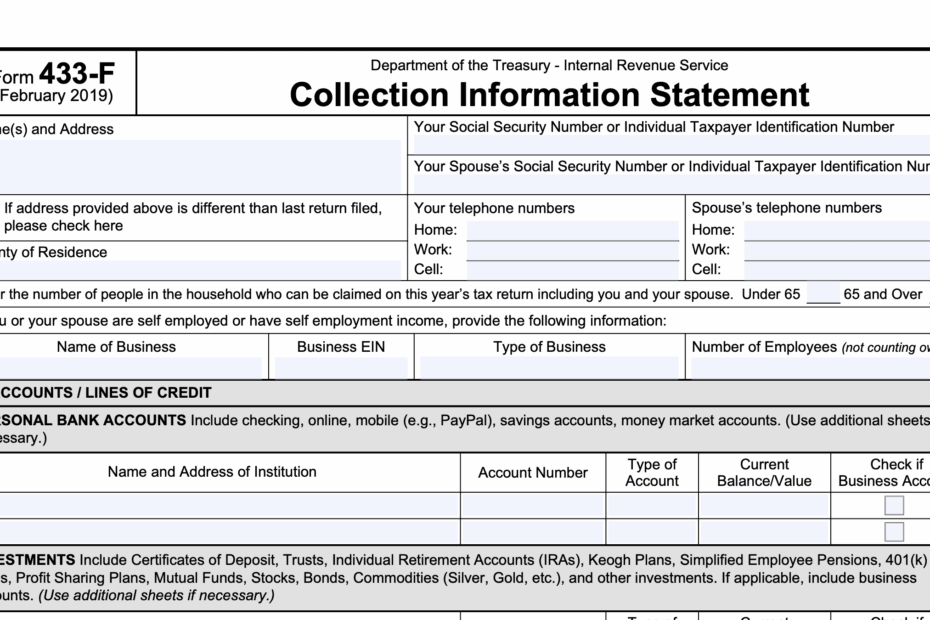

When dealing with the IRS, it is crucial to provide accurate financial information to ensure compliance with tax laws. One such form that taxpayers may need to fill out is IRS Form 433-F. This form is used to collect financial information from individuals who owe back taxes or are requesting an installment agreement with the IRS.

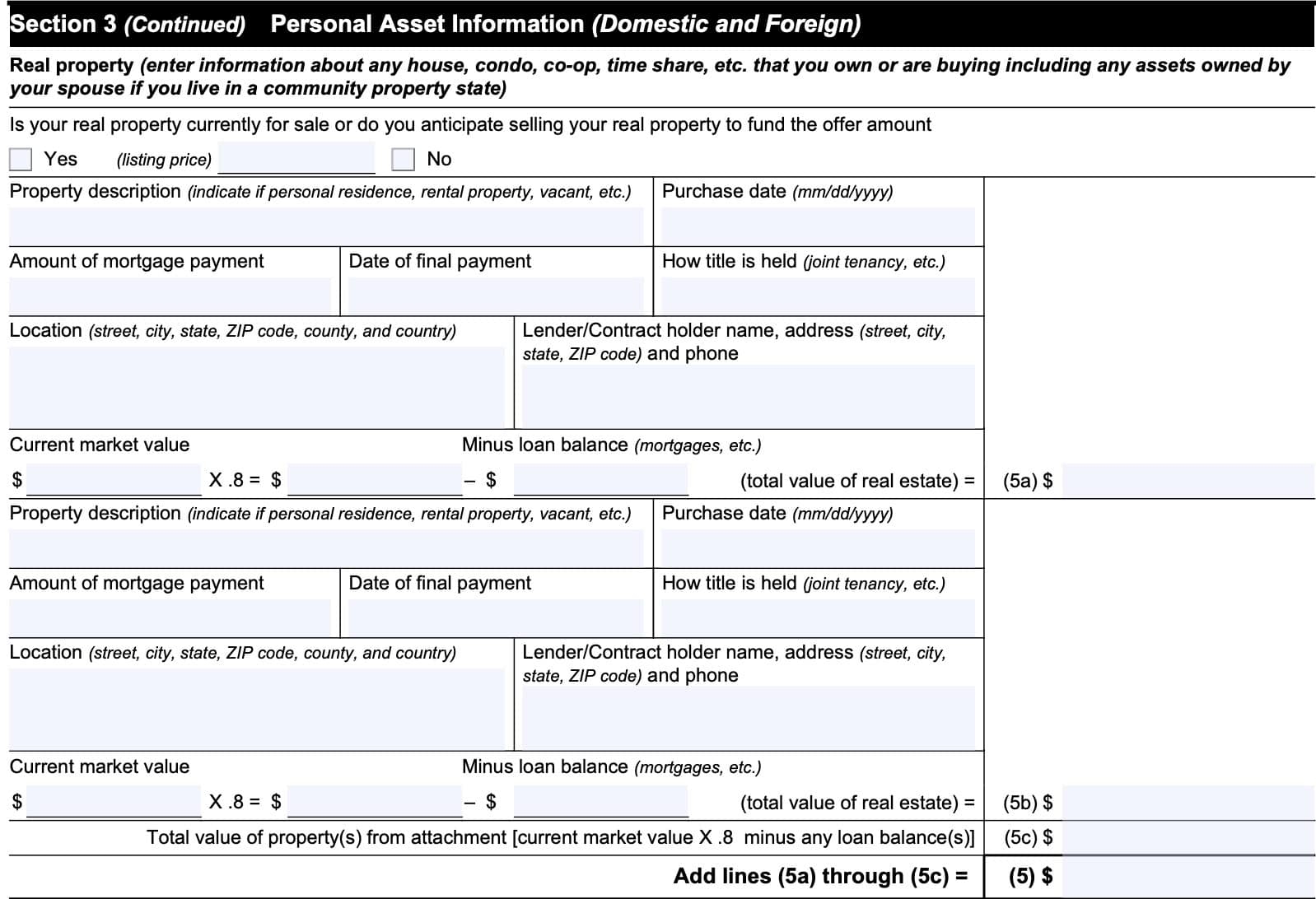

Form 433-F is typically used to assess an individual’s ability to pay their tax debt and determine the appropriate payment plan. It requires detailed information about the taxpayer’s income, expenses, assets, and liabilities. Filling out this form accurately is essential to avoid potential penalties or further scrutiny from the IRS.

Download and Print Printable Irs Form 433-F

IRS Form 433 A Instructions Collection Information Statement

IRS Form 433 A Instructions Collection Information Statement

Printable IRS Form 433-F

For individuals who need to fill out IRS Form 433-F, having access to a printable version of the form can make the process much easier. The form can be downloaded directly from the IRS website or obtained from a tax professional. It is important to ensure that all information provided on the form is accurate and up to date.

When filling out Form 433-F, individuals should be prepared to provide detailed information about their income sources, monthly expenses, assets, and liabilities. This information will be used by the IRS to assess the taxpayer’s financial situation and determine the best course of action for resolving any tax debt.

It is important to note that submitting false information on Form 433-F can result in serious consequences, including penalties and potential legal action. It is always best to be honest and transparent when dealing with the IRS to avoid any unnecessary complications.

Once Form 433-F has been completed and submitted to the IRS, individuals may be contacted for further information or clarification. It is important to respond promptly to any requests from the IRS to ensure a smooth resolution of any tax issues.

In conclusion, IRS Form 433-F is a crucial document for individuals who owe back taxes or are seeking an installment agreement with the IRS. By providing accurate and detailed financial information on this form, taxpayers can help ensure compliance with tax laws and avoid potential penalties. Having access to a printable version of Form 433-F can make the process easier and more convenient for individuals navigating the complexities of tax debt resolution.