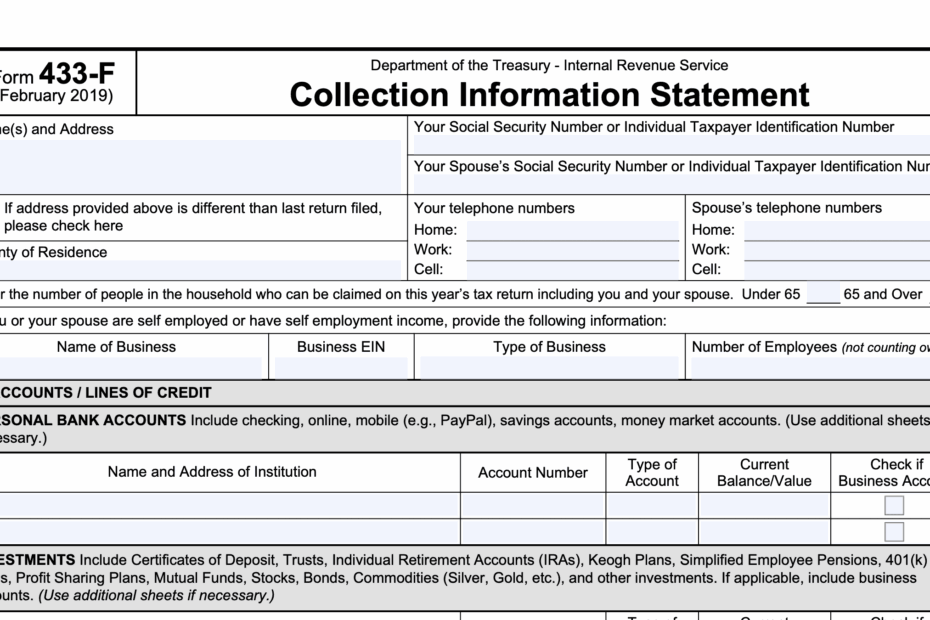

When dealing with tax-related issues, it is important to be organized and thorough in your documentation. One key form that individuals may need to fill out is IRS Form 433 F. This form is used to gather information about your financial situation and is often required when negotiating payment plans or settling tax debts with the IRS.

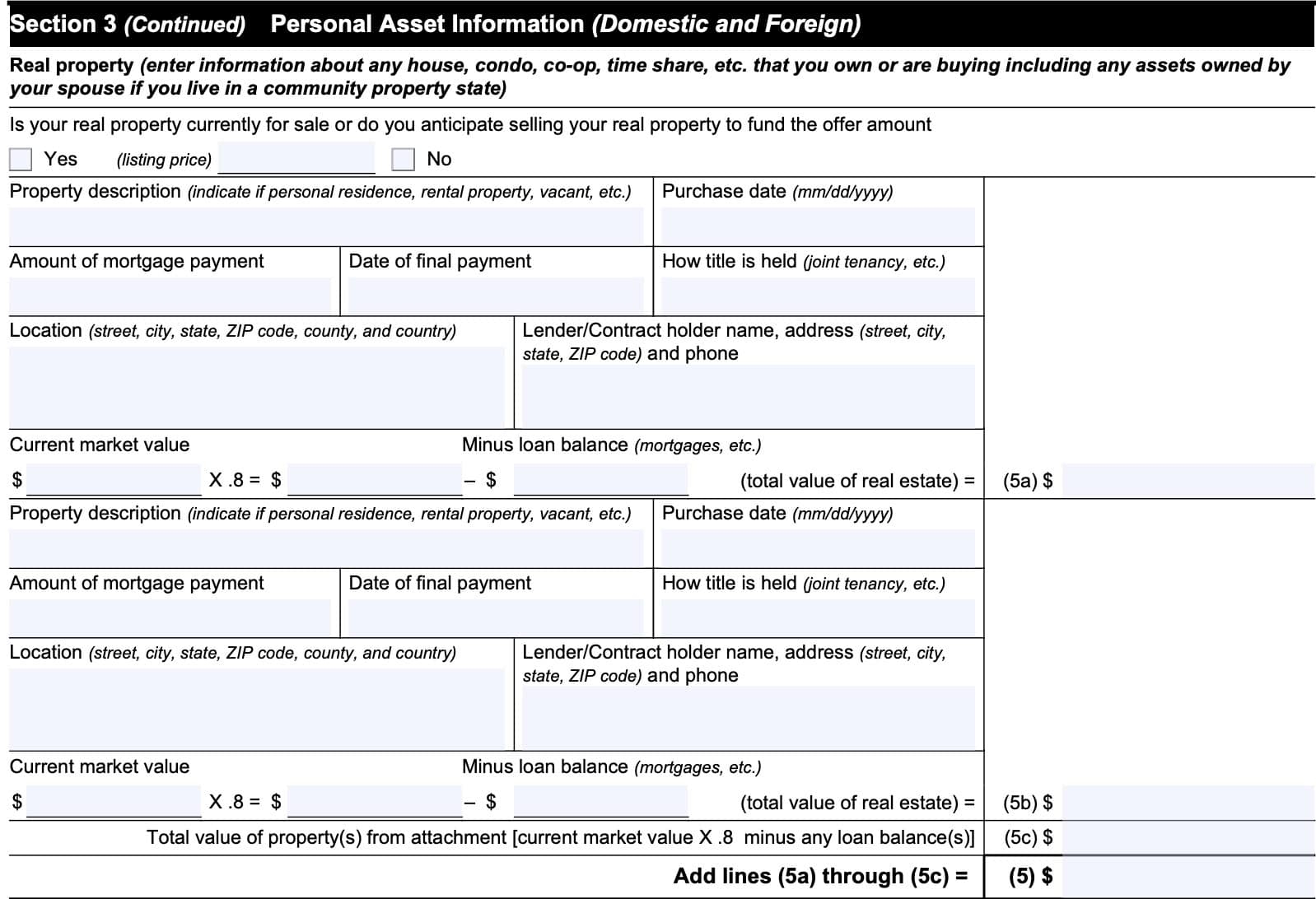

Printable IRS Form 433 F is readily available online and can be easily accessed for free. This form provides a detailed breakdown of your income, expenses, assets, and liabilities. It is crucial to fill out this form accurately and completely to ensure that the IRS has a clear understanding of your financial situation.

Easily Download and Print Printable Irs Form 433 F

IRS Form 433 A Instructions Collection Information Statement

IRS Form 433 A Instructions Collection Information Statement

When filling out IRS Form 433 F, it is important to gather all necessary documentation to support the information you provide. This may include pay stubs, bank statements, mortgage statements, and any other relevant financial records. Being thorough in your documentation will help streamline the process and prevent any delays in the review of your financial information.

After completing IRS Form 433 F, it is recommended to review the form carefully to ensure accuracy. Any discrepancies or errors could lead to delays in processing or potential issues with the IRS. Once the form is filled out completely and accurately, it can be submitted to the IRS either electronically or by mail.

In conclusion, Printable IRS Form 433 F is a crucial document for individuals dealing with tax-related issues. By accurately completing this form and providing thorough supporting documentation, individuals can streamline the process of negotiating payment plans or settling tax debts with the IRS. It is important to be organized and diligent in filling out this form to ensure a smooth and efficient process.