When it comes to taxes, it’s important to stay organized and make sure you’re reporting all of your income accurately. One form that often gets overlooked is IRS Form 720, which is used to report and pay excise taxes. This form is typically filed quarterly by businesses that deal with certain goods and services, such as alcohol, tobacco, and firearms.

While it may seem like a hassle to fill out yet another tax form, filing IRS Form 720 can actually save you money in the long run. By accurately reporting your excise taxes, you can avoid costly penalties and audits from the IRS. Additionally, keeping up with your tax obligations can help you maintain a good standing with the government and avoid any potential legal issues.

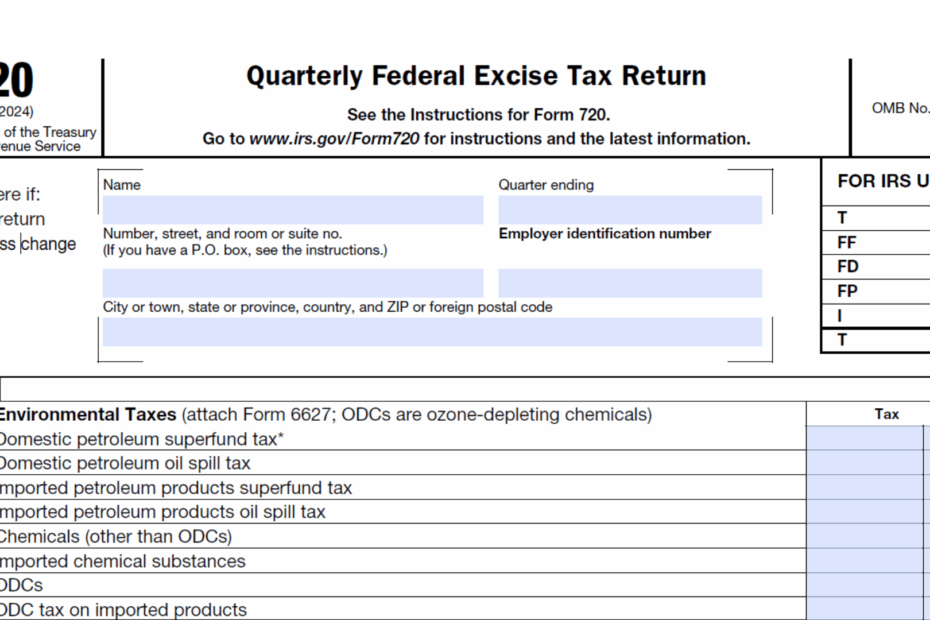

Quickly Access and Print Printable Irs Form 720

Form 720 Printable Form 720 Blank Sign Forms Online PDFliner

Form 720 Printable Form 720 Blank Sign Forms Online PDFliner

Printable IRS Form 720

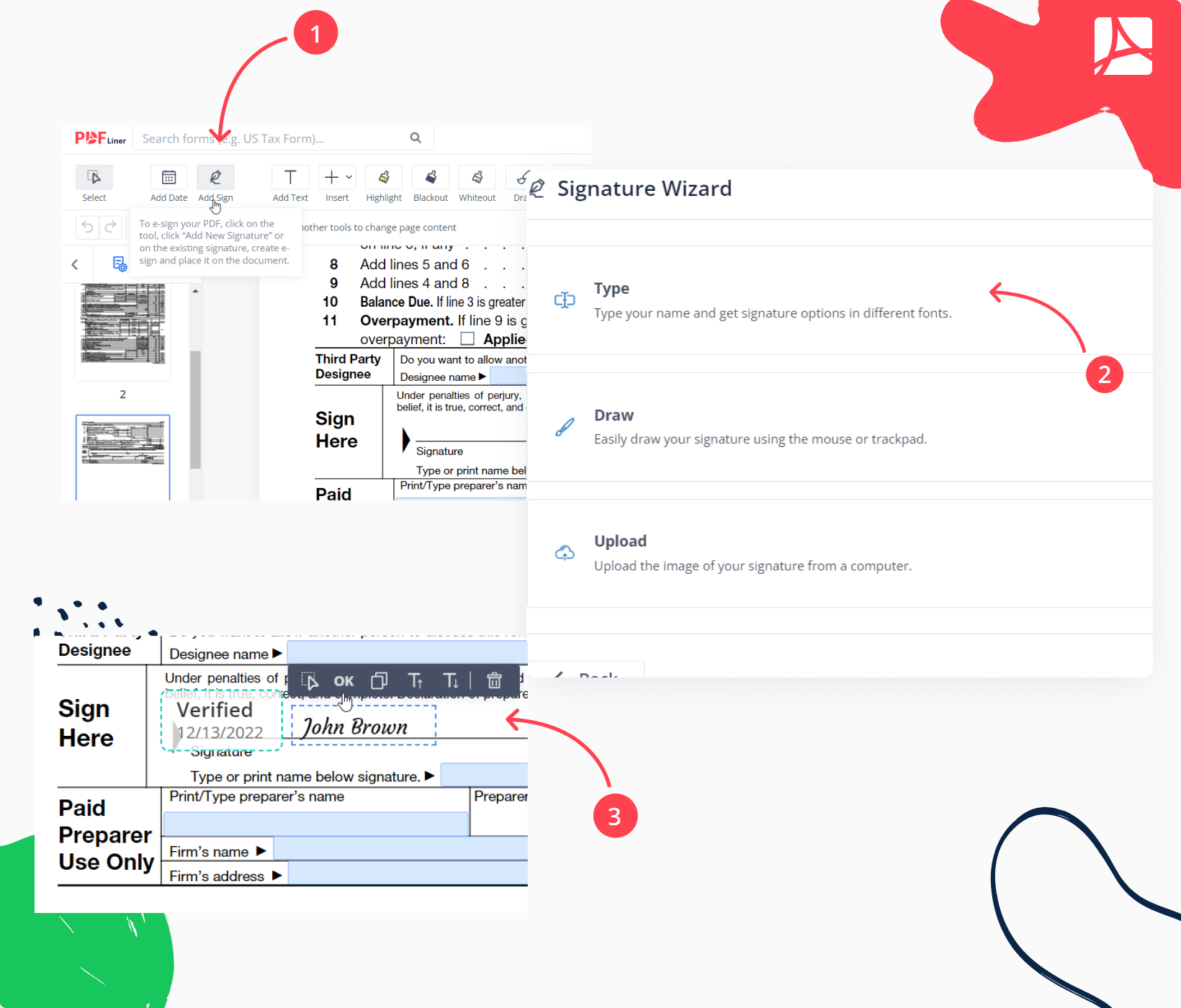

For those who need to file IRS Form 720, it’s important to have access to a printable version of the form. This allows you to easily fill out the necessary information and submit it to the IRS on time. Many online tax preparation websites offer printable versions of IRS Form 720, making it simple and convenient to file your excise taxes.

When filling out IRS Form 720, be sure to double-check all of your information before submitting it. Any mistakes or inaccuracies could result in penalties or delays in processing your tax return. It’s also important to keep thorough records of your excise tax payments and filings, in case you ever need to provide proof to the IRS.

Overall, filing IRS Form 720 is an important part of maintaining compliance with tax laws and regulations. By staying organized and keeping up with your tax obligations, you can avoid costly penalties and ensure that your business runs smoothly. With the availability of printable IRS Form 720, it’s easier than ever to file your excise taxes accurately and on time.

So, if you’re in need of filing IRS Form 720, be sure to utilize the printable version available online. By taking the time to accurately report your excise taxes, you can avoid potential issues with the IRS and keep your business running smoothly.