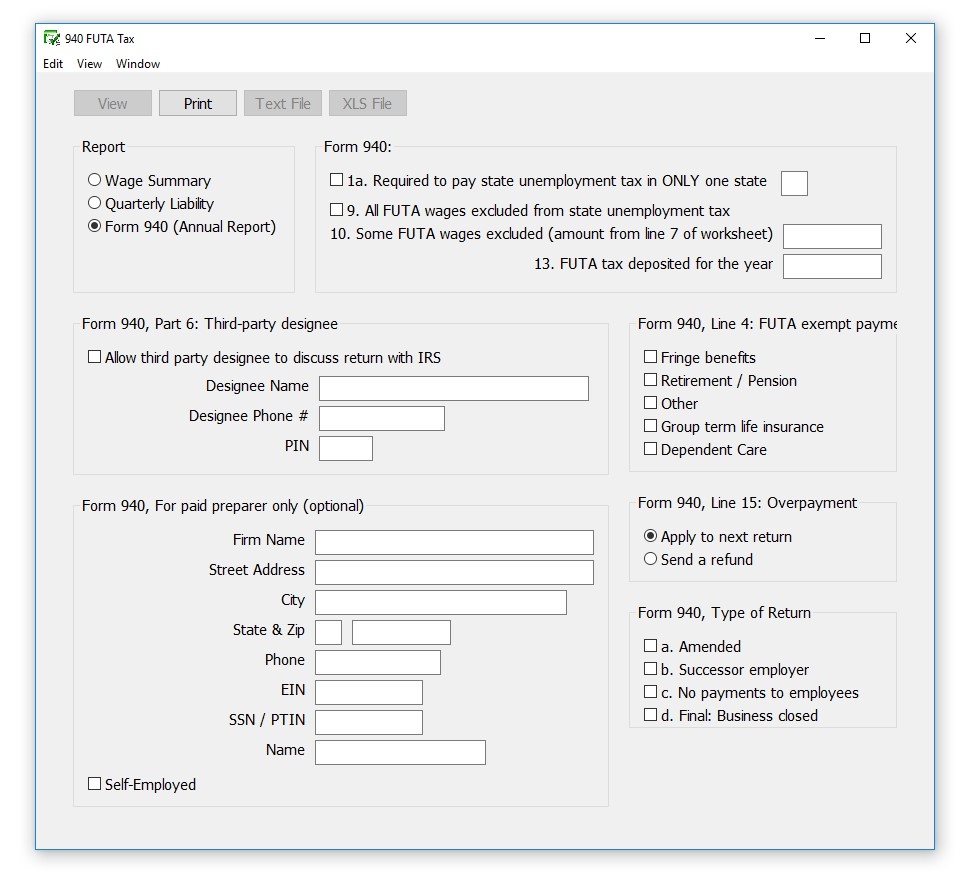

How To Create 940 Reports In CheckMark Payroll Software

How To Create 940 Reports In CheckMark Payroll Software

Printable IRS Form 940

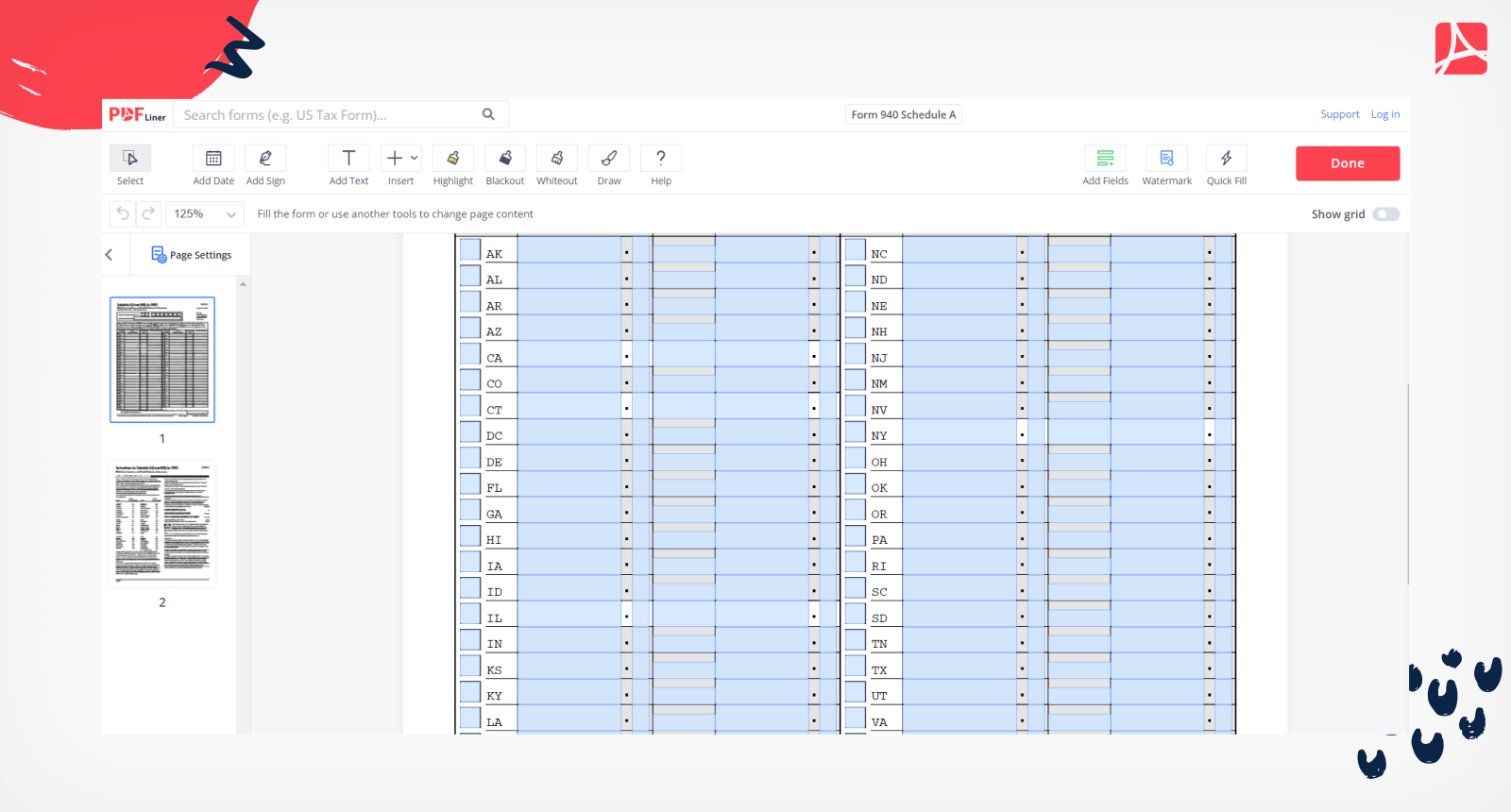

Form 940 is used by employers to report their annual FUTA tax liability, which helps fund unemployment benefits for workers who have lost their jobs. The form requires information such as total wages paid to employees, FUTA tax owed, and any adjustments or credits that may apply.

When using a printable IRS Form 940, it is important to ensure that all information is accurate and up to date. Any errors or omissions could result in penalties or delays in processing your tax return. It is recommended to double-check all calculations and review the form before submitting it to the IRS.

Once you have completed your Form 940, you can either file it electronically through the IRS website or mail it to the appropriate address. The deadline for filing Form 940 is January 31st of the following year, so it is important to submit your form on time to avoid any penalties.

In conclusion, printable IRS Form 940 is a convenient and efficient way for employers to report their FUTA tax liability. By using these printable forms, businesses can ensure they are in compliance with federal tax laws and avoid any potential penalties. Remember to file your Form 940 by the deadline and double-check all information to ensure accuracy.