When you move to a new address, it is important to notify the IRS so they can update their records accordingly. This can be done by filling out IRS Form 8822 B, which is specifically used to report a change of address for businesses. Failure to update your address with the IRS can result in delays in receiving important correspondence, such as tax refunds or notices.

By completing and submitting Form 8822 B, you ensure that the IRS has your most current contact information on file. This helps to avoid any potential issues with communication and ensures that you receive any important tax-related documents in a timely manner. It is a simple and straightforward process that can save you a lot of hassle in the long run.

Quickly Access and Print Printable Irs Form 8822 B

IRS Form 8822 Change Of Address Lies On Flat Lay Office Table And Ready To Fill U S Internal Revenue Services Paperwork Concept Time To Pay Taxes In United States Top View Stock

IRS Form 8822 Change Of Address Lies On Flat Lay Office Table And Ready To Fill U S Internal Revenue Services Paperwork Concept Time To Pay Taxes In United States Top View Stock

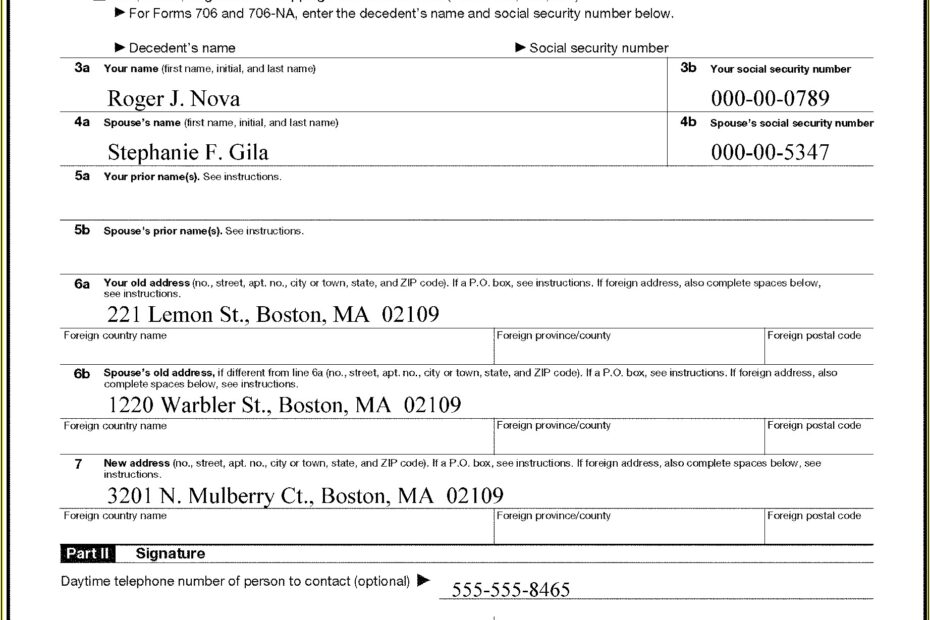

Printable IRS Form 8822 B

Form 8822 B is available for download on the IRS website and can be easily filled out electronically or printed and completed by hand. The form requires basic information such as your old address, new address, employer identification number (EIN), and the date of the change. Once completed, the form can be mailed to the IRS at the address provided on the form.

It is important to note that Form 8822 B is only for businesses. If you are an individual taxpayer looking to update your address, you will need to fill out a different form, such as Form 8822 for individuals. It is crucial to use the correct form to ensure that your information is updated accurately in the IRS system.

Failure to update your address with the IRS can lead to missed communications, penalties, and other issues that could have been easily avoided. Taking the time to fill out Form 8822 B when you have a change of address for your business is a simple and effective way to stay on top of your tax obligations and ensure that you receive important correspondence from the IRS.

In conclusion, filling out IRS Form 8822 B is a necessary step when you have a change of address for your business. By keeping your contact information up to date with the IRS, you can avoid potential issues and ensure that you receive important tax-related documents in a timely manner. It is a small effort that can make a big difference in your overall tax compliance.