IRS Form 1099-INT is a document used to report interest income to the Internal Revenue Service. This form is typically provided by banks, financial institutions, and other entities that pay interest to individuals or businesses. It is important to accurately report this income on your tax return to avoid any penalties or audits from the IRS.

For individuals who receive interest income from sources such as bank accounts, certificates of deposit, or loans, it is essential to carefully review the information on Form 1099-INT and ensure that it is reported correctly on your tax return. Failure to do so could result in additional taxes owed or other consequences.

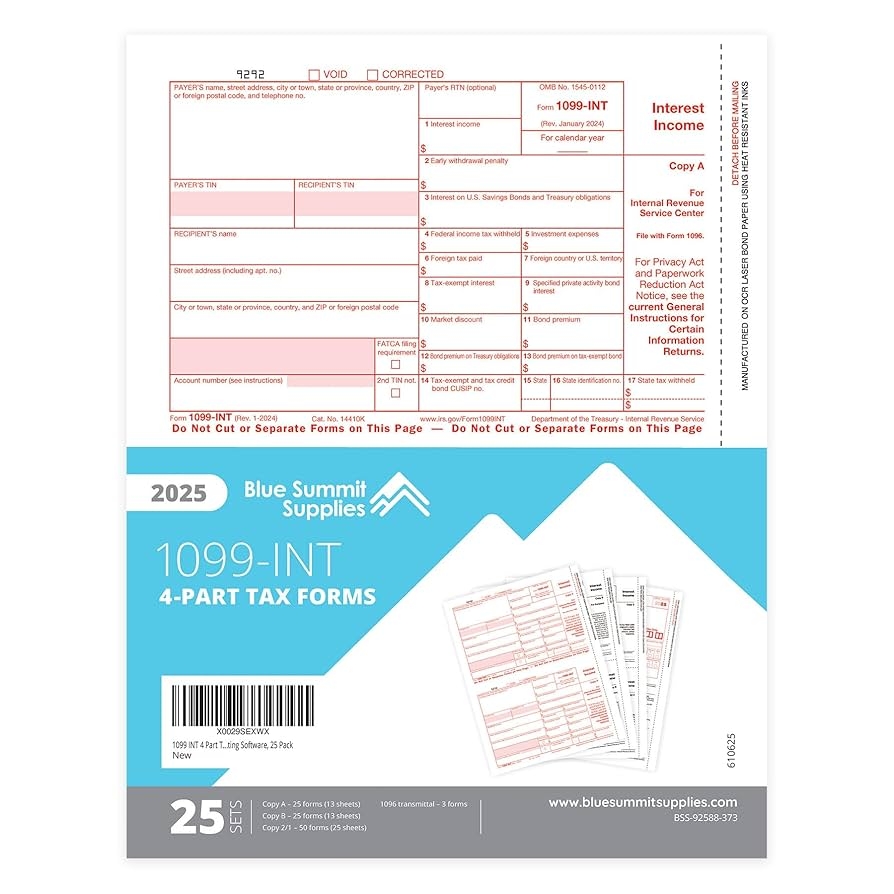

Save and Print Printable Irs Form 1099 Int

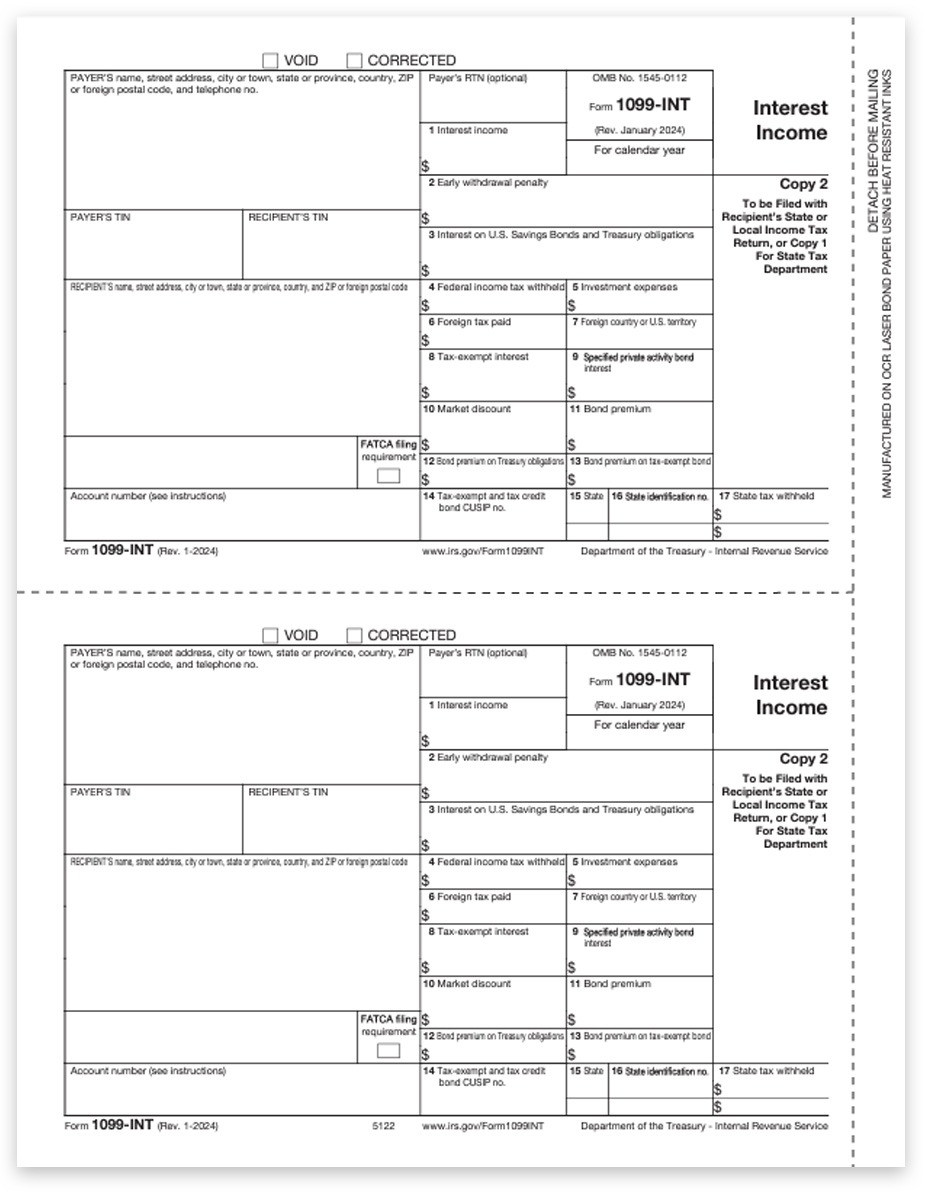

1099 INT Form Copy 2 State Or File

1099 INT Form Copy 2 State Or File

Printable IRS Form 1099-INT

If you need to access a printable version of IRS Form 1099-INT, you can typically find it on the website of the financial institution that issued the form to you. You may also be able to obtain a copy from the IRS website or by contacting the institution directly. It is important to keep accurate records of all your income and tax documents for the year.

When filling out Form 1099-INT, you will need to provide information such as your name, address, Social Security number, and the amount of interest income you received. Make sure to double-check all the information before submitting the form to the IRS to avoid any errors or delays in processing.

Once you have completed and submitted Form 1099-INT, make sure to keep a copy for your records. This document may be necessary for future reference or in case of an IRS audit. By staying organized and keeping accurate records, you can ensure that your tax filings are accurate and up to date.

In conclusion, understanding and properly reporting interest income on IRS Form 1099-INT is essential for compliance with tax laws and regulations. By accessing a printable version of the form and carefully reviewing the information, you can ensure that your tax filings are accurate and avoid any potential issues with the IRS. Remember to keep accurate records of all your income and tax documents to stay organized and prepared for tax season.