Are you looking for a convenient way to report your capital gains and losses to the IRS? Look no further than Printable IRS Form 8949. This form is used to report sales and exchanges of capital assets, such as stocks, bonds, and real estate, to the IRS. By accurately filling out this form, you can ensure that you are complying with tax laws and accurately reporting your financial transactions.

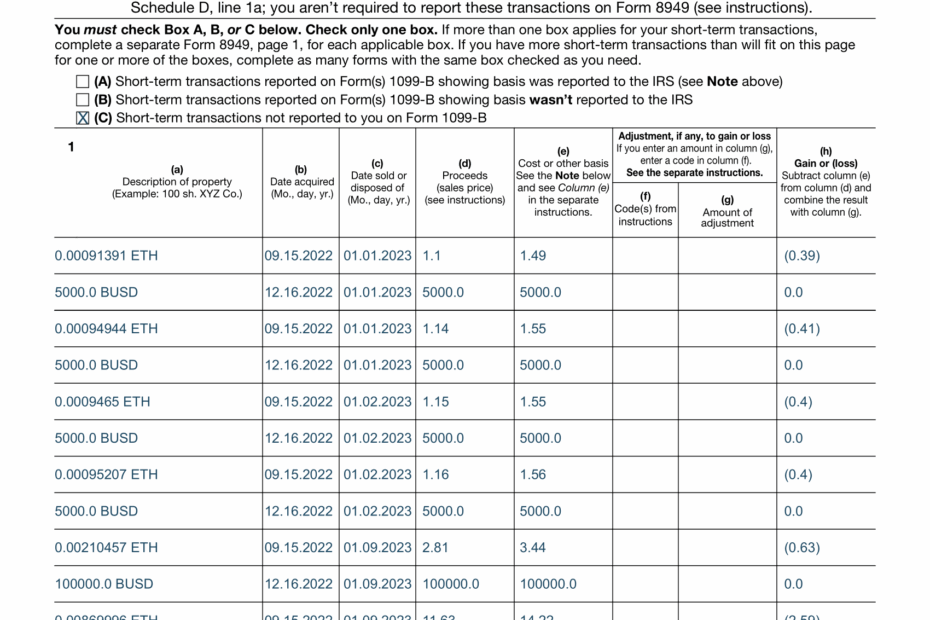

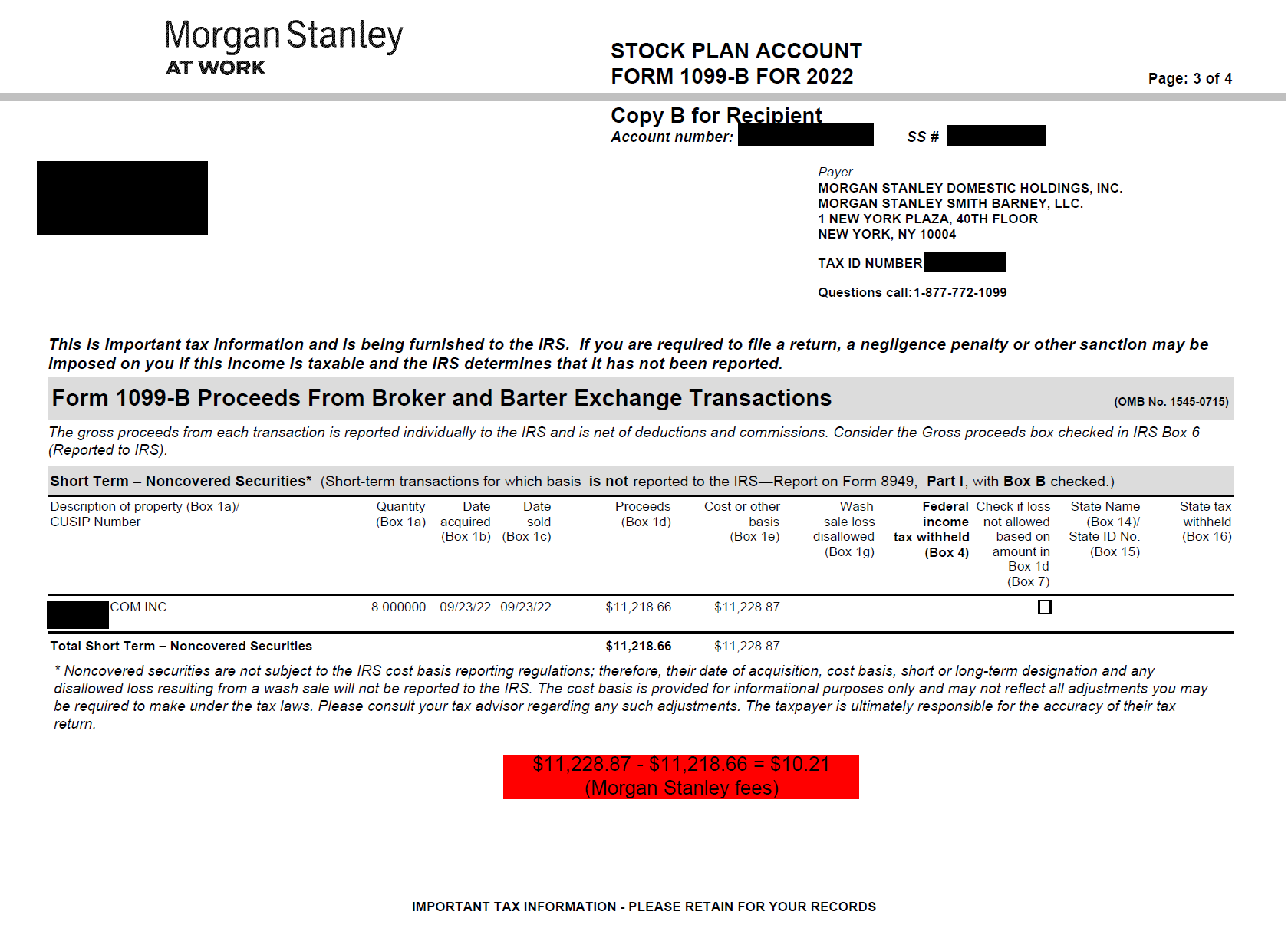

Printable IRS Form 8949 is a crucial document for taxpayers who have engaged in the sale or exchange of capital assets during the tax year. The form is used to detail each individual transaction, including the date of the sale, the amount of the proceeds, the cost basis, and the resulting gain or loss. By accurately completing this form, taxpayers can calculate their total capital gains or losses to report on their tax return.

Easily Download and Print Printable Irs Form 8949

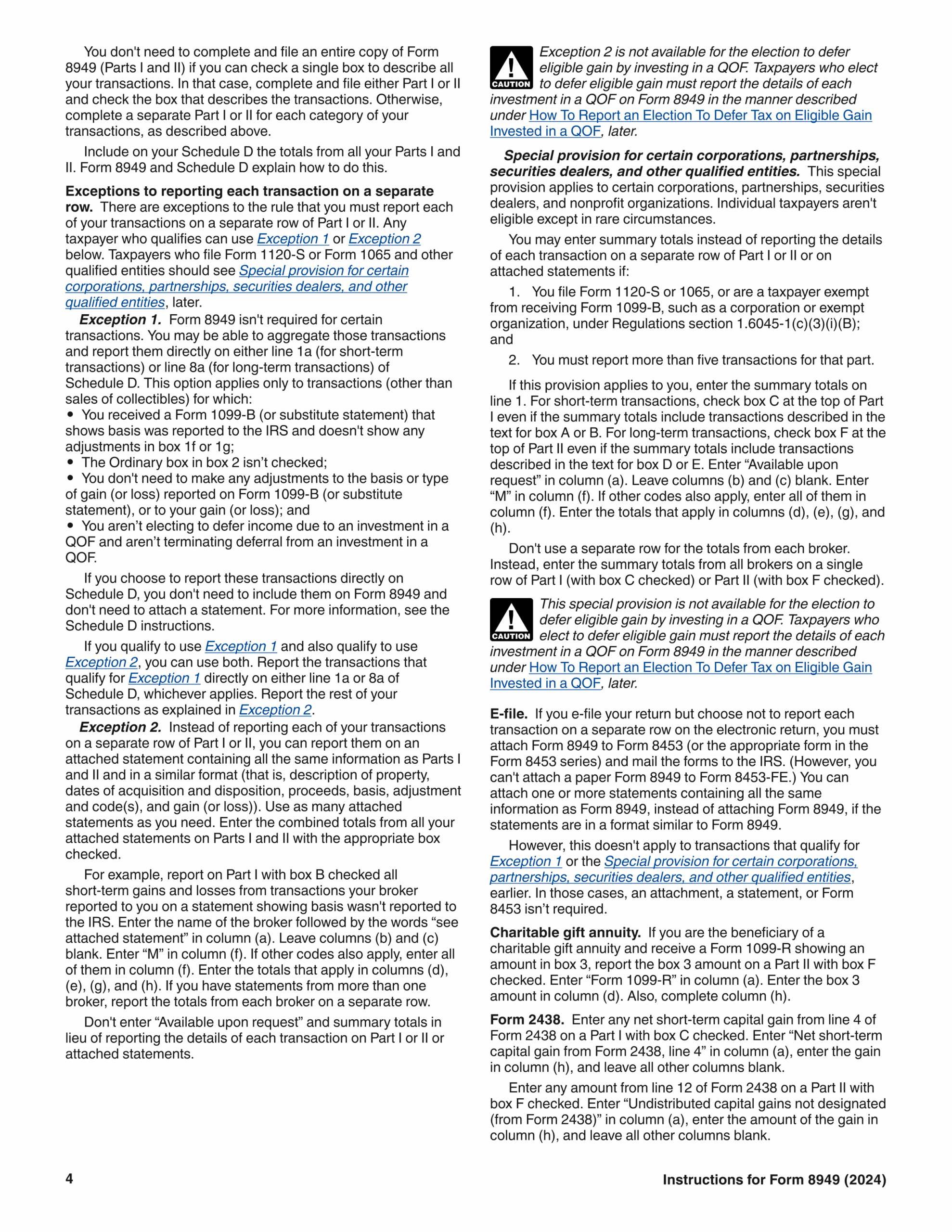

When filling out Printable IRS Form 8949, taxpayers must ensure that they provide all necessary information for each transaction. This includes the description of the property, the date acquired, the date sold, the proceeds, the cost basis, and the resulting gain or loss. Additionally, taxpayers must indicate whether the transaction is short-term or long-term, as this will impact the tax rate applied to the gain or loss.

It is important to note that Printable IRS Form 8949 must be accompanied by Schedule D when reporting capital gains and losses on your tax return. Schedule D is used to summarize the information provided on Form 8949 and calculate the total gain or loss to report on your tax return. By accurately completing both forms, taxpayers can ensure that they are reporting their capital gains and losses correctly to the IRS.

In conclusion, Printable IRS Form 8949 is an essential document for taxpayers who have engaged in the sale or exchange of capital assets. By accurately completing this form and accompanying Schedule D, taxpayers can ensure that they are complying with tax laws and accurately reporting their financial transactions to the IRS. Make sure to download and fill out this form to avoid any potential issues with the IRS.