As tax season approaches, it’s important to stay organized and ensure that you have all the necessary forms to file your taxes accurately. One crucial form that you may need is IRS Form 915, also known as the “Qualified Business Income Deduction Simplified Computation” form. This form is used to calculate the deduction for qualified business income for individuals, estates, and trusts.

Understanding and completing IRS Form 915 can be daunting, but having a printable version of the form can make the process much easier. With a printable IRS Form 915, you can fill out the form at your own pace and have a clear record of your calculations for your records.

Quickly Access and Print Printable Irs Form 915

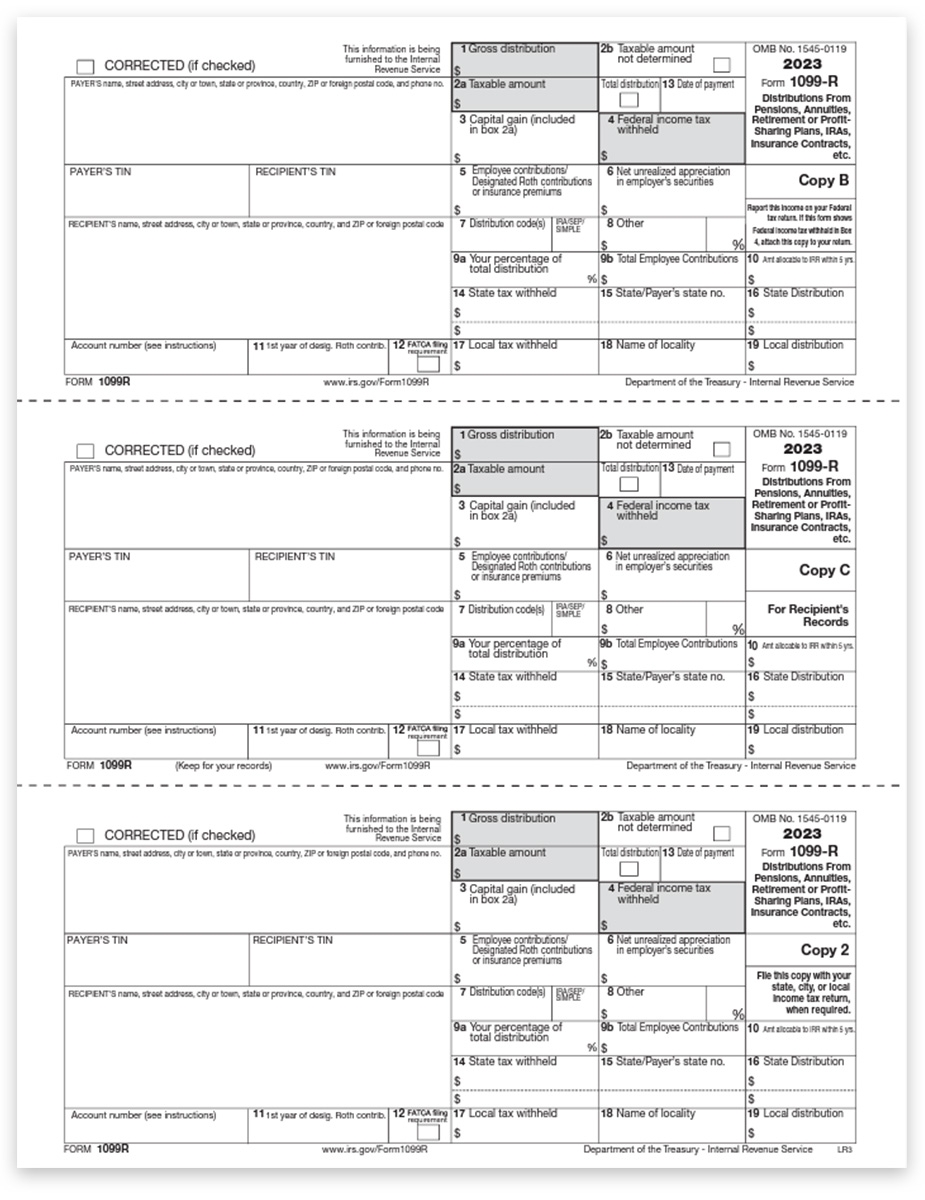

1099 Nec Form 1099MISC Blank 3up Perf Paper W Instructions Using Dos Copy B Command

1099 Nec Form 1099MISC Blank 3up Perf Paper W Instructions Using Dos Copy B Command

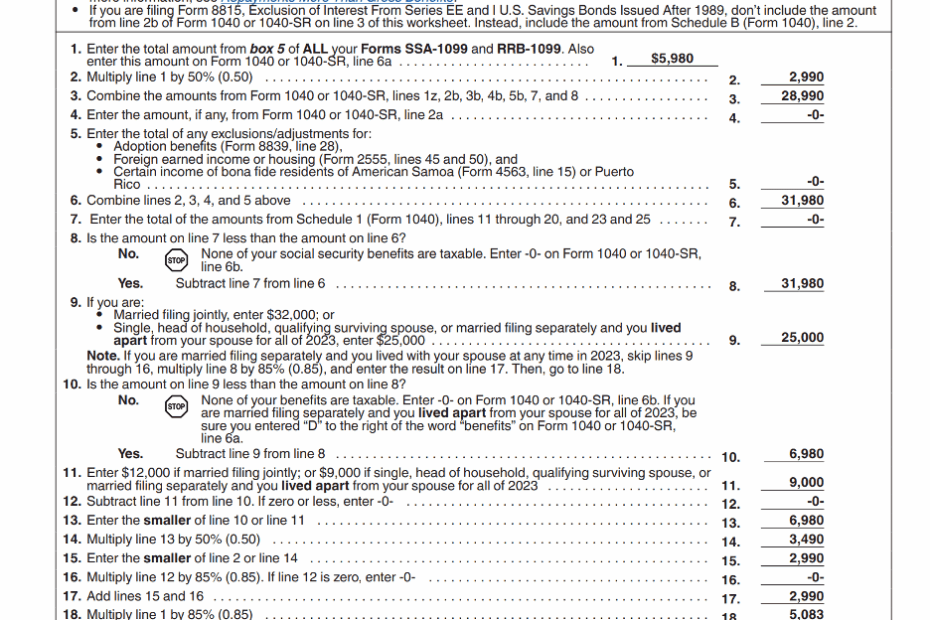

Printable IRS Form 915

IRS Form 915 is a one-page form that requires you to enter specific information about your qualified business income, deductions, and taxable income. The form includes instructions on how to calculate the deduction and provides a worksheet to help you determine the correct amount to claim. Having a printable version of the form allows you to work through each section methodically and double-check your calculations before submitting your tax return.

When filling out IRS Form 915, it’s important to gather all the necessary documentation, such as income statements, expense records, and any other relevant information. By having a printable version of the form, you can easily reference the instructions and input the required data accurately.

Once you have completed IRS Form 915, be sure to review it carefully to ensure that all information is accurate and that you have claimed the correct deduction amount. You can then submit the form along with your tax return to claim the qualified business income deduction and potentially reduce your taxable income.

In conclusion, having a printable version of IRS Form 915 can simplify the process of calculating the qualified business income deduction and ensure that you accurately report your income on your tax return. By carefully completing the form and reviewing your calculations, you can take advantage of this valuable deduction and potentially save money on your taxes.