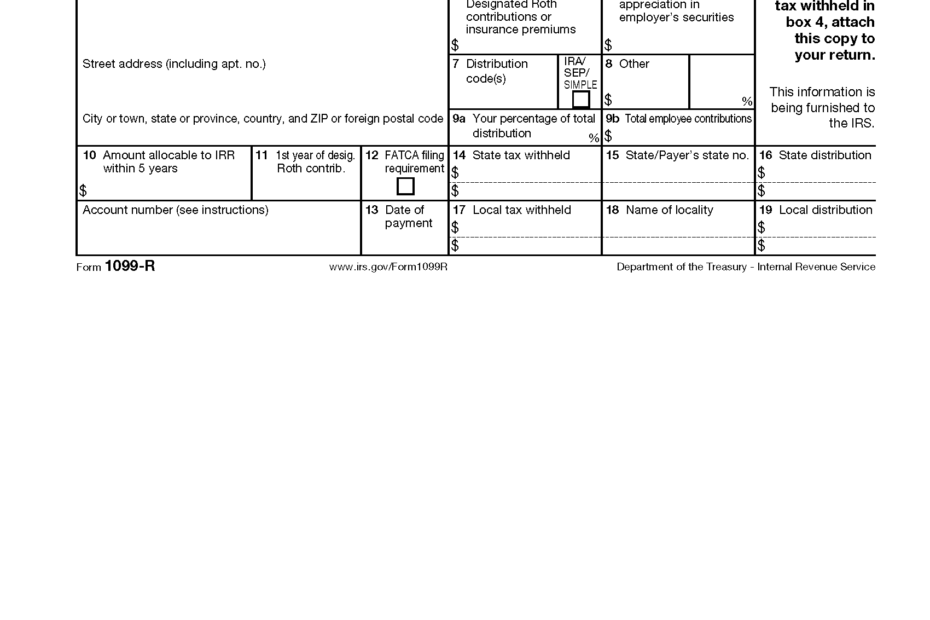

When it comes to filing taxes, there are many forms and documents that individuals need to be aware of. One important form that taxpayers may come across is the IRS Form 1099-R. This form is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other forms of retirement income.

It is crucial for individuals to understand how to properly fill out and submit Form 1099-R to ensure that they are accurately reporting their income and avoiding any potential issues with the IRS. Having a printable version of this form can make the process much easier for taxpayers.

Quickly Access and Print Printable Irs Form 1099 R

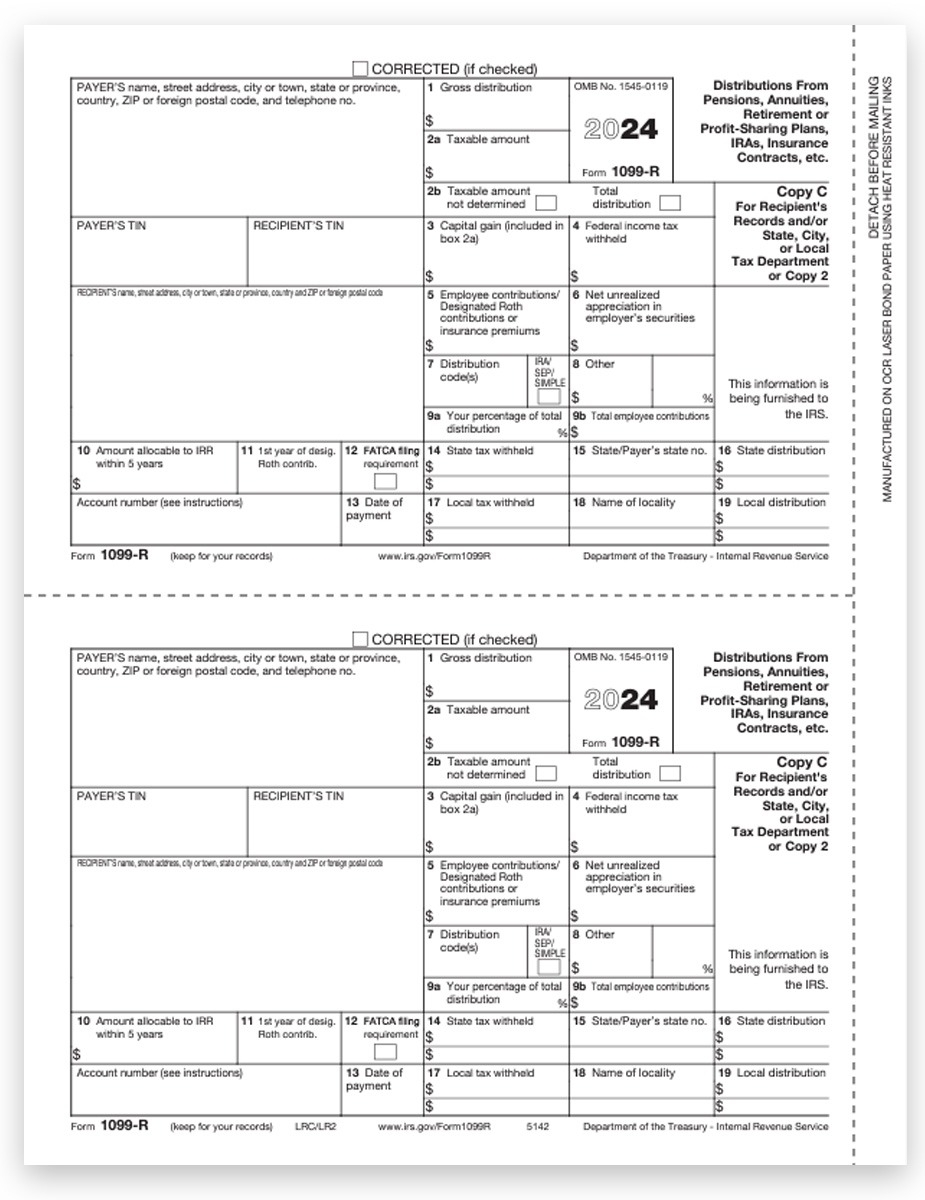

2024 1099 Forms IRS 1099 R Tax Forms Laser Printable Copy A Pack Of 100 Forms 1099 Misc Forms 2024

2024 1099 Forms IRS 1099 R Tax Forms Laser Printable Copy A Pack Of 100 Forms 1099 Misc Forms 2024

Printable IRS Form 1099-R

Printable IRS Form 1099-R is readily available online for individuals to access and download. This form typically includes details such as the recipient’s name, address, taxpayer identification number, and the total distribution amount received during the tax year. It is essential to fill out this form accurately to avoid any discrepancies in reporting income.

When using the printable IRS Form 1099-R, individuals should ensure that all the information provided is correct and matches the records of the payer. Any errors or inconsistencies could lead to delays in processing the tax return or potential audits by the IRS. It is recommended to double-check all the details before submitting the form.

Additionally, individuals should keep a copy of the completed Form 1099-R for their records. This can be useful in case any questions or issues arise regarding the reported income. Having documentation to support the information provided on the form can help taxpayers resolve any inquiries more efficiently.

In conclusion, understanding and correctly filling out Printable IRS Form 1099-R is essential for individuals receiving retirement income. By following the guidelines and ensuring the accuracy of the information provided, taxpayers can avoid potential tax-related problems and ensure a smooth filing process.