The IRS Form 1096 is a document used by businesses to summarize and transmit information returns such as 1099s, 1098s, and W-2Gs to the Internal Revenue Service. This form is required to be filed along with the corresponding information returns to ensure that the IRS has accurate records of income and tax withholding.

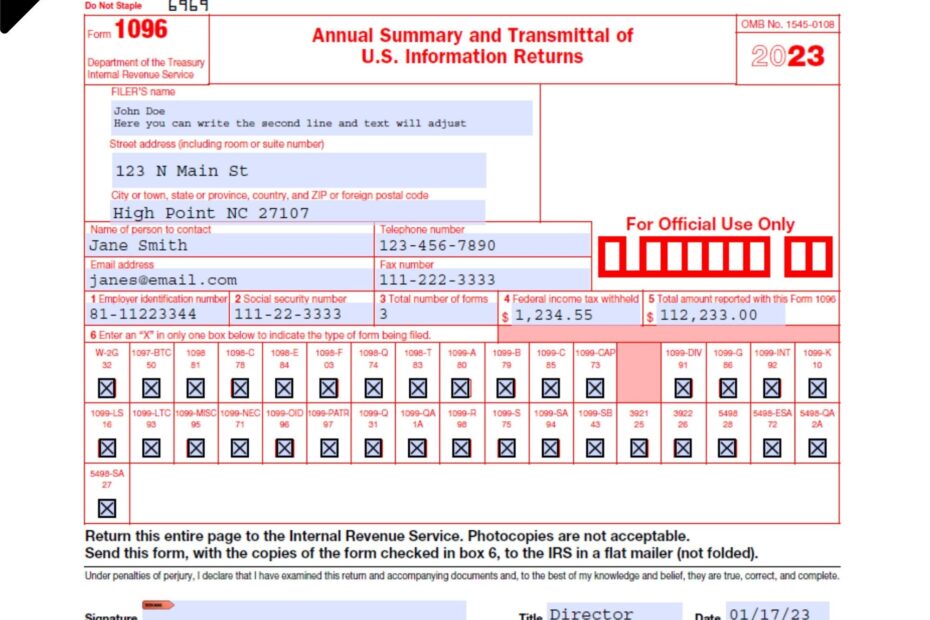

Businesses must file Form 1096 if they are submitting any of the mentioned information returns. The form includes details about the business, such as the name, address, and Employer Identification Number (EIN), as well as information about the total number of forms being submitted and the total amount of payments reported. It is important to fill out the form accurately to avoid any penalties or fines from the IRS.

Easily Download and Print Printable Irs Form 1096

Printable IRS Form 1096

Printable IRS Form 1096 is available on the IRS website for businesses to download and fill out. This form can be easily accessed and printed for convenience. It is important to use the most up-to-date version of the form to ensure compliance with IRS regulations.

When filling out the form, businesses will need to provide information such as the name and address of the business, the EIN, the total number of forms being submitted, and the total amount of payments reported. Once the form is completed, it can be mailed to the IRS along with the corresponding information returns.

Businesses should keep a copy of Form 1096 for their records and make sure to submit it by the deadline specified by the IRS. Failure to file the form on time or inaccurately can result in penalties and fines, so it is important to take the necessary steps to comply with IRS regulations.

In conclusion, Printable IRS Form 1096 is a crucial document for businesses to submit along with information returns to the IRS. By accurately filling out and submitting this form, businesses can ensure that the IRS has accurate records of income and tax withholding. It is important to stay informed about IRS regulations and deadlines to avoid any potential penalties or fines.