When it comes to filing taxes, it’s important to be thorough and accurate in order to avoid any potential issues with the IRS. One form that may be necessary for some taxpayers to fill out is Form 8862. This form is used to claim the Earned Income Credit (EIC) after it has been previously disallowed by the IRS. It is essential to understand the requirements and guidelines for using this form to ensure that you receive the proper tax credits.

Form 8862 is specifically designed for individuals who have had their EIC denied in the past and are now eligible to claim it again. In order to use this form, you must meet certain criteria set forth by the IRS. This includes providing accurate information about your income, filing status, and any dependents you may have. It’s important to carefully review the instructions for Form 8862 to ensure that you are eligible to claim the EIC.

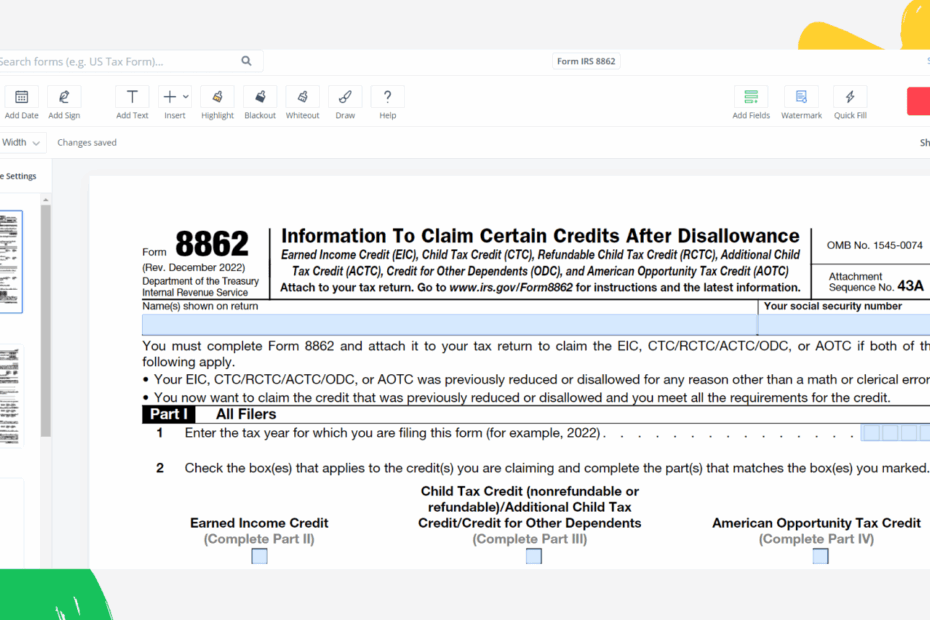

Easily Download and Print Printable Irs Form 8862

Filing Tax Form 8862 Information To Claim Earned Income Credit After Disallowance TurboTax Tax Tips U0026 Videos

Filing Tax Form 8862 Information To Claim Earned Income Credit After Disallowance TurboTax Tax Tips U0026 Videos

When filling out Form 8862, you will need to provide detailed information about your income, expenses, and any credits or deductions you are claiming. It’s crucial to double-check your entries and ensure that all information is accurate to avoid any potential issues with the IRS. Once you have completed the form, you can submit it along with your tax return to claim the EIC.

It’s important to note that Form 8862 must be filed each year that you are claiming the EIC after it has been disallowed in the past. Failure to do so could result in your credit being denied once again. By staying organized and keeping track of your tax documents, you can ensure that you are completing Form 8862 correctly and maximizing your tax credits.

Overall, Form 8862 is a valuable tool for individuals who are eligible to claim the EIC after it has been previously denied. By understanding the requirements and guidelines for using this form, you can avoid any potential issues with the IRS and ensure that you receive the proper tax credits. Be sure to consult with a tax professional if you have any questions about completing Form 8862 or claiming the EIC.

In conclusion, Form 8862 is an important document for individuals who are looking to claim the Earned Income Credit after it has been disallowed in the past. By following the guidelines and providing accurate information, you can successfully claim the EIC and maximize your tax credits. Make sure to stay informed and up to date on the latest tax regulations to ensure a smooth tax filing process.

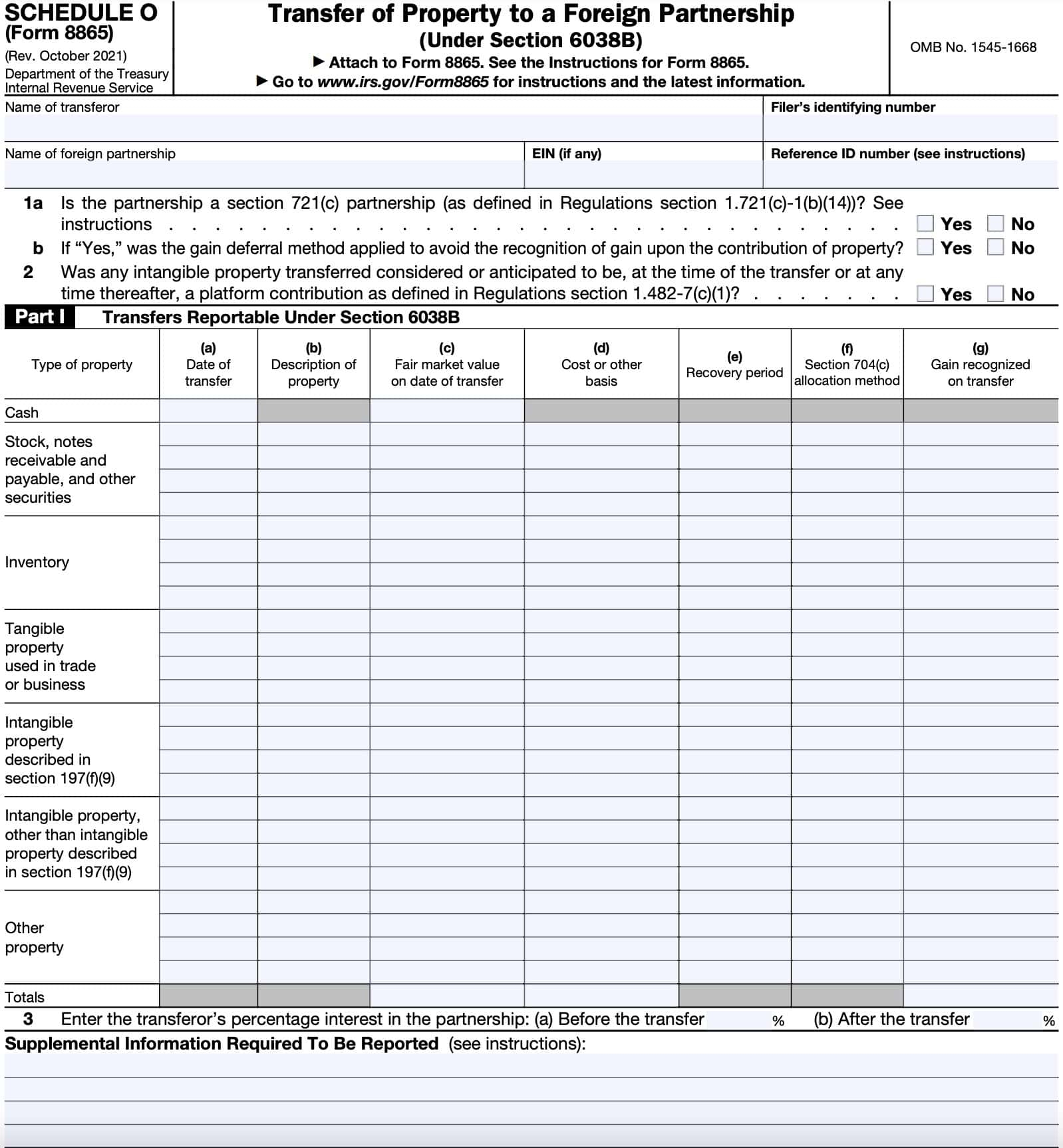

IRS Form 8865 Instructions Foreign Partnership Returns

IRS Form 8865 Instructions Foreign Partnership Returns

8862 Form 2024 2025 How To Fill Out Correctly PDF Guru

8862 Form 2024 2025 How To Fill Out Correctly PDF Guru

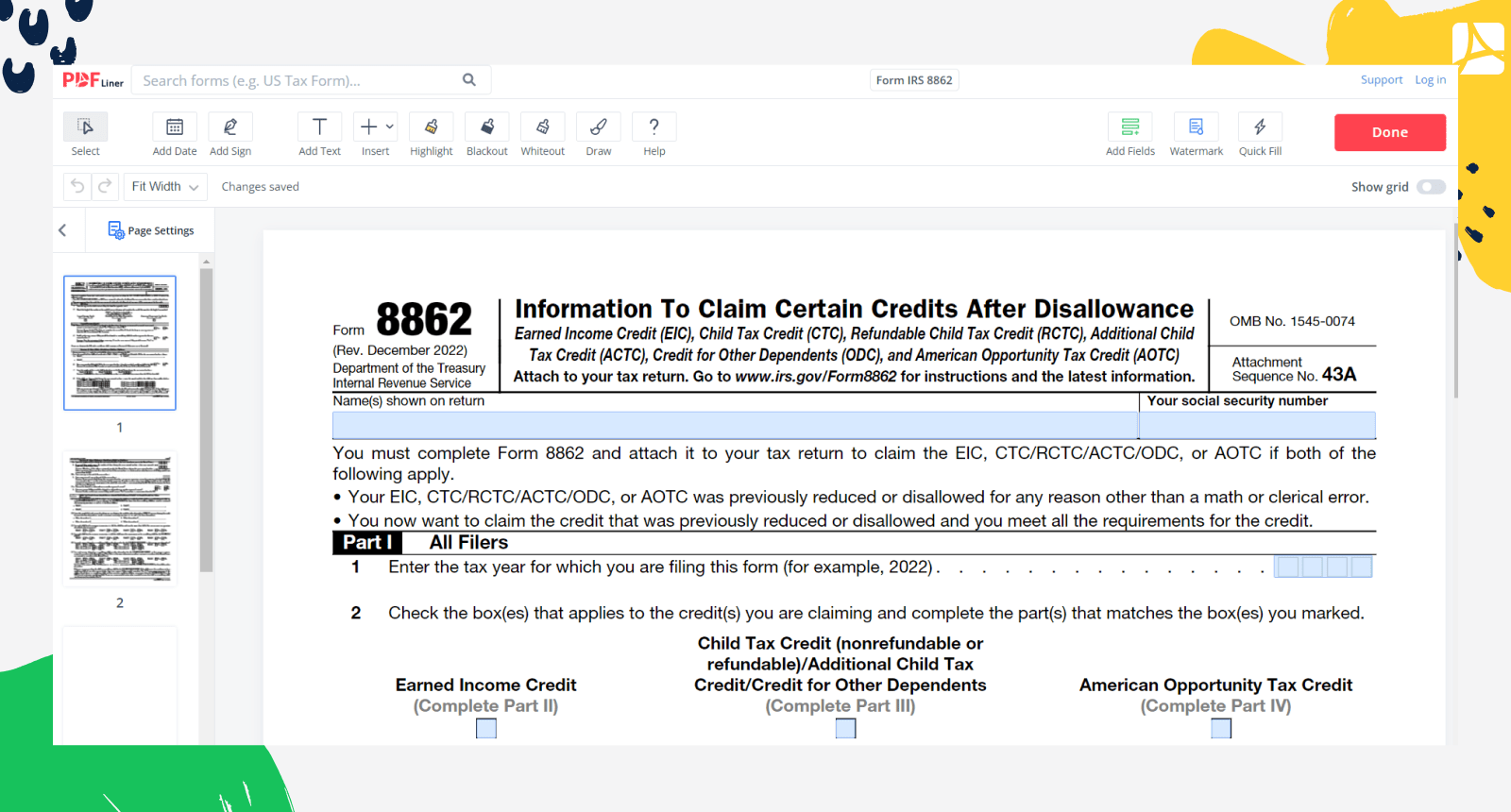

8862 Form Reclaiming The Earned Income Credit PdfFiller Blog

8862 Form Reclaiming The Earned Income Credit PdfFiller Blog

Form IRS 8862 Printable And Fillable Forms Online PDFliner

Form IRS 8862 Printable And Fillable Forms Online PDFliner

Looking for a simple way to take care of your financial needs? These free printable checks give you a straightforward, secure, and customizable alternative from the comfort of your home. Be it for your own needs, small businesses, or financial planning, these printable checks help you save money and effort without lowering professionalism. Compatible with popular bookkeeping tools and print-ready by design, they’re a wise choice to store-bought checks. Print your own today and take full control of your financial transactions—no delays, completely free. Explore our free templates and choose the one that matches your purpose. With our intuitive interface, managing your finances has never been this convenient. Get your Printable Irs Form 8862 and simplify your check-writing process with security!.