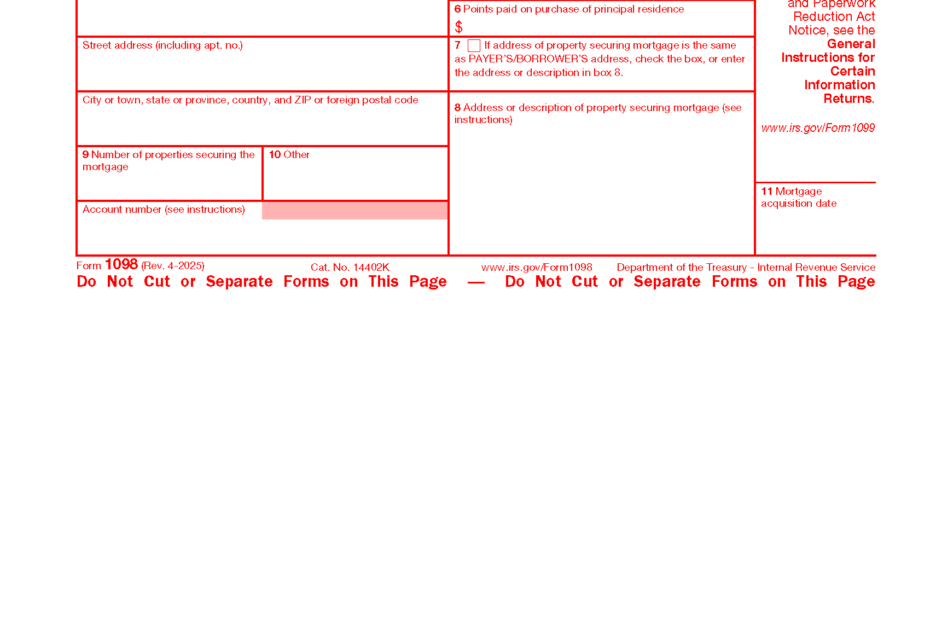

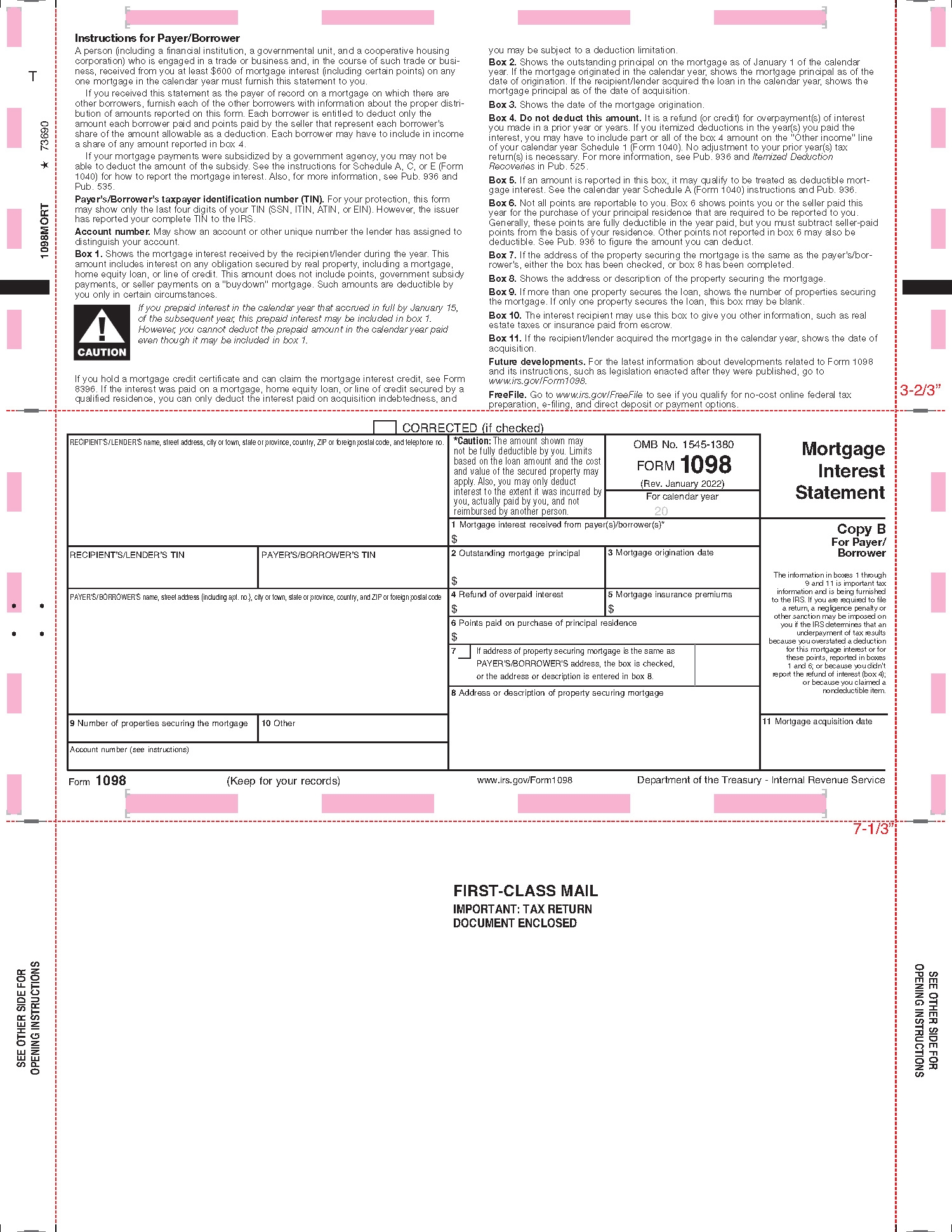

When it comes to tax season, staying organized is key. One important document that you may need to file your taxes is IRS Form 1098. This form is used to report various types of income and expenses, such as mortgage interest, student loan interest, and more. Having a printable version of Form 1098 can make the process much easier and efficient.

Whether you’re a homeowner, student, or business owner, understanding IRS Form 1098 is crucial for accurately reporting your financial information to the IRS. By having a printable version of this form on hand, you can easily fill it out and submit it along with your tax return.

Easily Download and Print Printable Irs Form 1098

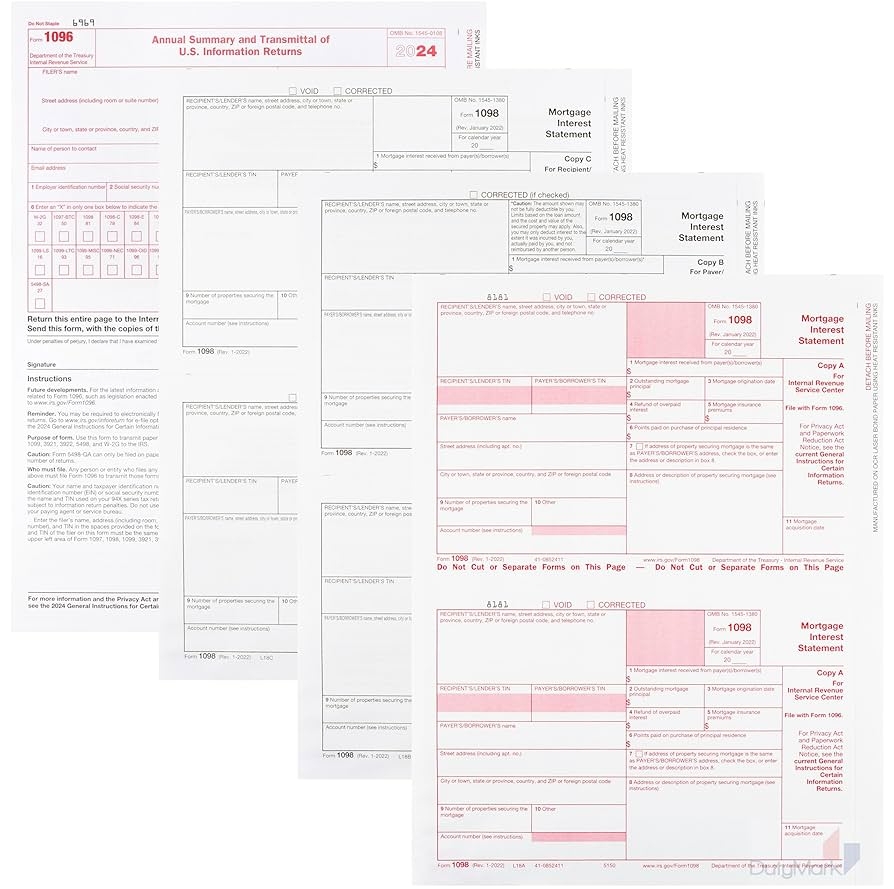

Amazon 1098 Mortgage Interest Tax Form 2024 3 Part Laser Federal Form Designed For QuickBooks And Accounting Software Pack Of 50 2024 Office Products

Amazon 1098 Mortgage Interest Tax Form 2024 3 Part Laser Federal Form Designed For QuickBooks And Accounting Software Pack Of 50 2024 Office Products

Printable IRS Form 1098

Printable IRS Form 1098 is available online for free on the IRS website. This form is typically used to report mortgage interest, student loan interest, and other types of interest payments. By filling out this form accurately, you can potentially lower your taxable income and save money on your taxes.

When using the printable version of IRS Form 1098, be sure to double-check all the information you input to ensure accuracy. Any mistakes or discrepancies could lead to delays in processing your tax return or even potential audits by the IRS. It’s always best to consult with a tax professional if you’re unsure about how to fill out this form correctly.

Overall, having a printable version of IRS Form 1098 can streamline the tax filing process and help you stay organized throughout the year. By keeping all your financial documents in order and submitting them accurately and on time, you can avoid potential penalties and ensure that your tax return is processed efficiently.

So, if you’re in need of Printable IRS Form 1098, be sure to visit the IRS website and download it for free. By taking the time to fill out this form correctly, you can potentially save money on your taxes and avoid any unnecessary headaches during tax season.