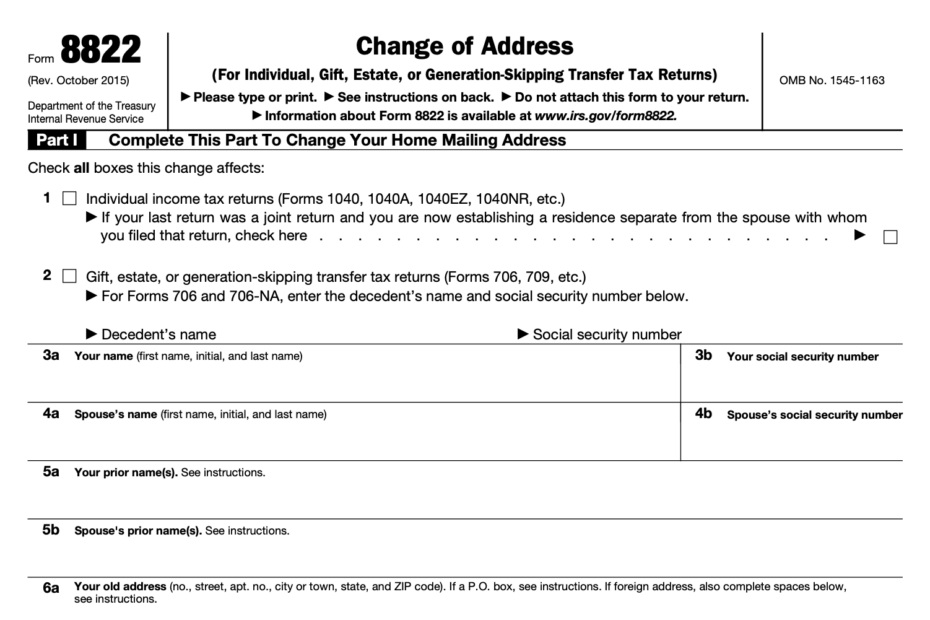

Changing your address can be a hassle, especially when it comes to notifying the IRS. However, with the Printable IRS Form 8822, the process becomes much simpler. This form allows you to update your address with the IRS so that you can continue to receive important correspondence without any issues.

Whether you’ve moved recently or just need to update your address for any other reason, the IRS Form 8822 is the solution you need. By filling out this form, you can ensure that your information is up to date and that you won’t miss out on any important communications from the IRS.

Quickly Access and Print Printable Irs Form 8822

Form 8822 B 2024 2025 How To Fill And Edit PDF Guru

Form 8822 B 2024 2025 How To Fill And Edit PDF Guru

Printable IRS Form 8822

When it comes to updating your address with the IRS, the Printable IRS Form 8822 is the easiest and most convenient option available. This form can be easily downloaded from the IRS website or obtained from your local IRS office. Once you have the form, simply fill it out with your updated information and mail it to the address provided on the form.

It’s important to note that the IRS Form 8822 is only used for updating your address. If you need to make any other changes, such as updating your name or filing status, you will need to fill out a different form. However, for address changes, the IRS Form 8822 is all you need.

By keeping your address updated with the IRS, you can ensure that you receive any refunds or correspondence in a timely manner. Failure to update your address could result in delays or even missed payments, so it’s important to take care of this as soon as possible.

Don’t let a change of address cause you unnecessary stress. With the Printable IRS Form 8822, updating your information with the IRS is quick and easy. Make sure to download the form today and keep your address current to avoid any potential issues in the future.

So, if you’ve recently moved or need to update your address for any reason, don’t wait any longer. Download the Printable IRS Form 8822 and make sure your information is up to date with the IRS. It’s a simple step that can save you a lot of headaches down the road.